- United States

- /

- Aerospace & Defense

- /

- NYSE:EVEX

Eve Holding (EVEX) Is Up 8.9% After Bahrain Air Mobility Deal Is the Long-Term Story Taking Flight?

Reviewed by Sasha Jovanovic

- On November 3, 2025, Eve Air Mobility announced a framework agreement with Bahrain's Ministry of Transportation and Telecommunications to develop advanced air mobility infrastructure and regulatory readiness for eVTOL operations across the Middle East.

- This collaboration aims to establish Bahrain as a pioneer in sustainable air mobility and includes custom eVTOL technology adaptations for the region's unique climate conditions.

- We'll examine how the focus on infrastructure and regulatory advancement in the Middle East shapes Eve's long-term investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Eve Holding's Investment Narrative?

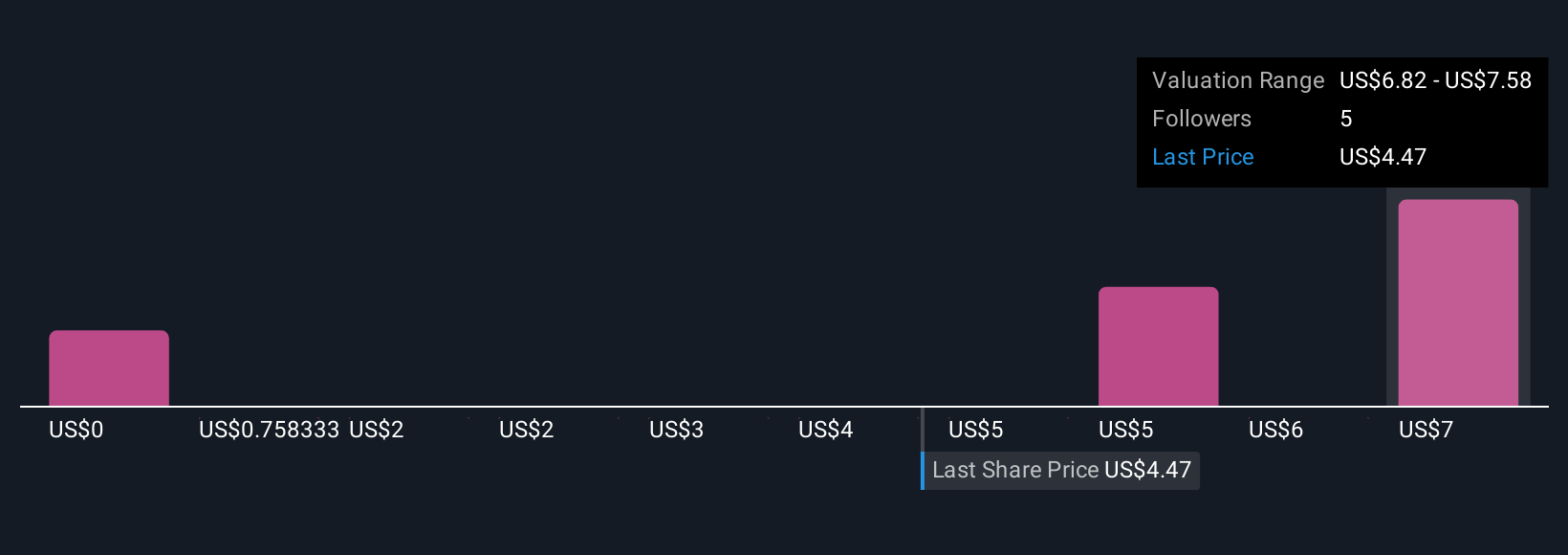

At its core, the Eve Holding investment story is about belief in the long-term adoption of electric vertical takeoff and landing (eVTOL) technology, paired with the company's ability to secure regulatory progress and commercial partnerships across key global markets. The recent framework agreement in Bahrain feels encouraging, signalling early regional buy-in for infrastructure and regulatory support, which could strengthen investor confidence around one of Eve’s most important short-term catalysts: converting high-profile partnerships into tangible commitments and, eventually, revenue. However, the November earnings reveal continued and widening net losses, reinforcing the near-term risks associated with funding requirements and limited revenue visibility, especially as commercial operations are targeted years down the line. While the Bahrain news adds momentum, it is unlikely to be immediately material in offsetting mounting losses or addressing short-term profitability concerns, but it could shift attention to future growth possibilities and ease some pressure around market readiness in new geographies. Yet, while hopes are rising for future potential, Eve's cash burn and lack of revenue remain front of mind for investors.

Eve Holding's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 4 other fair value estimates on Eve Holding - why the stock might be worth less than half the current price!

Build Your Own Eve Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eve Holding research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Eve Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eve Holding's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eve Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EVEX

Excellent balance sheet with slight risk.

Market Insights

Community Narratives