- United States

- /

- Electrical

- /

- NYSE:EMR

Evaluating Emerson Electric (EMR): Is the Current Share Price Leaving More Upside on the Table?

Reviewed by Simply Wall St

See our latest analysis for Emerson Electric.

The past year has seen Emerson Electric’s share price steadily climb, building momentum from operational improvements and sustained positive sentiment around its sector. With a 25.6% total shareholder return over the last twelve months and a robust 66% three-year total return, Emerson continues to demonstrate long-term value, even as short-term dips appear in quarterly moves.

If you’re interested in seeing what other industrial leaders are up to, it could be the perfect time to explore See the full list for free.

With the stock trading close to recent highs and maintaining double-digit growth in both revenue and net income, the key question is whether Emerson’s future gains are already priced in or if further upside remains for new buyers.

Most Popular Narrative: 10.8% Undervalued

Emerson Electric is trading at $134.52, notably below the most widely followed narrative's fair value estimate of $150.84. Strong growth assumptions and sector momentum set the stage for a deeper look at what drives this outlook.

The accelerating adoption of digital automation and artificial intelligence solutions in global industrial markets is fueling strong demand for Emerson's advanced software platforms and AI-enabled products, such as Ovation 4.0 and Nigel AI adviser. This is resulting in robust order growth and positions the company for sustained revenue expansion.

Want to know the growth blueprint behind this valuation? The key is a high-impact mix of future profit margins and earnings expansion. Curious what specific assumptions analysts are making that could justify such optimism? Dive deeper to uncover the bold projections and financial targets inside this calculation.

Result: Fair Value of $150.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, some analysts caution that persistent margin pressure or underwhelming demand in key markets could quickly undermine the upbeat outlook for Emerson.

Find out about the key risks to this Emerson Electric narrative.

Another View: Multiples Tell a Different Story

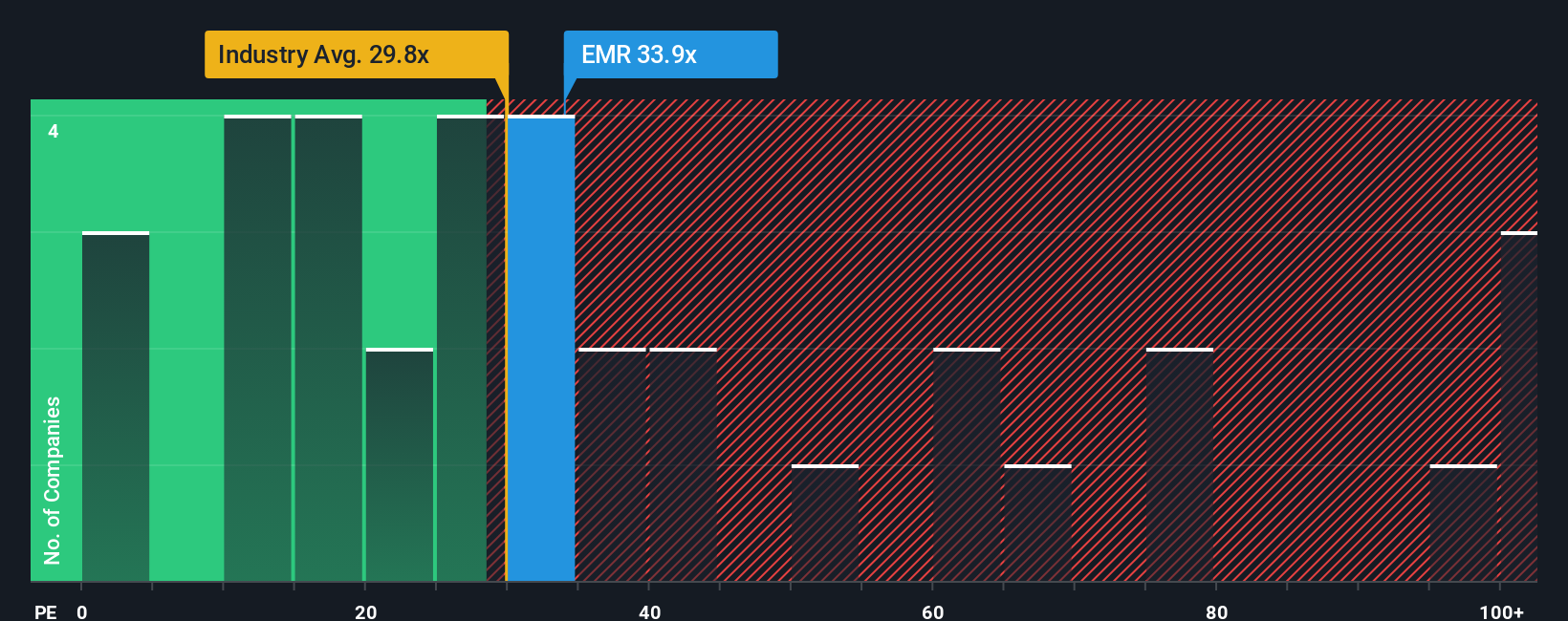

Looking from a price-to-earnings angle, Emerson is trading at 34.3 times earnings. This is above both its fair ratio of 31.7x and the sector average of 30.5x, but below its peer average of 44.9x. While this leaves little margin for error, it also suggests the stock could look expensive if growth slows or sentiment shifts. Will the market reward Emerson’s premium price tag, or could investors face greater risk ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Emerson Electric Narrative

If you see things differently or want to add your own perspective, you can analyze the numbers for yourself and craft a personalized view in just a few minutes with Do it your way.

A great starting point for your Emerson Electric research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investing Ideas?

Don’t limit yourself to just one opportunity. The right stock could be waiting for you. Make your next move and elevate your strategy today.

- Capture hidden value by reviewing these 866 undervalued stocks based on cash flows that pass rigorous cash flow checks and may be trading at bargain prices right now.

- Tap into unstoppable trends by searching through these 26 AI penny stocks positioned to change industries with artificial intelligence and machine learning advancements.

- Lock in passive income growth with these 21 dividend stocks with yields > 3% offering consistent yields above 3%, ideal for building wealth over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emerson Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EMR

Emerson Electric

A technology and software company, provides various solutions in the Americas, Asia, the Middle East, Africa, and Europe.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives