- United States

- /

- Construction

- /

- NYSE:FIX

Is Comfort Systems USA Still a Bargain After a 123.5% Share Price Surge in 2025?

Reviewed by Bailey Pemberton

- Wondering if Comfort Systems USA might be a hidden gem or perhaps priced for perfection? You are not alone, and there is a lot to consider when trying to uncover the real value behind this stock.

- The company’s share price has seen wild swings, with a 17.3% gain in the last month and an eye-popping 123.5% jump year-to-date. This suggests that expectations and risk perceptions are in flux.

- Much of the buzz lately has focused on Comfort Systems USA’s involvement in high-profile infrastructure projects and industry-wide investment tailwinds. Many see these factors as driving recent price momentum. These news items have fueled optimism, but they also mean the bar might be set higher for future performance.

- When you break down the numbers, Comfort Systems USA scores a 3 out of 6 for undervaluation across our core valuation checks. Up next, we will dig into the most common valuation approaches. This will reveal a perspective that could help you frame value in a much smarter way by the end of the article.

Approach 1: Comfort Systems USA Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects Comfort Systems USA’s future cash flows and discounts them back to their present value to estimate what the business is worth today. This approach helps investors look beyond the current share price by focusing on the company’s fundamental cash-generating potential.

For Comfort Systems USA, the latest twelve months Free Cash Flow (FCF) comes in at $798.7 Million. Analysts forecast FCF to reach $2.4 Billion by 2029, reflecting strong anticipated growth. Beyond 2029, additional projections are extrapolated by Simply Wall St, building a complete picture of the company’s earnings power into the next decade.

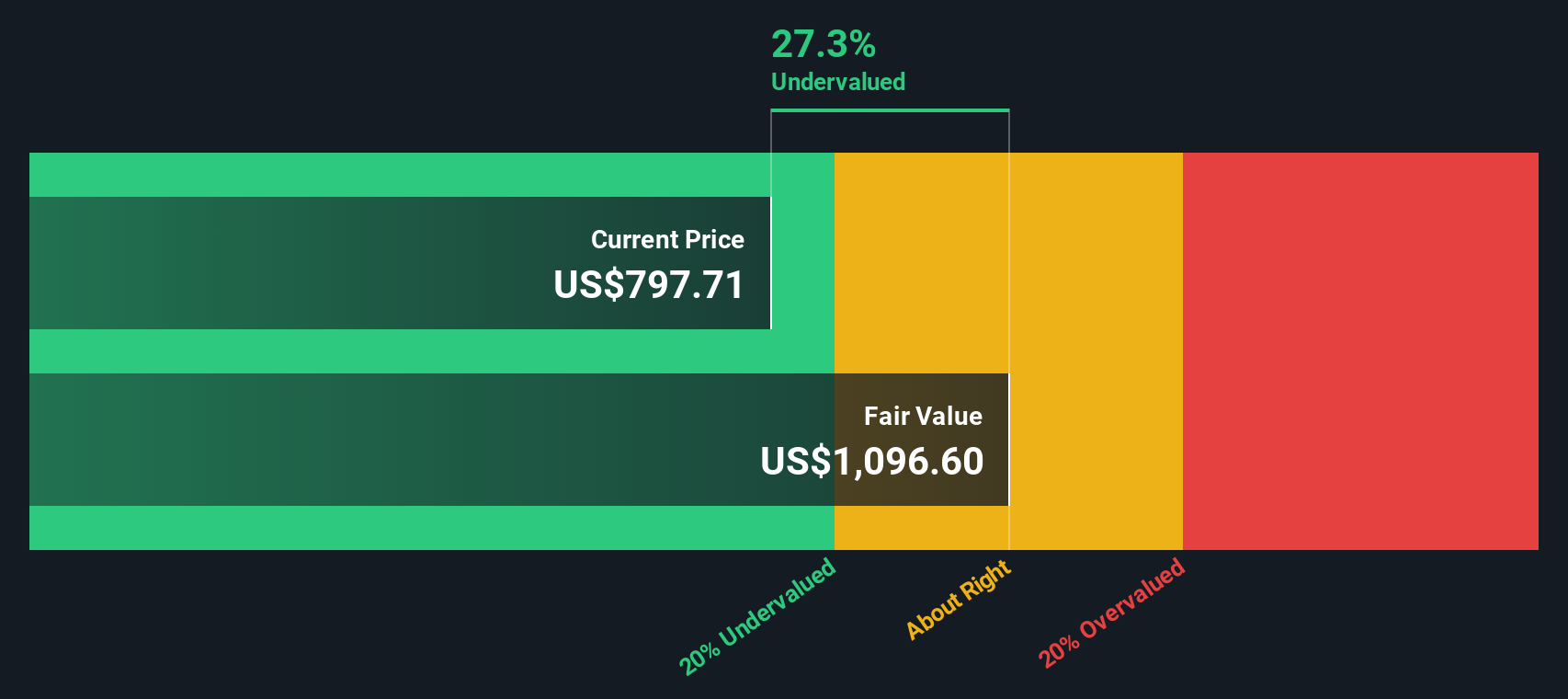

Based on these projections, the DCF model estimates the intrinsic value of Comfort Systems USA at $1,478.46 per share. With the current share price approximately 35.2% below this calculated fair value, the model indicates that the stock is significantly undervalued relative to its cash flow outlook.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Comfort Systems USA is undervalued by 35.2%. Track this in your watchlist or portfolio, or discover 842 more undervalued stocks based on cash flows.

Approach 2: Comfort Systems USA Price vs Earnings

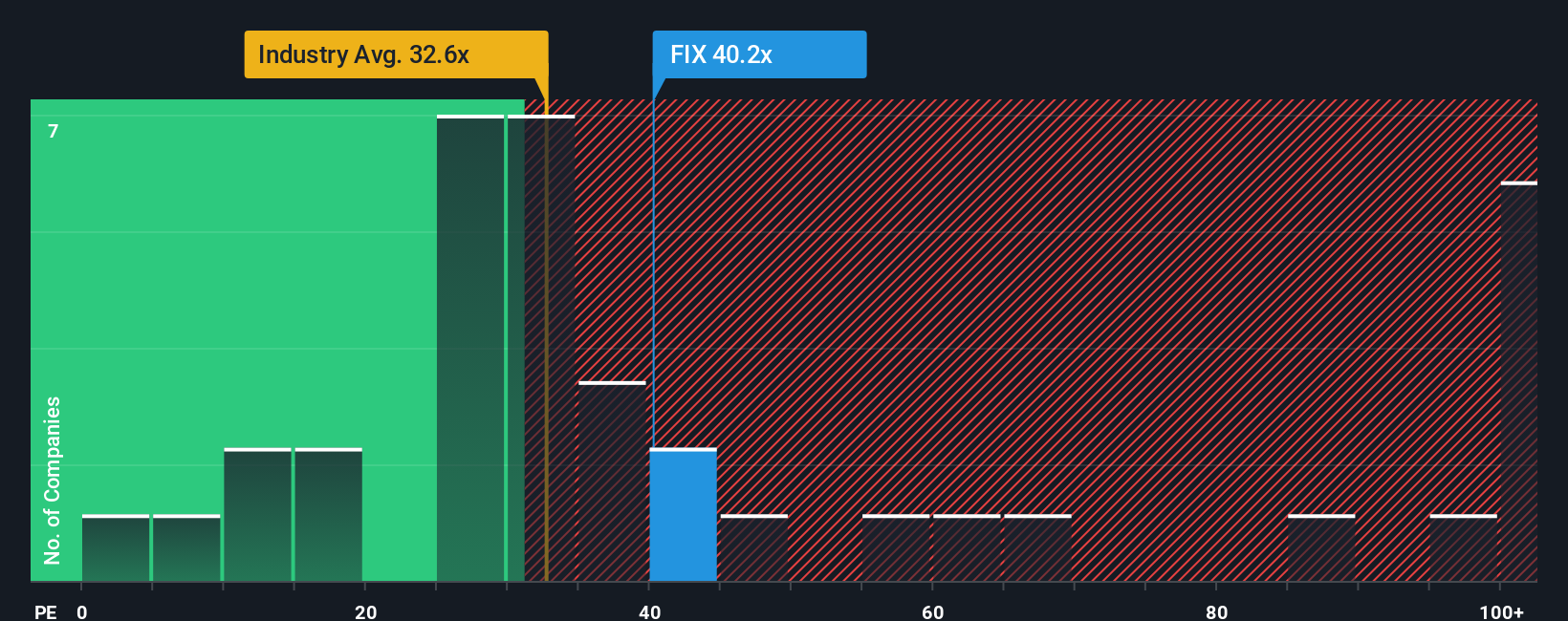

The Price-to-Earnings (PE) ratio is a popular valuation tool for profitable companies like Comfort Systems USA, as it relates the stock price to how much the company earns per share. This makes it easier for investors to judge whether they are paying a reasonable price for current and expected future profitability.

Growth expectations and risks play a big part in what a “fair” PE ratio looks like. Companies with stronger growth prospects or lower perceived risk typically command a higher PE ratio, while those facing headwinds or uncertainties often trade at a discount.

Right now, Comfort Systems USA trades at a PE ratio of 40.2x. This places it roughly in line with the average PE of its direct peers at 40.6x, but well above the wider construction industry average of 34.5x. On its surface, this suggests that the market is pricing in above-average profitability or growth for Comfort Systems USA compared to its industry.

Instead of relying solely on market or peer comparisons, Simply Wall St’s proprietary Fair Ratio offers a more nuanced benchmark. The Fair Ratio for Comfort Systems USA is 46.5x and accounts for growth potential, profit margins, size, industry dynamics, and a detailed assessment of risk. This approach helps investors avoid common valuation traps by providing a tailored benchmark that adjusts for what matters most to a company’s valuation story.

Comparing the current PE ratio (40.2x) to the Fair Ratio (46.5x), Comfort Systems USA appears to be undervalued on this key metric, suggesting there could be upside potential if its fundamentals hold up.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Comfort Systems USA Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story you believe about a company’s future, which you translate into specific forecasts, such as its future revenue, profit margins, earnings, and ultimately your estimate of fair value.

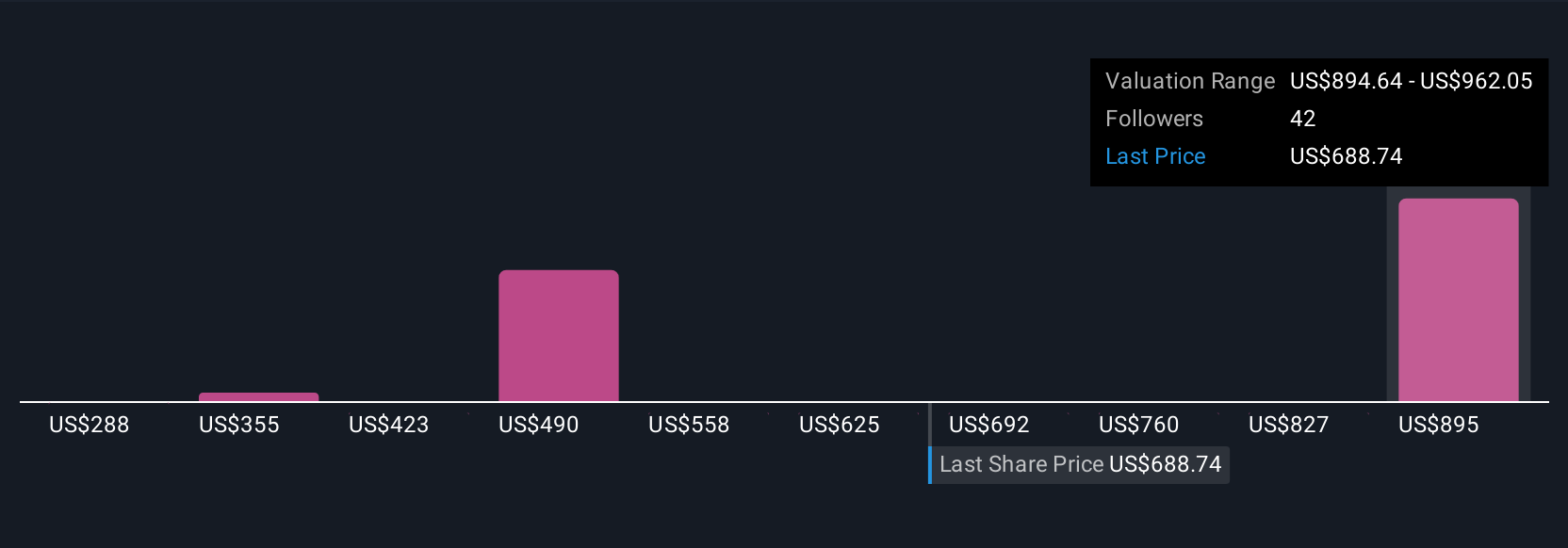

Narratives bridge the gap between numbers and real-world perspective by allowing you to build a financial forecast based on your own outlook, and then see how that translates into a fair value for the stock. On Simply Wall St’s Community page, millions of investors share and update these Narratives, so you can quickly compare your view to others, or even create your own with a few clicks.

This approach empowers you to make smarter buy or sell decisions by directly comparing your Narrative’s fair value with the current share price. Since Narratives update automatically when new news or company results emerge, your investment view always stays relevant.

For example, some investors currently believe Comfort Systems USA is worth as much as $1,008 per share due to strong industrial demand and growing profits. Others see fair value closer to $767 based on concerns about risks in tech, labor shortages, or a potential industry slowdown. Narratives make these different perspectives clear and help you invest with confidence in the story that makes sense to you.

Do you think there's more to the story for Comfort Systems USA? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIX

Comfort Systems USA

Provides mechanical and electrical installation, renovation, maintenance, repair, and replacement services for the mechanical and electrical services industry in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives