- United States

- /

- Construction

- /

- NYSE:EME

Does the Recent 19% Pullback Make EMCOR Group an Attractive Value in 2025?

Reviewed by Bailey Pemberton

- Wondering whether EMCOR Group is trading at a price that makes sense for your portfolio? Let’s dig into what really matters for investors interested in value.

- The stock has risen 33.5% year-to-date and is up 20.5% over the last year, but it recently cooled off with a 19.1% decline in the last month.

- There has been a whirlwind of industry headlines recently, from infrastructure spending pushing contractors into the spotlight to renewed interest in companies specializing in building efficiency and retrofits, adding fuel to the share price swings.

- EMCOR Group currently scores a perfect 6/6 on our valuation checks, but keep in mind that traditional metrics are just the starting point. We will break down the usual valuation tools in a moment, and at the end, reveal an even deeper framework for understanding what EMCOR Group is truly worth.

Find out why EMCOR Group's 20.5% return over the last year is lagging behind its peers.

Approach 1: EMCOR Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting future cash flows and discounting them back to today’s value. This approach helps investors gauge what the business is really worth based on its expected ability to generate cash in the years ahead.

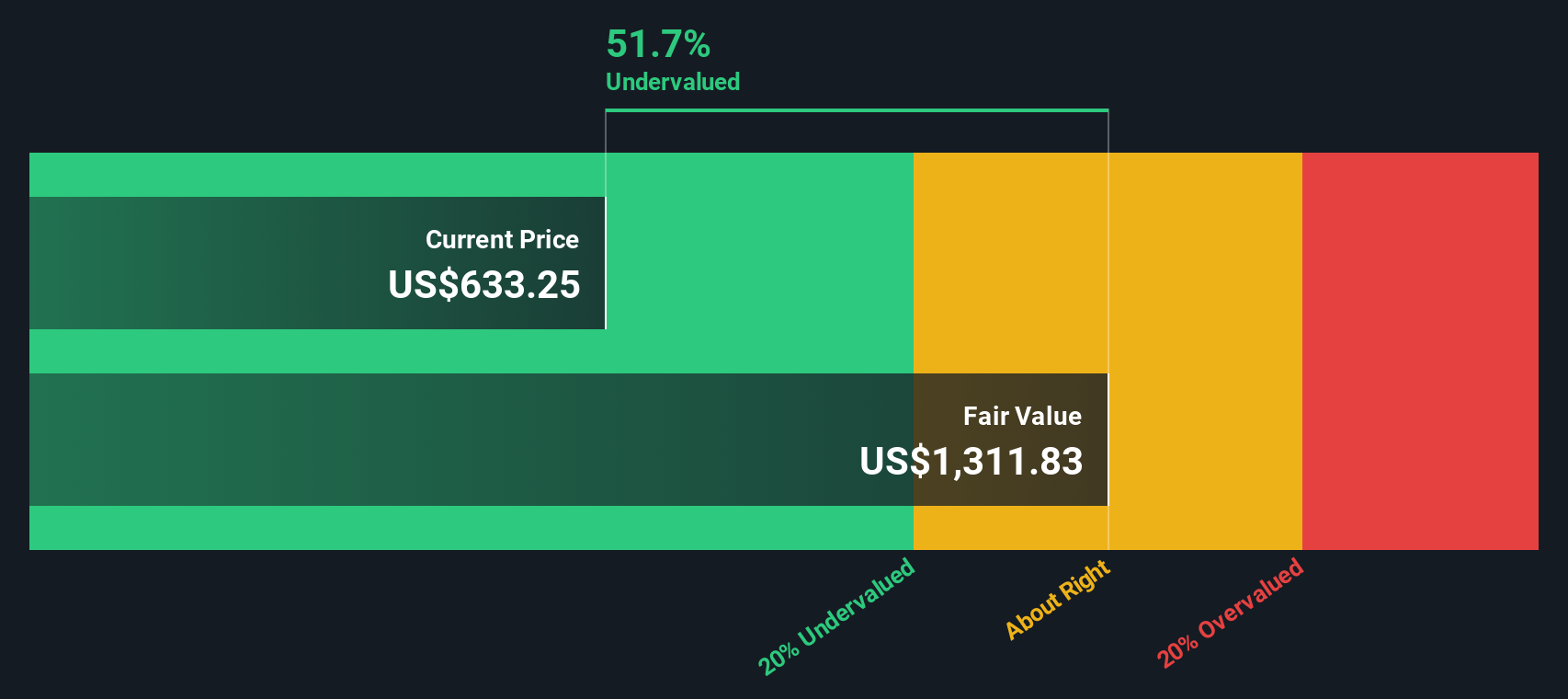

EMCOR Group currently generates Free Cash Flow of $1.15 billion, according to the latest figures. Analysts forecast steady growth in these cash flows, projecting around $1.30 billion in 2026, $1.47 billion in 2027, and reaching $2.01 billion by 2029. Beyond the analyst estimates, further growth toward 2035 is extrapolated by Simply Wall St, with projections continuing to climb but at a more modest pace.

Using a two-stage Free Cash Flow to Equity approach, the DCF model calculates an intrinsic value per share of $909.27. At this valuation, EMCOR Group’s shares trade at a 32.8% discount, suggesting the stock is significantly undervalued compared to what these cash flows indicate it is truly worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests EMCOR Group is undervalued by 32.8%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: EMCOR Group Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like EMCOR Group. It offers a straightforward snapshot of how much investors are willing to pay for each dollar of earnings, making it practical for comparing businesses that consistently deliver profits.

Interpreting what qualifies as a "normal" or "fair" PE ratio depends on expectations for future growth and the risks inherent to a specific company. Higher anticipated growth often justifies a higher PE, while greater risks or weaker outlooks may warrant a discount.

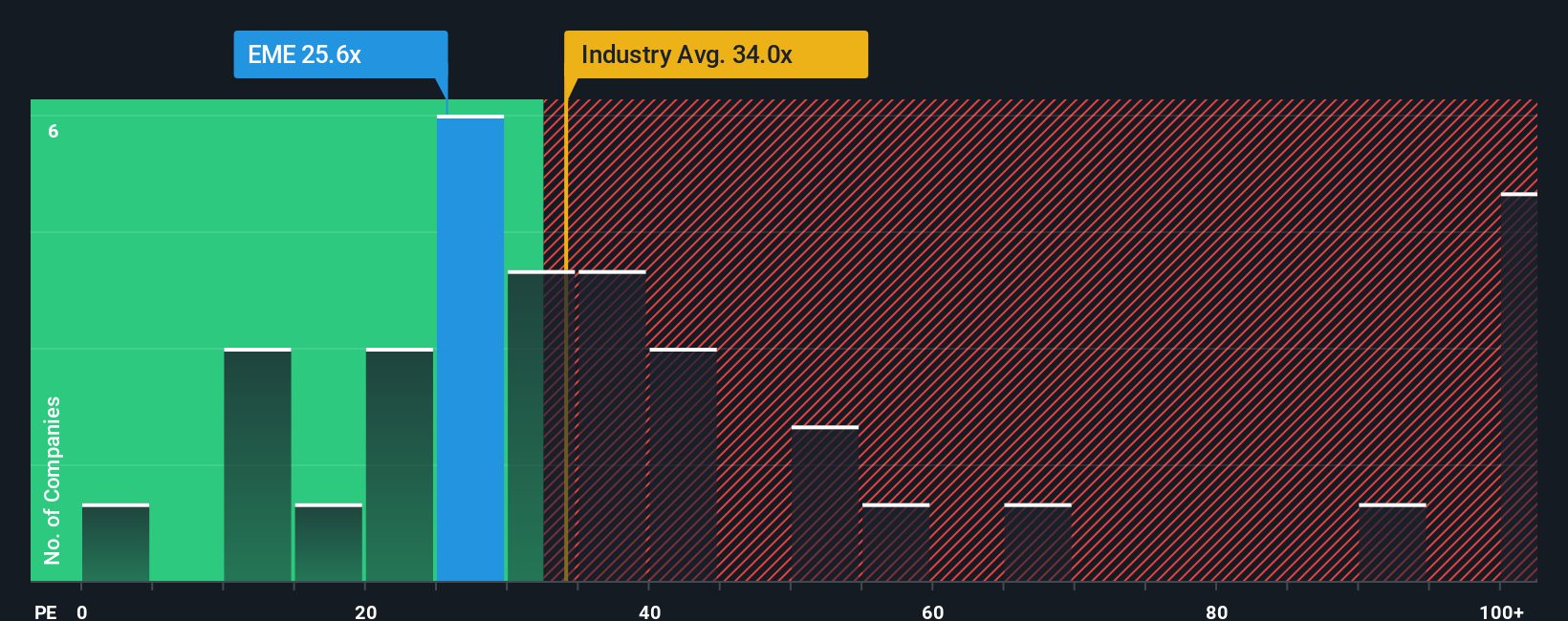

EMCOR Group currently trades at a PE ratio of 24.2x. In comparison, the construction industry average is 33.8x, and the average among its peers is a much steeper 54.1x. At first glance, EMCOR appears to be valued conservatively in relation to both its sector and its closest competitors.

However, Simply Wall St refines this perspective with its proprietary Fair Ratio, which is calculated at 30.3x for EMCOR Group. This Fair Ratio incorporates company-specific factors like earnings growth potential, profit margins, industry context, market cap, and risk profile. As a result, it serves as a more tailored and relevant benchmark than industry averages or peer groups alone.

With EMCOR's actual PE ratio of 24.2x sitting notably below the Fair Ratio of 30.3x, the stock looks attractively valued on this measure, indicating that investors may be getting more growth for a lower price than the market typically expects given its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your EMCOR Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple and approachable way to connect your perspective on a company, not just by crunching numbers but by telling a story about the company’s future, including your own estimates of its fair value, expected revenue growth, earnings, and profit margins.

When you build a Narrative, you link EMCOR Group’s real-world outlook to a specific financial forecast and a fair value calculation. This clarifies why you believe the share price should go higher, lower, or stay the same. Narratives make this process accessible to everyone and can be created directly on Simply Wall St’s Community page, which is trusted by millions of investors.

With Narratives, you can quickly gauge whether EMCOR Group is a buy or a sell by comparing your fair value estimate to the current share price. These insights update automatically as news breaks or earnings are released, keeping your thinking relevant and dynamic.

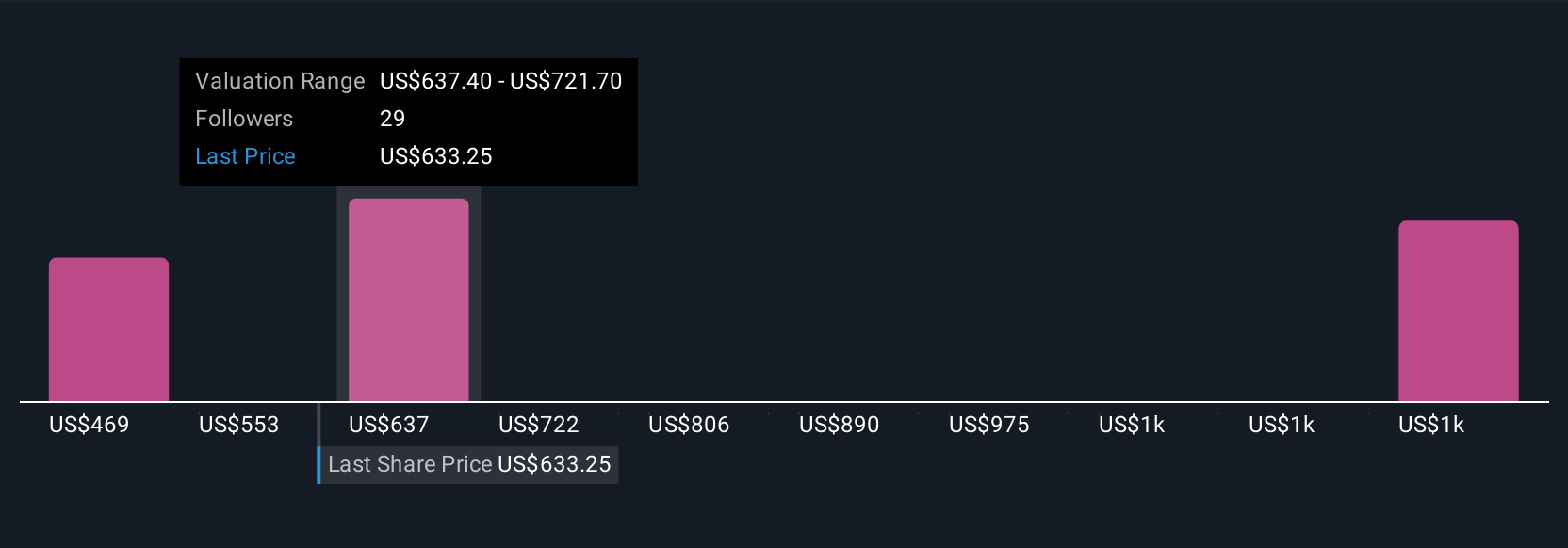

For example, some investors currently see EMCOR Group as fairly valued at $468.79 per share based on steady growth and careful margin assumptions. Others envision a much higher upside at $758.50 given strong demand, improved margins, and strategic execution. Your Narrative helps you decide which story is most likely and invest with confidence.

For EMCOR Group, we’ll make it really easy for you with previews of two leading EMCOR Group Narratives:

Fair Value: $758.50

Current Discount to Fair Value: 19.5%

Revenue Growth Assumption: 8.33%

- Demand from sector trends, green building upgrades, and digital integration is building a record-high project backlog. This supports revenue growth and stronger long-term margins.

- Strategic acquisitions and investment in talent and prefabrication increase market reach and efficiency, outpacing labor market challenges.

- Analysts expect growing earnings but note risks from labor shortages and sector cyclicality. The consensus price target is 8.6% above the current share price, suggesting a fair-to-undervalued status.

Fair Value: $468.79

Current Premium to Fair Value: 30.3%

Revenue Growth Assumption: 9.0%

- EMCOR Group benefits from infrastructure spending, data center and AI buildout, and energy transition trends, supporting steady growth and strong fundamentals.

- Risks include economic downturns, labor shortages, exposure to government policy shifts, cost inflation, and intense industry competition.

- The current share price is viewed as fair to slightly overvalued, with intrinsic value estimates reflecting a balanced outlook between upside catalysts and risks for long-term investors.

Do you think there's more to the story for EMCOR Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EMCOR Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EME

EMCOR Group

Provides electrical and mechanical construction and facilities, building, and industrial services in the United States and the United Kingdom.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success