- United States

- /

- Aerospace & Defense

- /

- NYSE:EVEX

Should Eve Holding’s (EVEX) Embraer Partnership and Order Pipeline Momentum Prompt Fresh Investor Attention?

Reviewed by Sasha Jovanovic

- Earlier in November 2025, Cantor Fitzgerald reiterated its positive outlook on Eve Holding Inc., citing a robust customer order pipeline exceeding 2,900 and recent financing support for eVTOL electric motor development from Brazil’s National Development Bank.

- This momentum is further strengthened by Eve’s relationship with Embraer, which provides valuable manufacturing, certification expertise, and financial resources to support growth.

- We’ll explore how access to Embraer’s manufacturing and certification capabilities shapes Eve Holding’s investment narrative following these developments.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Eve Holding's Investment Narrative?

To buy into the Eve Holding story right now, you have to believe the eVTOL sector is on the cusp of mainstream adoption, and that Eve's ties to Embraer unlock a rare combination of technical and financial credibility in a crowded field. The recent news of additional support from Brazil's National Development Bank gives Eve a meaningful boost on the technology front, potentially offsetting some near-term funding concerns. This could be a positive for crucial short-term catalysts, particularly the need to execute on a sizeable order book and achieve eVTOL certification milestones. Still, risks remain front and center. Unprofitability has deepened over the past year, with net losses widening and no revenue yet on the books, while share price weakness persists. The extra financing is helpful, but it does not fully address ongoing cash burn or execution challenges; the timeline toward meaningful revenue and profitability continues to be a central uncertainty.

However, regulatory and cash flow hurdles still loom as key unknowns for the path ahead.

Exploring Other Perspectives

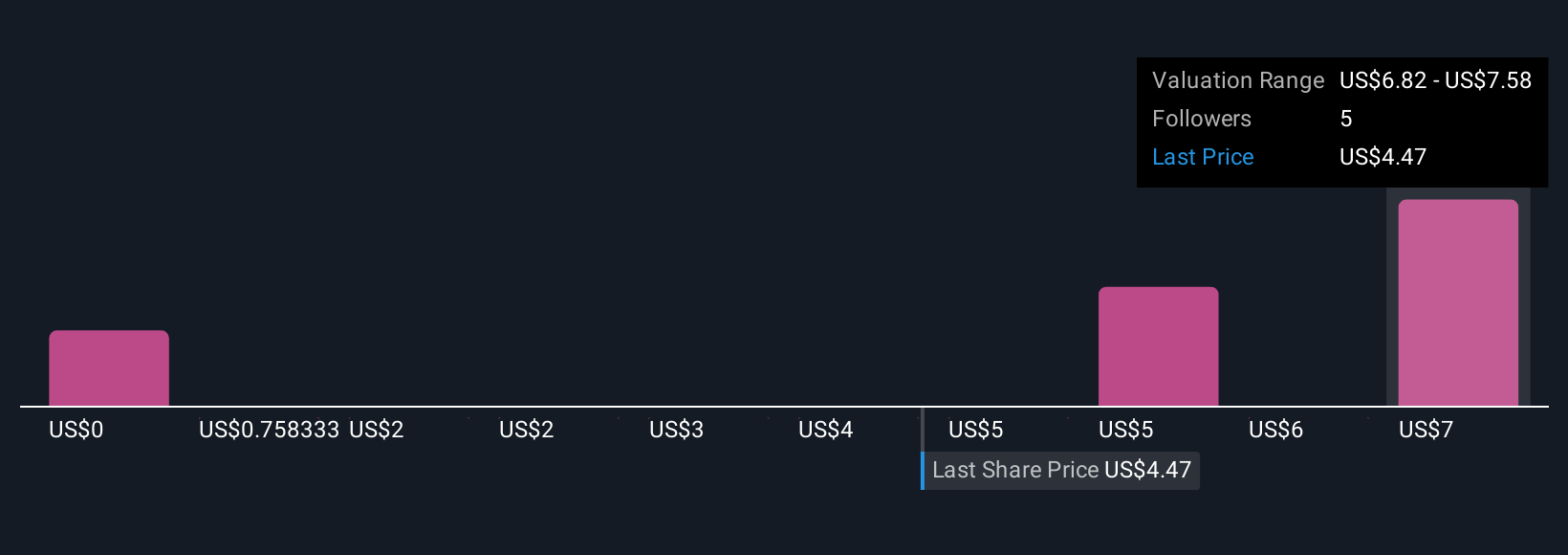

Explore 4 other fair value estimates on Eve Holding - why the stock might be worth less than half the current price!

Build Your Own Eve Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eve Holding research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Eve Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eve Holding's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eve Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EVEX

Excellent balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success