- United States

- /

- Machinery

- /

- NYSE:FTV

Does Fluke’s New Solar Fault Locator Reveal a Shifting Innovation Focus at Fortive (FTV)?

Reviewed by Sasha Jovanovic

- Earlier this month, Fluke Corporation, a Fortive subsidiary, launched the Fluke GFL-1500 Ground Fault Locator, a new technology designed to help solar technicians quickly and safely detect ground faults in utility-scale solar systems without the need for extensive disconnections.

- This launch targets a persistent operational challenge in renewable energy maintenance, aiming to reduce costly downtime and enhance technician safety by simplifying the fault-finding process with a user-friendly, non-contact tool.

- We'll now consider how this breakthrough ground fault locator may impact Fortive's investment narrative, particularly regarding innovation and end-market exposure.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Fortive Investment Narrative Recap

To be a Fortive shareholder, you need to believe the company can drive innovation-led growth in critical industrial and infrastructure end-markets while weathering increased earnings volatility after spinning off Precision Technologies. The recent launch of the Fluke GFL-1500 supports Fortive’s product innovation catalyst and expands exposure to renewable energy solutions, but it does not materially offset the most important short-term challenge: public sector spending headwinds and the concentration risk stemming from a more focused portfolio.

Of Fortive’s recent announcements, the completion of its Precision Technologies spin-off (Ralliant) in June is most relevant, as it significantly sharpened the company’s focus and altered its risk-return profile, the same sharper focus now amplifies both opportunities like the Fluke GFL-1500’s solar market entry and segment-specific risks referenced above.

By contrast, investors should also be mindful of how prolonged softness in public sector end-markets could pressure core revenue in upcoming quarters, especially if...

Read the full narrative on Fortive (it's free!)

Fortive's narrative projects $4.5 billion revenue and $741.9 million earnings by 2028. This requires a 9.8% yearly revenue decline and a $27 million decrease in earnings from $768.9 million today.

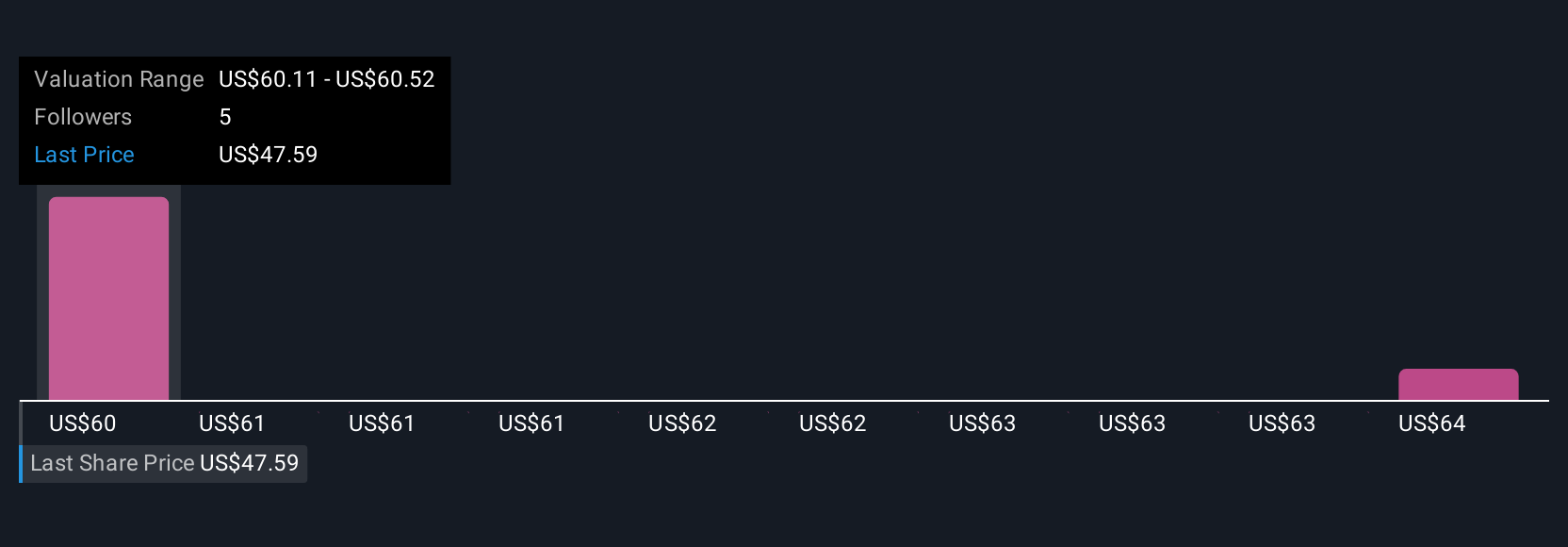

Uncover how Fortive's forecasts yield a $57.25 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members’ fair value estimates for Fortive range from US$46.25 to US$57.25, based on two distinct analyses. With earnings volatility rising after the Ralliant spin-off, explore how these differing views could shape the conversation around Fortive’s business outlook.

Explore 2 other fair value estimates on Fortive - why the stock might be worth just $46.25!

Build Your Own Fortive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fortive research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Fortive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fortive's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FTV

Fortive

Designs, develops, manufactures, and markets products, software, and services in the United States, China, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives