- United States

- /

- Machinery

- /

- NYSE:GBX

Greenbrier Companies (GBX) Valuation in Focus Following US Customs Probe on Duty Evasion

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 13.7% Undervalued

According to the most widely followed narrative, Greenbrier Companies appears to be trading at a significant discount to its estimated fair value, with the stock considered 13.7% undervalued. This outlook is based on analyst consensus and incorporates several key quantitative assumptions regarding the company's future performance.

"Greenbrier's strategic focus on improving operating efficiency and reducing costs is expected to drive higher net margins and earnings, even while facing a challenging railcar market. The continued investment in capacity rationalization and facility optimization, as seen with the rationalization in Europe, could lead to long-term cost reductions and improved competitive positioning. This may positively impact net margins and operating income."

Interested in the strategy behind this undervalued label? One bold financial narrative expects not only a major shift in profit margins but also assumes a valuation multiple more often reserved for companies with rapid future growth. Curious about the assumptions behind this projected fair value? The answer contains surprising forward-looking figures and a few aggressive market calls.

Result: Fair Value of $53.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent trade policy shifts or a prolonged slowdown in railcar orders could quickly undermine the case for a sustained rebound.

Find out about the key risks to this Greenbrier Companies narrative.Another View: Discounted Cash Flow Puts Price in a New Light

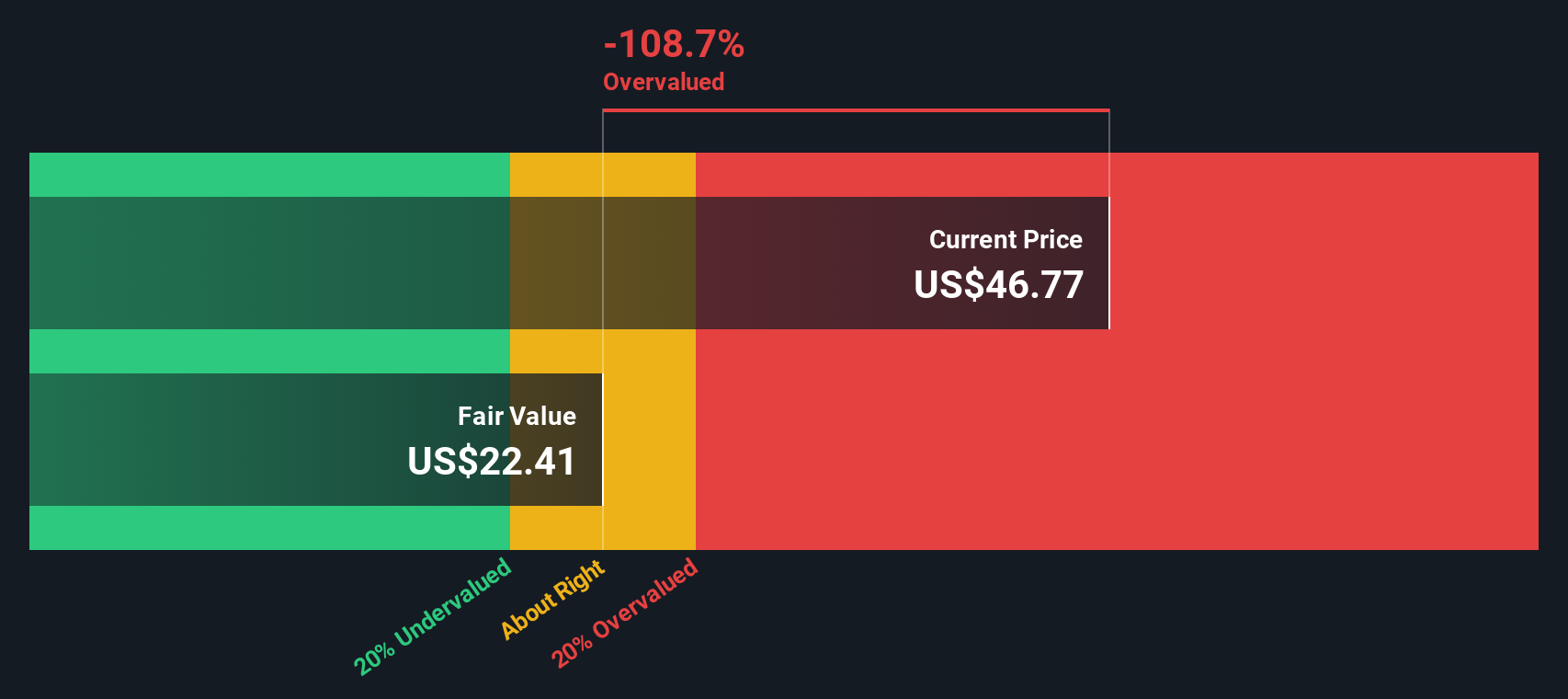

While the analyst consensus uses future profit and revenue to back its price target, our SWS DCF model presents a much less optimistic outlook. This approach suggests Greenbrier's shares may actually be trading above fair value. Which method do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Greenbrier Companies Narrative

If these perspectives do not align with your own or you prefer diving into the numbers directly, you can test your own assumptions and craft a personal view in just a few minutes. Do it your way

A great starting point for your Greenbrier Companies research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors are always a step ahead. Don't just focus on Greenbrier Companies when you could be seizing fresh opportunities in sectors primed for growth and innovation.

- Unlock growth by checking out AI penny stocks powering game-changing advances in artificial intelligence and machine learning.

- Secure your portfolio with steady income streams. Evaluate dividend stocks with yields > 3% offering reliable yields above 3% for dependable returns.

- Get ahead of market trends by targeting undervalued stocks based on cash flows poised to rebound based on strong underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GBX

Greenbrier Companies

Designs, manufactures, and markets railroad freight car equipment in North America, Europe, and South America.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives