- United States

- /

- Electrical

- /

- NYSE:ETN

Is It Too Late to Consider Eaton After a 7.5% Weekly Rally?

Reviewed by Bailey Pemberton

- Wondering if Eaton is a hidden value opportunity, or if its recent rally has pushed it beyond fair value? Let's break down what's driving the excitement, as well as what it might really be worth.

- Eaton's stock has climbed 7.5% over the past week, with a strong year-to-date performance of 16.8%, continuing an impressive multi-year run.

- Much of this momentum has been fueled by increased investor interest in industrial automation and electrification, two key areas where Eaton is making headlines. Recent partnerships and expansion announcements have only added to the buzz around its long-term prospects.

- On our valuation scale, Eaton scores just 1 out of 6. This suggests there may be more optimism in the price than deep value, at least by traditional checks. We’ll look at how that score is calculated and also reveal a different way to judge value by the end of this article.

Eaton scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Eaton Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its future cash flows and then discounting them back to their present value. This approach helps investors cut through market noise by asking what the business would be worth today based on its ability to generate cash in the future.

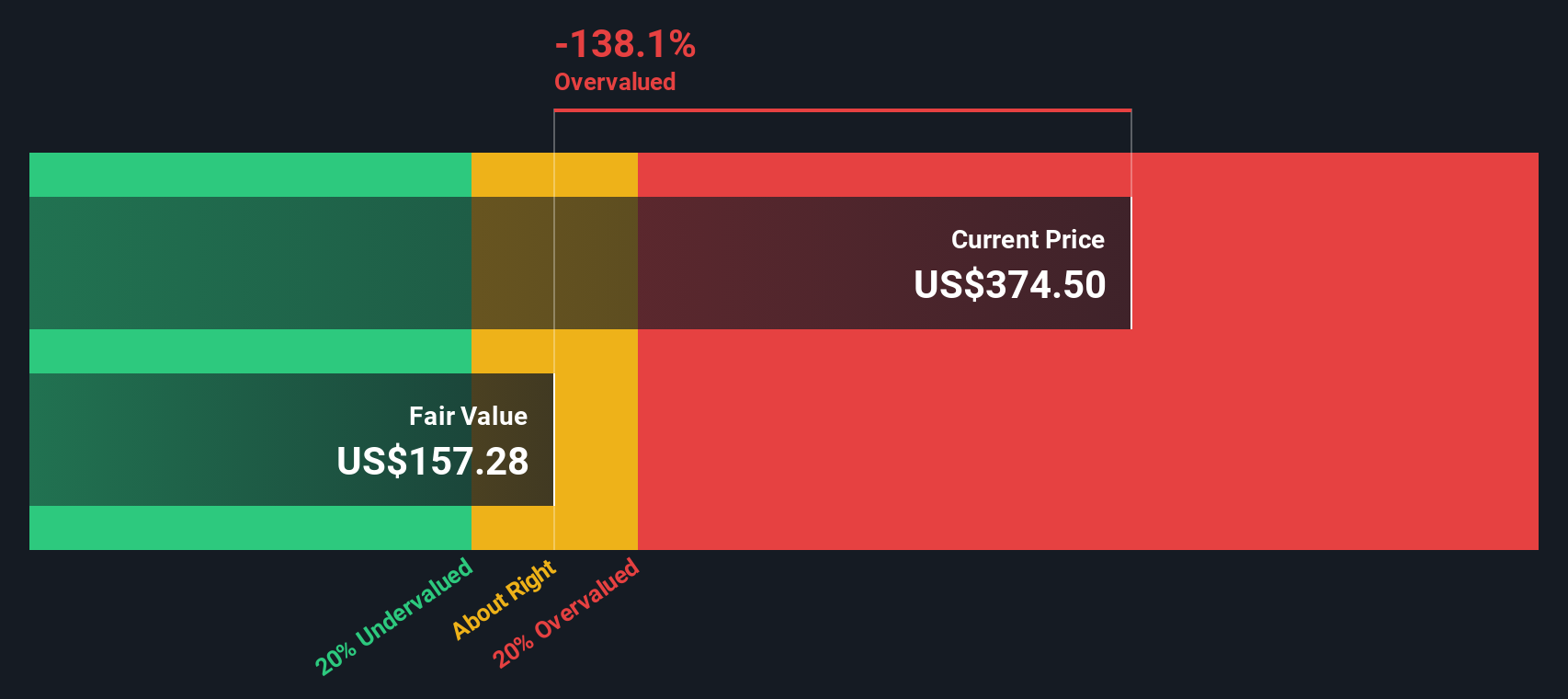

For Eaton, the latest reported Free Cash Flow stands at approximately $3.25 billion. Analyst forecasts provide estimates for annual Free Cash Flow through 2029, after which projections are extrapolated. The company's Free Cash Flow is expected to grow steadily, reaching a projected $5.49 billion by 2029, according to available analyst data and straightforward extrapolations by Simply Wall St.

Using these cash flow assumptions, the DCF model calculates an intrinsic fair value of $151.36 per share. Comparing this with Eaton's recent share price shows the stock is trading at a 156.2% premium to its DCF valuation, which implies it is deeply overvalued by this method.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Eaton may be overvalued by 156.2%. Discover 853 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Eaton Price vs Earnings

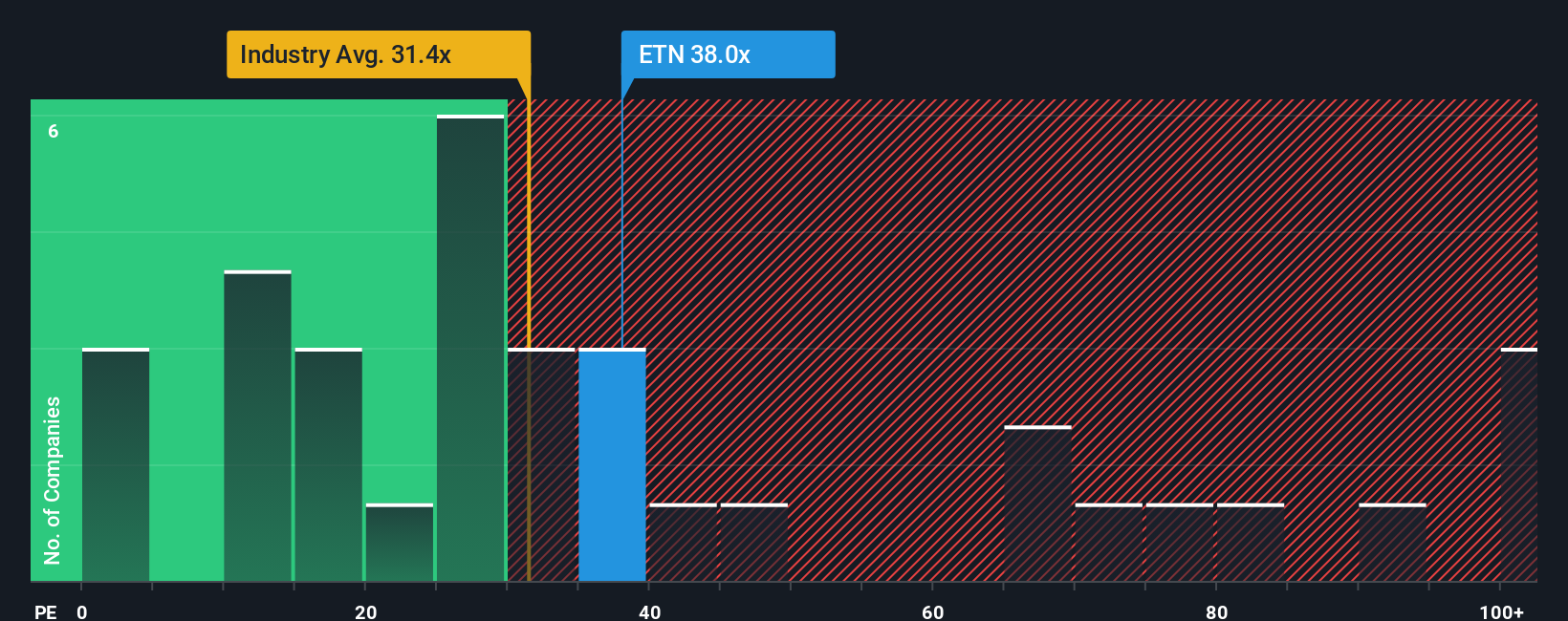

The Price-to-Earnings (PE) ratio is a popular valuation metric for profitable companies like Eaton because it directly compares a company’s share price to its earnings. This gives investors a sense of how much they are paying for each dollar of profit. It is especially relevant when a business generates consistent profits over time, making it easier to evaluate against similar firms.

The "right" PE ratio depends on growth expectations and risks. Companies with higher expected earnings growth or lower risk usually trade at higher PE ratios, while slower-growing or riskier firms tend to have lower ones.

Eaton’s current PE ratio is 38.46x. This is above the electrical industry average of 30.34x, but below the peer group average of 45.22x. To refine things further, Simply Wall St’s proprietary Fair Ratio for Eaton stands at 37.19x. The Fair Ratio is more insightful than just using peer or industry averages because it considers Eaton’s unique combination of growth trajectory, profitability, market cap, and risk profile, offering a more tailored benchmark.

With Eaton trading at a 38.46x PE and a Fair Ratio of 37.19x, the gap is relatively small. This suggests the stock is priced about right, considering its fundamentals and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1394 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Eaton Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a clear, accessible story that connects your perspective on a company—how you see its opportunities, risks, and future growth—to a financial forecast and ultimately to your own fair value estimate. With Narratives, you articulate your assumptions about factors like future revenue, earnings, and margins, making the story behind the numbers both explicit and actionable.

On Simply Wall St's platform, millions of investors use the Narratives tool (available in the Community page) to create, share, and update their viewpoints as new information such as news or earnings reports emerges. Narratives make it easy to see how different stories translate into different valuations, helping you compare any Fair Value estimate to the current Price to decide if a stock is a buy or sell for you. For example, one investor may believe Eaton will benefit from rapid electrification and sustained demand, leading them to a bullish narrative with a higher price target like $440; another might be cautious about cyclical risks and execution challenges, building a more conservative narrative and a target near $288.

Do you think there's more to the story for Eaton? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eaton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETN

Eaton

Operates as a power management company in the United States, Canada, Latin America, Europe, and the Asia Pacific.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives