- United States

- /

- Trade Distributors

- /

- NYSE:GATX

GATX (GATX): Valuation in Focus After Q3 Revenue Beat but Earnings Miss and Ongoing Strategic Moves

Reviewed by Simply Wall St

GATX (GATX) recently posted its third-quarter financials, and investors have plenty to unpack. Revenue outpaced forecasts because of strong demand and nearly full utilization in the company’s North American railcar fleet.

See our latest analysis for GATX.

GATX’s stock has shown some momentum in 2025, climbing 6.6% year-to-date in share price on the back of high fleet utilization and solid demand. Despite a choppy few weeks, such as the 8.4% dip over the last month following mixed earnings, the long-term story is compelling, with total shareholder returns of 18% over one year and 163% over five years, suggesting sustained value creation well beyond recent volatility.

If you’re eager to spot other companies with sustained growth and strong management stakes, now’s a good moment to explore fast growing stocks with high insider ownership.

With GATX beating revenue expectations but missing on earnings, and the stock still trading below average analyst price targets, investors are left to ask whether GATX is undervalued after its recent dip, or if the market is already factoring in all future growth.

Most Popular Narrative: 14.2% Undervalued

The narrative’s fair value for GATX stands at $188.75, comfortably above the recent close of $161.99. This suggests notable upside if its vision plays out. The reasoning behind this optimistic outlook focuses on specific industry conditions and company strategies.

The pending Wells Fargo Rail transaction is expected to deliver scale efficiencies and incremental cash flow once closed. This offers the potential for accretive earnings and improved operating leverage in the medium to long term.

Are analysts betting big on a future where key margins expand and growth compounds over years? Several bold financial targets underpin this valuation, including game-changing profit assumptions and revenue forecasts. Find out what numbers analysts are baking in and discover the unique scenario driving their price target.

Result: Fair Value of $188.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent economic headwinds in Europe and volatile remarketing gains could challenge this bullish view, which introduces uncertainty into GATX’s growth prospects.

Find out about the key risks to this GATX narrative.

Another View: Multiples Perspective

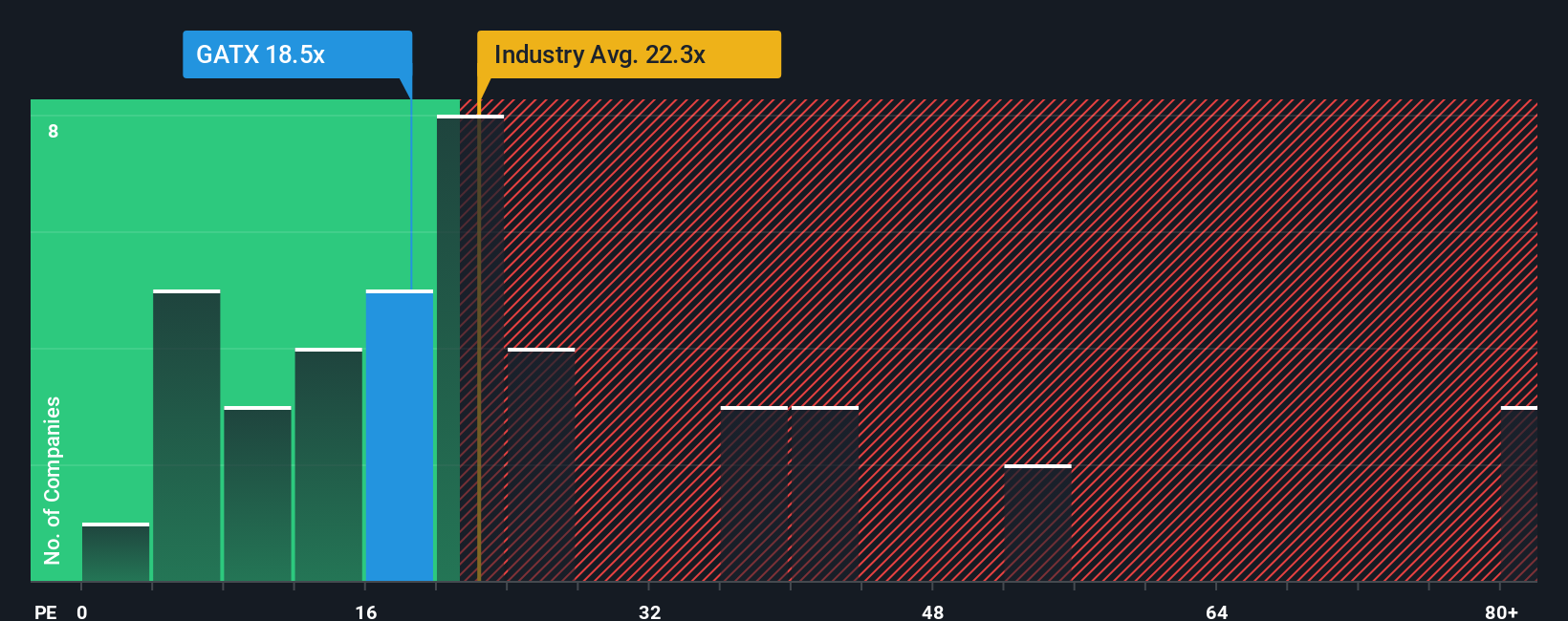

Looking at GATX through the lens of its price-to-earnings ratio, we see the shares trading at 18.8 times earnings, which is noticeably lower than both the US Trade Distributors industry average of 22.6x and the peer average of 65.7x. Notably, the market’s fair ratio for GATX is estimated at 20.7x. This suggests some room for re-rating. Is the market underestimating the company's resilience, or does this gap signal caution?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out GATX for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own GATX Narrative

If you want to challenge these perspectives or dig deeper into the numbers yourself, you can easily build your own take on GATX in just minutes with Do it your way.

A great starting point for your GATX research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t stop with just one stock. Set yourself up for smarter investing by looking at these unique opportunities before the market catches on.

- Tap into companies with high potential by reviewing these 878 undervalued stocks based on cash flows that the market may be pricing below their true worth.

- Capitalize on tomorrow's technology by backing these 27 AI penny stocks positioned to benefit from the accelerating adoption of artificial intelligence.

- Benefit from steady income streams by checking out these 17 dividend stocks with yields > 3% offering yields above 3% for reliable cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GATX

GATX

Together its subsidiaries, operates as railcar leasing company in the United States, Canada, Mexico, Europe, and India.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives