- United States

- /

- Machinery

- /

- NYSE:EPAC

How Investors Are Reacting To Enerpac Tool Group (EPAC) Record Results and New $200M Buyback Program

Reviewed by Sasha Jovanovic

- Enerpac Tool Group recently reported record fourth-quarter and full-year results, highlighted by sales of US$167.52 million and net income of US$28.08 million for the quarter ended August 31, 2025, alongside the announcement of a new US$200 million share repurchase program.

- The company's raised guidance for fiscal 2026 and commitment to returning capital to shareholders through substantial buybacks points to increased management confidence in sustained business performance and long-term growth.

- We'll evaluate how Enerpac's robust earnings and new share buyback authorization could impact its investment narrative and future outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Enerpac Tool Group Investment Narrative Recap

To be a shareholder in Enerpac Tool Group, you need to believe in ongoing demand for industrial tools and solutions, even amid global economic uncertainty and exposure to tariffs, while watching for whether recent record quarterly results and increased share repurchases offer momentum. This news, highlighting robust sales and a new buyback, supports the near-term earnings narrative but does not materially change the risk that ongoing geopolitical or economic softness could limit order growth and pressure profitability if conditions worsen.

The company's just-announced US$200 million share repurchase program is most relevant; it emphasizes a sustained commitment to returning capital to shareholders. However, the main short-term catalyst remains execution in core markets and integration of recent acquisitions, while the largest risk is persistent margin pressure from tariffs and potential end market volatility.

In contrast, investors should also be aware that persistent cost headwinds from tariffs and potential pricing challenges could still weigh on Enerpac's margins, especially if...

Read the full narrative on Enerpac Tool Group (it's free!)

Enerpac Tool Group's outlook forecasts $711.0 million in revenue and $127.9 million in earnings by 2028. This implies a 5.4% annual revenue growth rate and a $39.8 million earnings increase from the current $88.1 million level.

Uncover how Enerpac Tool Group's forecasts yield a $49.50 fair value, a 23% upside to its current price.

Exploring Other Perspectives

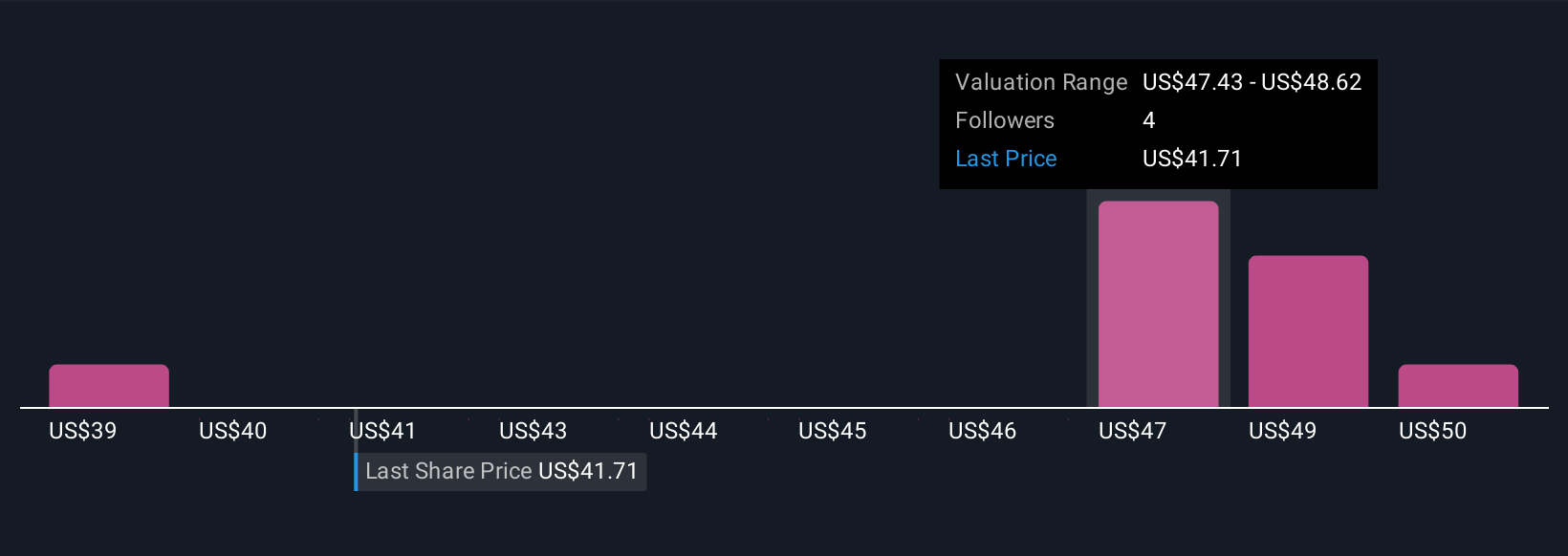

Three member valuations from the Simply Wall St Community placed Enerpac’s fair value between US$39.11 and US$49.50 per share. While many are focused on capital returns and recent earnings growth, persistent cost pressures from tariffs remain an important factor shaping future performance and could warrant a closer look at alternative views.

Explore 3 other fair value estimates on Enerpac Tool Group - why the stock might be worth just $39.11!

Build Your Own Enerpac Tool Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Enerpac Tool Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Enerpac Tool Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Enerpac Tool Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enerpac Tool Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EPAC

Enerpac Tool Group

Manufactures and sells a range of industrial products and solutions in the United States, the United Kingdom, Germany, Australia, Canada, China, Saudi Arabia, Brazil, France, the Netherlands, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives