- United States

- /

- Electrical

- /

- NYSE:EMR

How Investors May Respond To Emerson Electric (EMR) Securing Key Lithium and Solar Automation Projects

Reviewed by Sasha Jovanovic

- In recent weeks, Emerson Electric announced significant client wins, including providing advanced automation and control systems for the Thacker Pass lithium project, South32's Hermosa mine, and Mitsui's Three W Solar installation in Texas, supporting clean energy and critical minerals initiatives.

- These projects reinforce Emerson's expanding role in enabling key infrastructure for electrification and renewable energy markets, driven by growing demand for digital automation in both mining and utility-scale solar sectors.

- We'll look at how Emerson’s automation solutions for high-growth sectors like lithium and solar could reshape its investment outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Emerson Electric Investment Narrative Recap

Investors who believe in the accelerating adoption of digital automation and electrification as drivers of long-term growth may find Emerson Electric’s latest renewable energy client wins encouraging, but these announcements are unlikely to materially alter the near-term risk of margin pressure in its Intelligent Devices segment from persistent tariffs and foreign exchange volatility. While the projects showcase Emerson’s capabilities in mission-critical sectors, they do not fully resolve concerns about broader segment profitability or exposure to cyclical end markets.

The recent automation agreement with Lithium Americas for the Thacker Pass lithium project best exemplifies how Emerson is capitalizing on the push for energy transition infrastructure, reflecting its alignment with trends that support demand for digital automation and continuous margin improvement amid evolving sector challenges.

By contrast, investors should also be aware that ongoing FX headwinds and tariffs continue to present a real risk to near-term margins, especially if...

Read the full narrative on Emerson Electric (it's free!)

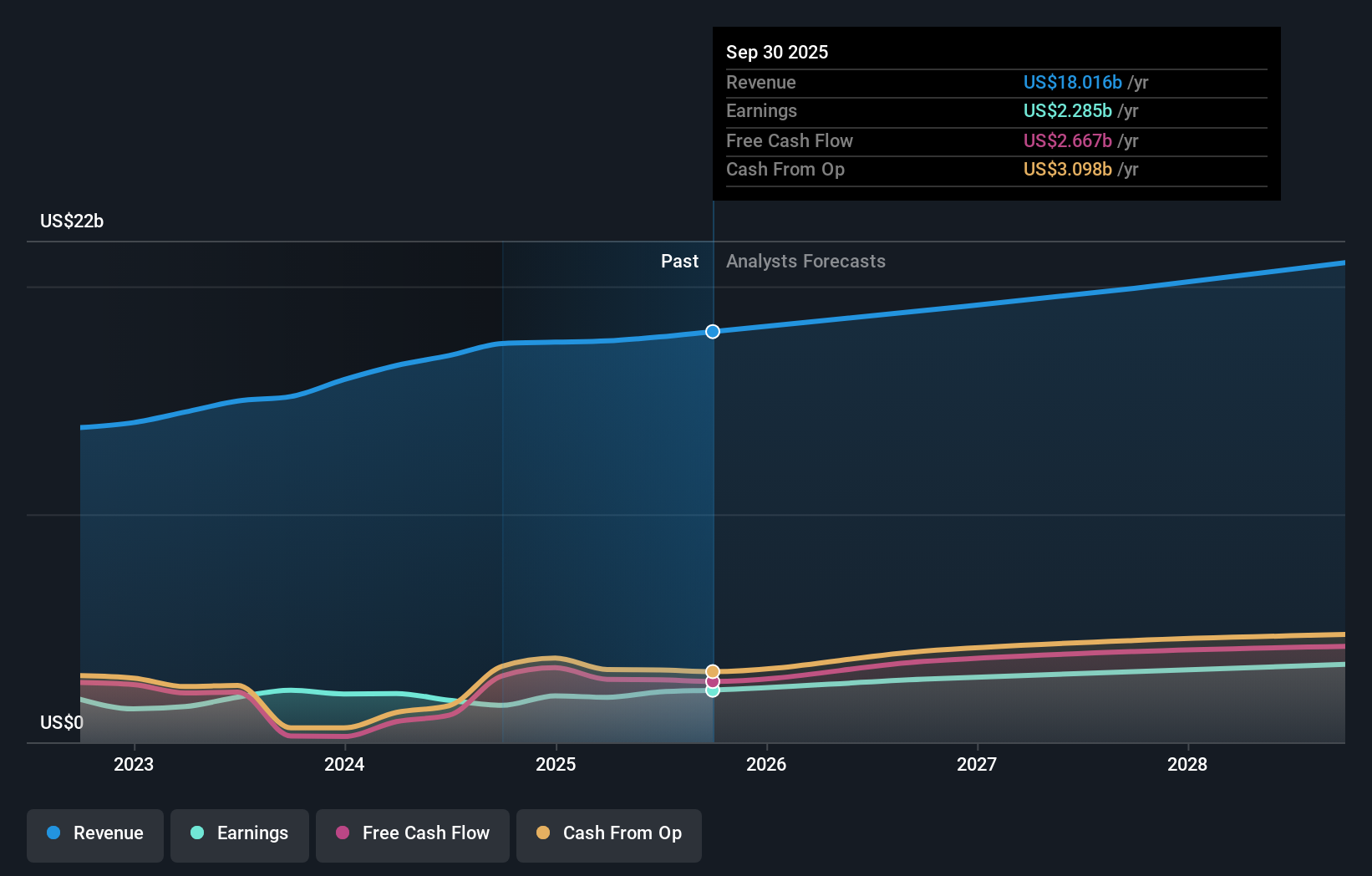

Emerson Electric's outlook anticipates $21.3 billion in revenue and $3.3 billion in earnings by 2028. This path assumes a 6.2% annual revenue growth rate and a $1.1 billion increase in earnings from the current $2.2 billion level.

Uncover how Emerson Electric's forecasts yield a $150.84 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community range widely from US$109 to US$228 per share. With margin pressure risks still present, opinions on future performance vary significantly, inviting you to consider these diverse viewpoints.

Explore 5 other fair value estimates on Emerson Electric - why the stock might be worth 15% less than the current price!

Build Your Own Emerson Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Emerson Electric research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Emerson Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Emerson Electric's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emerson Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EMR

Emerson Electric

A technology and software company, provides various solutions in the Americas, Asia, the Middle East, Africa, and Europe.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives