- United States

- /

- Trade Distributors

- /

- NYSE:GATX

GATX (GATX): Evaluating Valuation as Railcar Growth Stalls and Cash Concerns Trigger Fresh Scrutiny

Reviewed by Simply Wall St

GATX (GATX) is coming off its latest appearance at the Stephens Annual Investment Conference, and investors are taking a closer look at concerns around stagnant railcar growth, persistent cash burn, and questions about capital returns.

See our latest analysis for GATX.

Despite headline concerns about slowing railcar growth and mounting cash pressures, GATX's share price has managed a 5.2% gain year-to-date, even as recent momentum has softened. Over the past year, total shareholder return slipped by 1.1%. Looking at the three- and five-year total returns of 48.7% and 107.1%, the business has consistently delivered for longer-term holders, even with the current headwinds settling in.

If you’re rethinking your next move, this could be an opportune moment to broaden your search and discover fast growing stocks with high insider ownership

The question now is whether GATX’s muted railcar growth and cash challenges indicate an undervalued opportunity, or if the recent share price accurately reflects all the associated risks and anticipated future growth understood by the market.

Most Popular Narrative: 15.3% Undervalued

GATX’s most widely followed narrative sets a fair value that is notably higher than the last close, pointing toward untapped upside. The recent fair value bump, paired with robust forward-looking assumptions, presents a compelling snapshot of the company’s potential.

Strategic deployment of new railcars via committed supply agreements and selective international expansion (particularly in India) position GATX to capitalize on long-term growth in commodity flows and diversified revenue streams, which may improve future revenue and operating margins.

Want to see what’s really powering this bullish price target? One set of ambitious analyst projections forms the backbone of the narrative. Discover which forward growth rates and margin improvements are convincing analysts GATX is significantly mispriced. The numbers may surprise you.

Result: Fair Value of $188.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macro uncertainty in Europe and reliance on volatile asset remarketing gains could undermine GATX’s growth thesis if these headwinds become more pronounced.

Find out about the key risks to this GATX narrative.

Another View: How Does Value Stack Up?

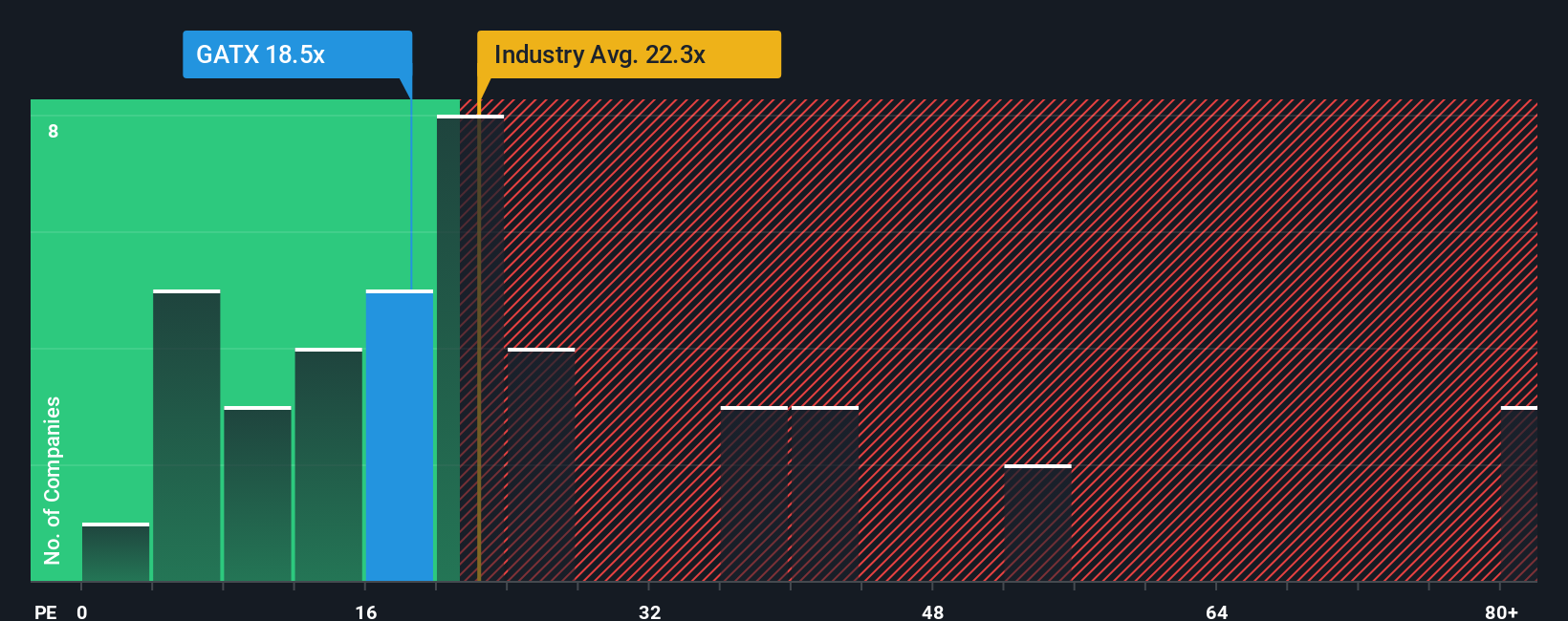

Taking a step back from analyst estimates, GATX currently trades at a price-to-earnings ratio of 18.6x. This is lower than both the US Trade Distributors industry average of 19.5x and the peer group’s 22.4x. The market’s fair ratio, based on our analysis, is 20.7x. This suggests GATX is attractively priced relative to competitors, but does that gap point to hidden opportunity or simply caution about future headwinds?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out GATX for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own GATX Narrative

If you think the numbers tell a different story or want to dig into the details yourself, you can put together your own view in just a few minutes. Do it your way

A great starting point for your GATX research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for the perfect moment. Gain fresh investment inspiration by tapping into standout opportunities you might be missing right now. Make your next move count.

- Unlock high-yield potential and steady income by reviewing these 15 dividend stocks with yields > 3% with generous payouts and reliable business models.

- Explore the possibilities of technological breakthroughs by evaluating these 25 AI penny stocks focused on artificial intelligence and data innovation.

- Maximize your value hunt and spot hidden gems by checking out these 914 undervalued stocks based on cash flows featuring attractive fundamentals and compelling upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GATX

GATX

Together its subsidiaries, operates as railcar leasing company in the United States, Canada, Mexico, Europe, and India.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026