- United States

- /

- Aerospace & Defense

- /

- NYSE:EVEX

A Fresh Look at Eve Holding (NYSE:EVEX) Valuation Following Bahrain Expansion Deal

Reviewed by Simply Wall St

Eve Holding (NYSE:EVEX) has signed a framework agreement with Bahrain’s Ministry of Transportation and Telecommunications, aiming to fast-track sustainable air mobility across the Middle East. The initiative paves the way for eVTOL operations and international expansion.

See our latest analysis for Eve Holding.

While Eve Holding’s agreement with Bahrain marks an exciting step towards international expansion, the company’s share price has faced significant pressure recently, with a 22.6% year-to-date decline and a 14.6% drop over the past month. Still, the longer-term story looks different. A one-year total shareholder return of nearly 37% suggests that investors see promise beyond the headlines, although a challenging three-year total return paints a more volatile picture overall.

If this kind of forward-looking innovation grabs your attention, it could be the right moment to discover opportunities in See the full list for free.

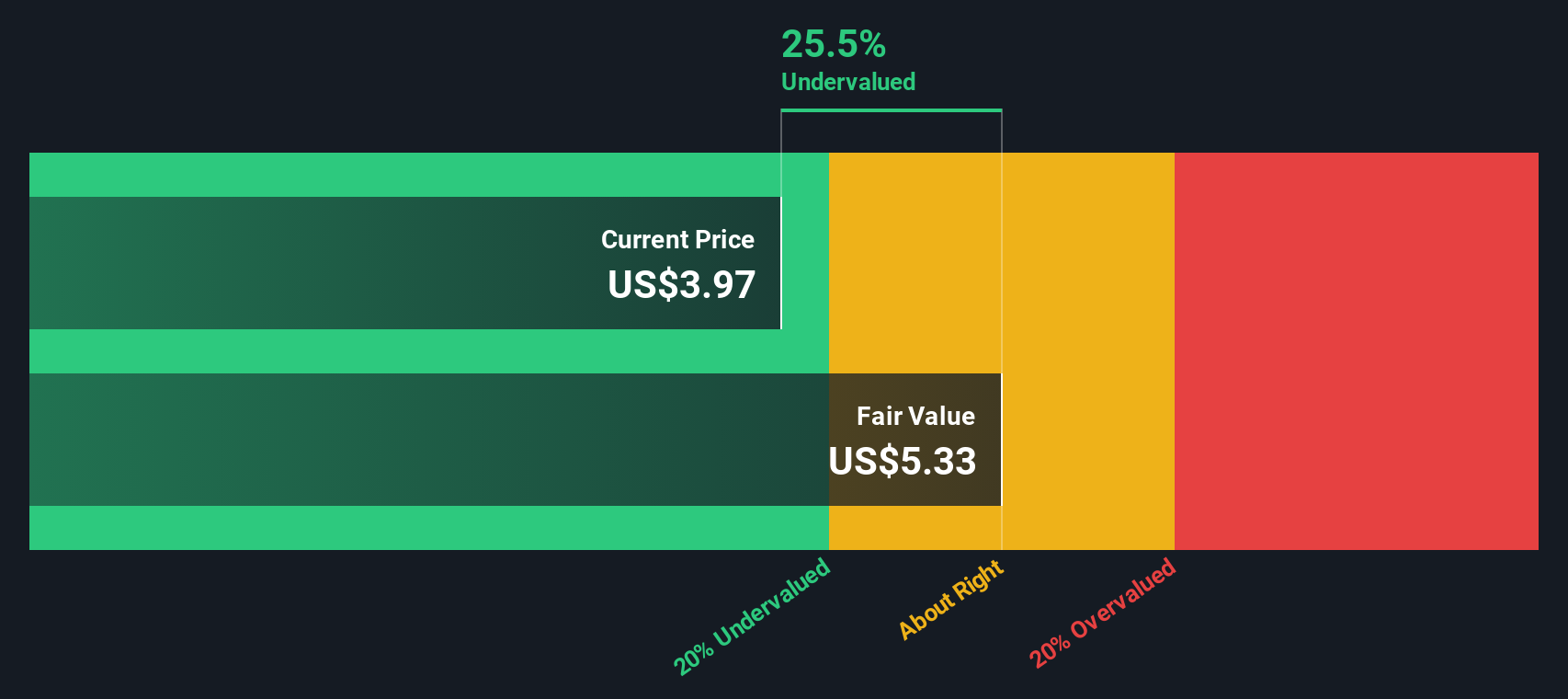

Given the stock’s recent declines and the ambitious expansion plans underway, investors now face a crucial question: is Eve Holding undervalued ahead of its next growth chapter, or is the market already pricing in all that future potential?

Price-to-Book Ratio of 7.8x: Is it justified?

Eve Holding’s shares currently trade at a price-to-book ratio of 7.8x, significantly higher than both its industry and peer group averages. This suggests the market is pricing in considerable optimism about the company’s future growth prospects.

The price-to-book ratio compares the market value of a company to its book value. It often serves as a gauge of whether a stock is valued richly relative to the assets currently on the balance sheet. For a company like Eve Holding, which is in the early stages of growth and not yet profitable, a higher ratio may indicate expectations for dramatic revenue expansion or transformative developments in the business.

When placed alongside the US Aerospace & Defense industry average of 3.3x and the peer average of 7.2x, Eve’s valuation stands out as particularly expensive. This signals that investors are paying a sizable premium for its long-term potential, though not necessarily justified by today’s fundamentals.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 7.8x (OVERVALUED)

However, persistent net losses and volatile returns highlight ongoing operational risks. These factors could quickly shift investor sentiment if growth does not materialize as expected.

Find out about the key risks to this Eve Holding narrative.

Another View: SWS DCF Model Weighs In

While the market is placing a hefty premium on Eve Holding using the price-to-book ratio, our SWS DCF model arrives at a different conclusion. According to this approach, shares trade at roughly 9.7% below estimated fair value, suggesting the stock could be undervalued based on future cash flows. Is this a rare opening for investors, or do ongoing losses cast doubt that growth will deliver as predicted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Eve Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Eve Holding Narrative

If you want to dig into the numbers for yourself or take a different view, you can shape your own analysis in just a few minutes, with Do it your way.

A great starting point for your Eve Holding research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investing means staying ahead of trends, and the Simply Wall Street Screener puts a world of opportunities right at your fingertips. Don’t miss your chance to get strategic with your next investment move.

- Uncover potential bargains by targeting value opportunities with these 878 undervalued stocks based on cash flows that the market might be overlooking right now.

- Boost your portfolio’s long-term income stream by tapping into these 16 dividend stocks with yields > 3% with sustainable, attractive yields.

- Ride the wave of digital innovation and stay ahead by searching for leaders among these 25 AI penny stocks as they transform tomorrow’s tech landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eve Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EVEX

Excellent balance sheet with low risk.

Market Insights

Community Narratives