- United States

- /

- Electrical

- /

- NYSE:EMR

The Bull Case For Emerson Electric (EMR) Could Change Following Thacker Pass Lithium Automation Win – Learn Why

Reviewed by Sasha Jovanovic

- In recent days, Lithium Americas Corp. announced it selected Emerson Electric to provide its comprehensive automation systems and technical services for the Thacker Pass lithium project in northern Nevada, supporting the development of what is considered the world's largest known measured lithium resource.

- This collaboration positions Emerson to play a key role in the U.S. lithium supply chain, an area seeing robust demand growth due to the rise in electric vehicles and renewable energy storage needs.

- We'll explore how securing the Thacker Pass automation contract may impact Emerson's growth outlook within its broader investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Emerson Electric Investment Narrative Recap

To be a shareholder in Emerson Electric, you need to believe in the company’s ability to capitalize on global demand for industrial automation and digital solutions, especially as energy transition and electrification accelerate. While the Thacker Pass lithium project expands Emerson’s exposure to the U.S. battery supply chain, a growing end market, this win is unlikely to materially shift the biggest near-term catalyst, which remains broad-based recovery across key automation markets, or its major risk, which is margin pressure from tariffs and FX volatility.

Among recent announcements, Emerson’s 5% dividend increase stands out. This move, which comes as the company pursues new automation contracts like Thacker Pass, highlights management’s continued efforts to reward shareholders and suggests confidence in stable future cash flows, even as uncertainties in global end markets persist.

However, before focusing on Emerson’s expanding automation pipeline, investors should be aware of the ongoing risk of unpredictable FX swings and margin pressure, which...

Read the full narrative on Emerson Electric (it's free!)

Emerson Electric's outlook projects $21.3 billion in revenue and $3.3 billion in earnings by 2028. This reflects a 6.2% annual revenue growth rate and a $1.1 billion increase in earnings from the current $2.2 billion level.

Uncover how Emerson Electric's forecasts yield a $150.84 fair value, a 14% upside to its current price.

Exploring Other Perspectives

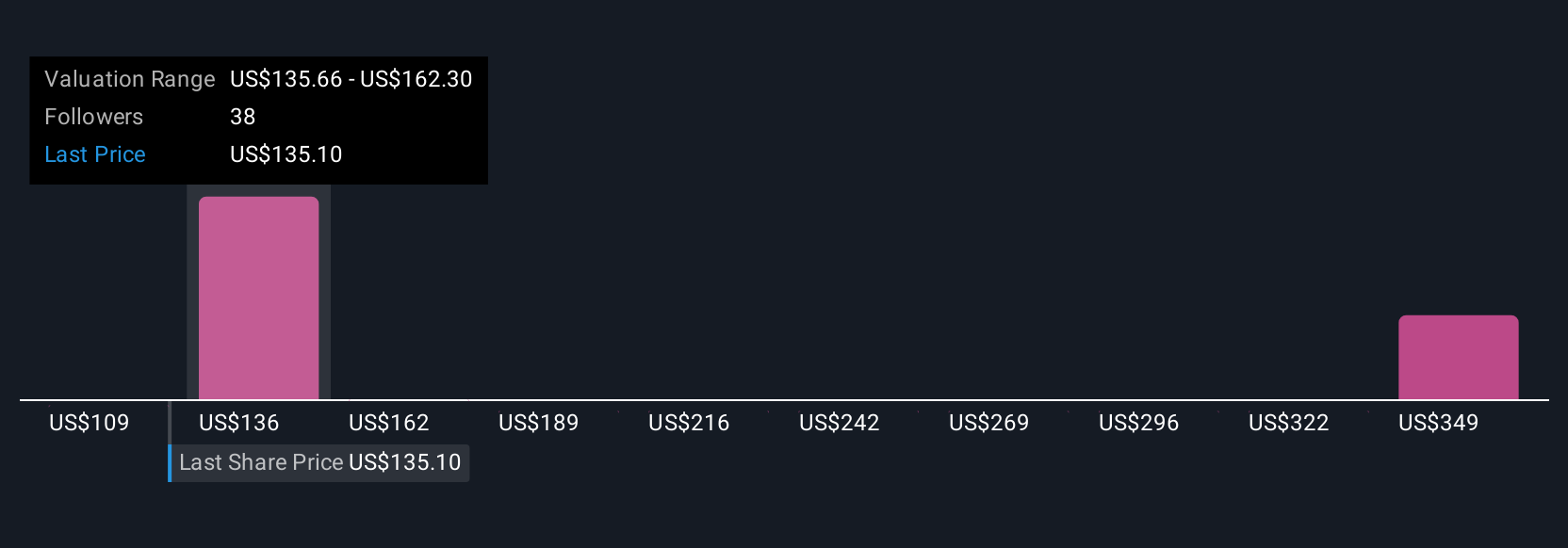

Five distinct fair value estimates from the Simply Wall St Community range from US$109.01 to US$355.52 per share. While opinions vary, the fast adoption of automation and AI-enabled platforms could influence future sentiment and performance; explore how other investors assess the opportunities and risks facing Emerson.

Explore 5 other fair value estimates on Emerson Electric - why the stock might be worth 18% less than the current price!

Build Your Own Emerson Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Emerson Electric research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Emerson Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Emerson Electric's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emerson Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EMR

Emerson Electric

A technology and software company, provides various solutions in the Americas, Asia, the Middle East, Africa, and Europe.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives