- United States

- /

- Machinery

- /

- NYSE:ESAB

ESAB (ESAB): Evaluating Valuation Following Strong Earnings and Analyst Upgrades

Reviewed by Simply Wall St

ESAB (NYSE:ESAB) recently delivered better-than-expected quarterly earnings and revenue, which has sparked several analyst upgrades. The company's improved growth outlook and strong footing in the Americas have put it back in the investor spotlight.

See our latest analysis for ESAB.

ESAB's 1-year total shareholder return of 9.5% reflects steady long-term momentum, even as recent share price performance has been a bit choppy. After climbing 11% in the last month, the stock recently pulled back slightly. This coincided with the company securing new credit facilities and receiving fresh analyst optimism, both of which suggest market confidence in ESAB’s growth potential is on the upswing.

If you're watching how capital goods companies are repositioning, now is a perfect moment to explore fast growing stocks with high insider ownership.

With analyst upgrades piling up and shares trading below the latest price targets, investors are left wondering whether ESAB offers real value at current levels or if the market is already pricing in all the growth ahead.

Most Popular Narrative: 13.8% Undervalued

ESAB’s narrative points to a fair value of $139.40, which is notably above the recent close of $120.10. The story driving this valuation centers on robust global demand and lucrative growth opportunities.

ESAB is positioned to benefit from rising global infrastructure investment and energy project activity, particularly in high-growth markets like Asia-Pacific and the Middle East. Recent wins and acquisitions in these regions are supporting robust volume growth and higher EBITDA margins, indicating stronger future revenue and earnings potential as these long-term demand drivers persist.

Want to see why analysts believe ESAB could unlock substantial value in just a few years? The entire argument hinges on ambitious financial goals and improved profitability that could put even industrial giants in the shade. What is the playbook behind this price? Find out what bold assumptions are hidden inside the narrative.

Result: Fair Value of $139.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, revenue pressures in the Americas and exposure to volatile emerging markets could still challenge ESAB's growth trajectory in the near term.

Find out about the key risks to this ESAB narrative.

Another View: What Do The Multiples Say?

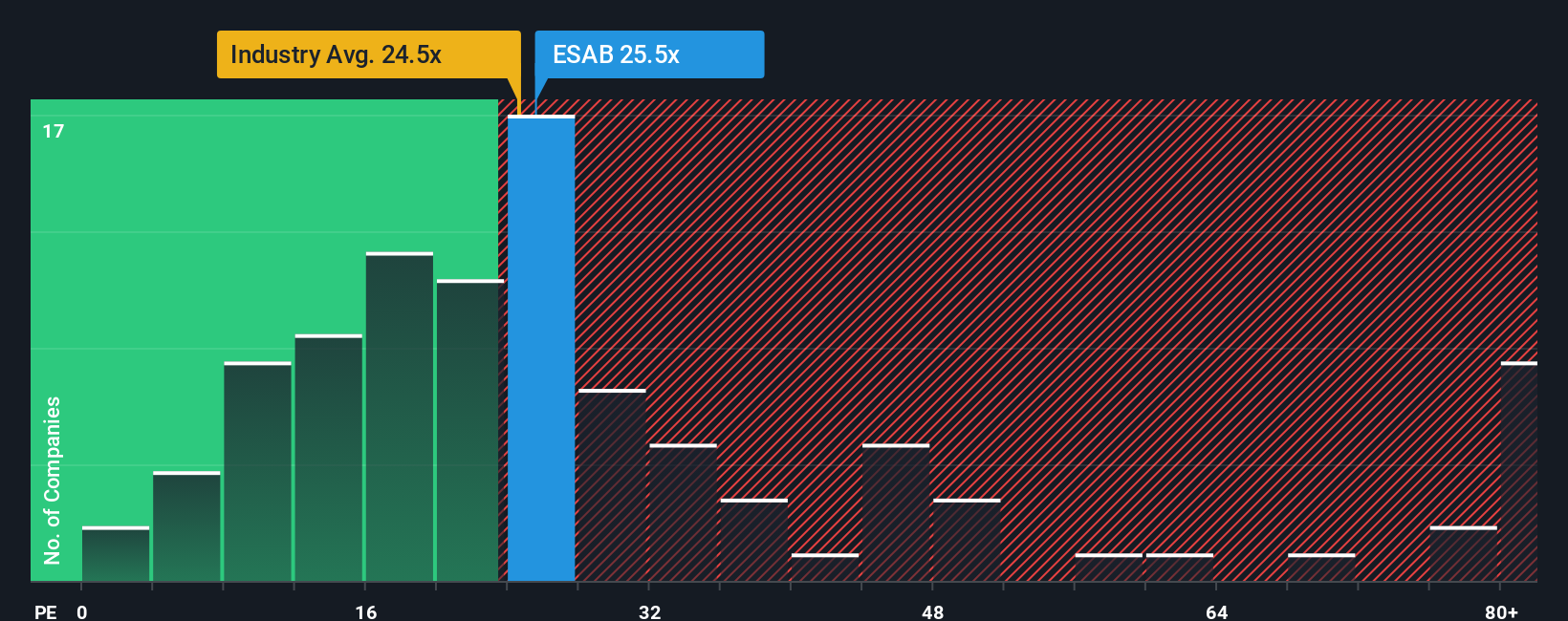

From a market multiples perspective, ESAB looks a bit pricey. Its price-to-earnings ratio sits at 26.1x, which is above both its peers (24.8x) and the US Machinery industry average (24.7x). The current figure also exceeds the calculated fair ratio of 25.6x, suggesting investors are already paying a premium for future growth. Does this leave much room for upside, or does it create valuation risk if expectations slip?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ESAB Narrative

Want to dig deeper or challenge this story using your own research? You can build your perspective quickly using our tools: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding ESAB.

Looking for More Smart Investment Angles?

Don’t let standout opportunities slip by. Use the right tools to spot what others might miss. Broaden your search and get ahead with these strategies:

- Capture impressive yields with these 17 dividend stocks with yields > 3% offering over 3 percent. This is ideal for investors seeking robust income and stable growth in unpredictable markets.

- Target the next wave of innovation as you review these 27 AI penny stocks powering breakthroughs in automation, productivity, and long-term potential.

- Snag undervalued gems before the crowd by tapping into these 877 undervalued stocks based on cash flows to uncover companies trading below their true worth based on cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ESAB might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESAB

ESAB

Engages in the formulation, development, manufacture, and supply of consumable products and equipment for use in cutting, joining, automated welding, and gas control equipment.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives