- United States

- /

- Construction

- /

- NYSE:EME

Does EMCOR Group’s Expansion Signal More Growth After a 4.5% Share Price Decline?

Reviewed by Bailey Pemberton

- Wondering if EMCOR Group is truly as undervalued as some investors think? You are not alone, and a closer look at the numbers could lead to some surprises.

- Despite a recent dip of 4.5% in the last week and 10.2% over the past month, EMCOR Group is still up an impressive 35.4% year-to-date and 24.5% over the last year, with a massive 635.8% return over five years.

- Recent headlines have put the spotlight on continued expansion into new markets and high-profile project wins. Both of these factors have fueled speculation about the company’s growth potential. Market discussions also highlight EMCOR’s resilience in volatile conditions, with analysts pointing out its strong fundamentals.

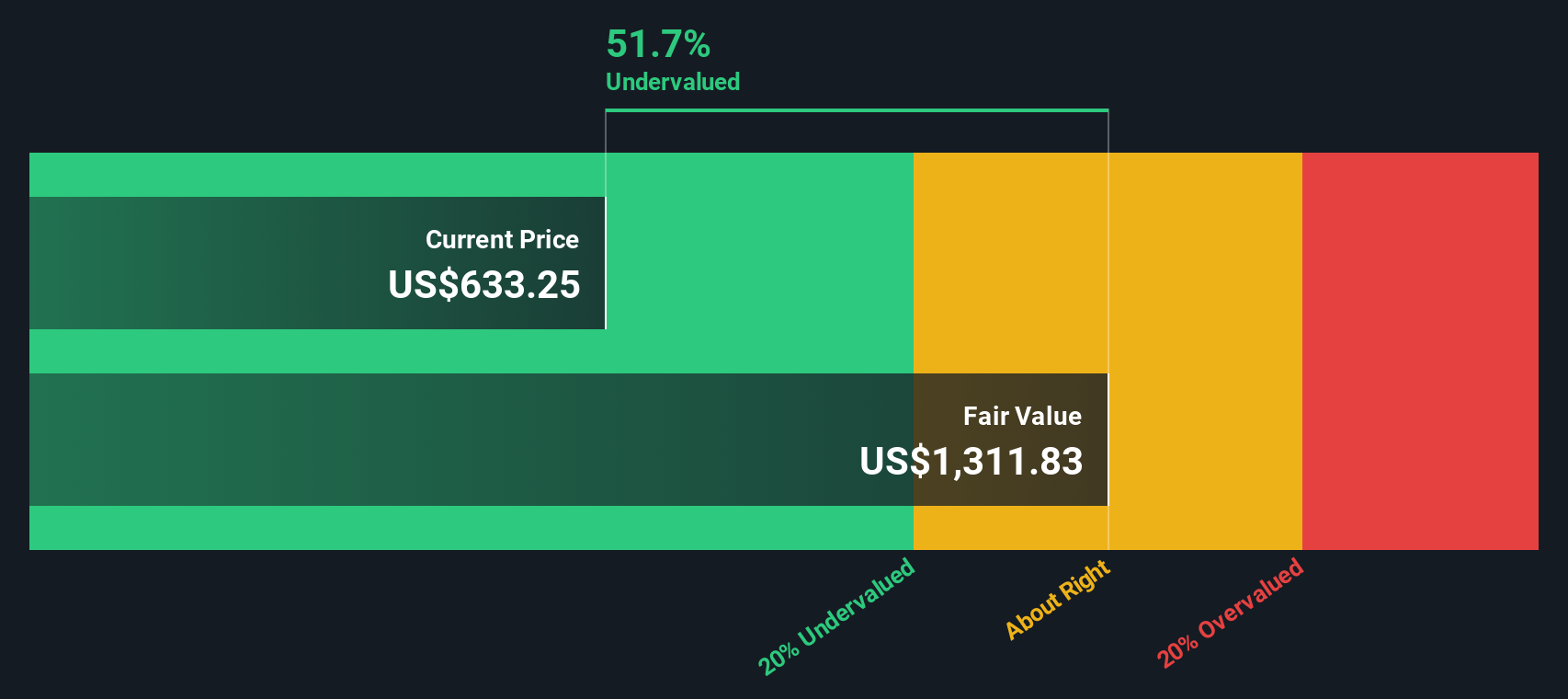

- Currently, the company scores 6/6 on our valuation checks, meaning it appears undervalued across all criteria. Up next, we will break down how these checks stack up against standard valuation approaches. Later in the article, we will reveal an additional way to understand EMCOR’s true worth.

Find out why EMCOR Group's 24.5% return over the last year is lagging behind its peers.

Approach 1: EMCOR Group Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its expected future cash flows and discounting them back to today’s dollars. In EMCOR Group’s case, the DCF uses the 2 Stage Free Cash Flow to Equity approach to analyze its potential over the coming years.

Currently, EMCOR Group generates Free Cash Flow (FCF) of $1.15 billion. According to analysts, FCF is expected to rise each year over the next five years, ultimately reaching $2.01 billion by the end of 2029. Beyond that period, further projections are extrapolated based on recent trends, and all values here are quoted in US dollars.

Running these projections through the DCF model results in an estimated fair value of $917.85 per share. Compared to the company’s current share price, the DCF suggests the stock is trading at a 32.5% discount. This suggests EMCOR Group may be significantly undervalued on a cash flow basis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests EMCOR Group is undervalued by 32.5%. Track this in your watchlist or portfolio, or discover 879 more undervalued stocks based on cash flows.

Approach 2: EMCOR Group Price vs Earnings

The Price-to-Earnings (PE) ratio is widely regarded as a practical valuation tool for profitable companies like EMCOR Group, as it relates a company’s share price to its actual earnings. A lower PE can indicate a stock is undervalued if earnings are expected to grow, while a higher PE may be justified by rapid growth or lower perceived risk.

Growth expectations and risk play significant roles in determining what counts as a “normal” or “fair” PE ratio. Companies with strong, stable growth prospects often command higher PEs, while those facing uncertainty or limited expansion potential tend toward lower multiples.

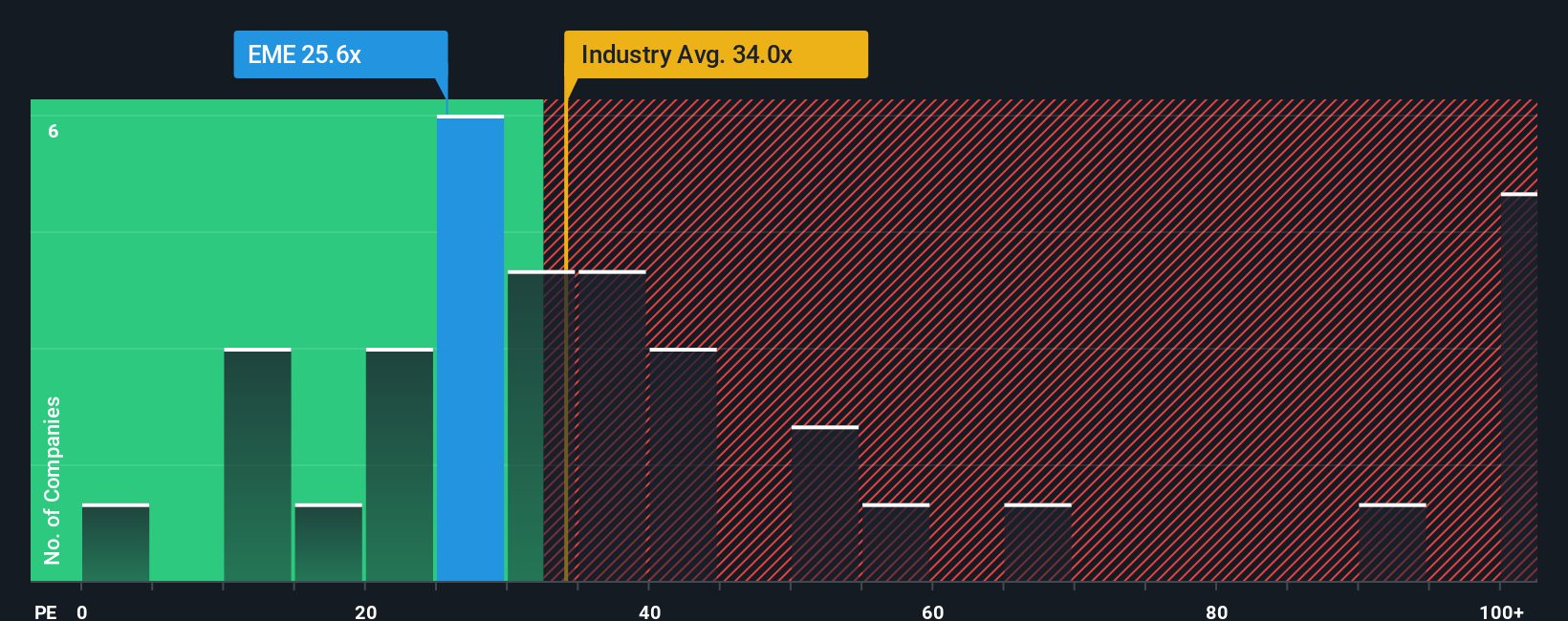

Currently, EMCOR Group trades at a PE ratio of 24.5x. This is well below both the average for its industry at 33.1x and the peer group average of 52.3x. On the surface, this points to a potentially undervalued stock relative to its sector and competitors.

However, the Fair Ratio, calculated by Simply Wall St, is a more nuanced benchmark. It factors in EMCOR’s earnings growth, profit margin, industry context, market cap, and specific risks, rather than relying solely on broad averages. For EMCOR, the Fair Ratio is 30.4x, reflecting the multiple the company deserves based on its complete outlook.

By directly comparing EMCOR Group’s current PE of 24.5x with its Fair Ratio of 30.4x, the stock appears to be notably undervalued using this approach, reinforcing the notion that there may be further upside.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your EMCOR Group Narrative

Earlier we mentioned there is an even better way to make sense of valuation, so let’s introduce you to Narratives, a dynamic method that lets investors anchor their own story about EMCOR Group’s future to the numbers that matter.

A Narrative is simply your perspective on where the company is headed: you express your outlook with your assumptions about future revenue, profit margins, fair value, and even the risks in play. Narratives connect the company’s underlying story to a financial forecast, then translate it directly into a fair value estimate.

Available right within the Simply Wall St Community page, Narratives make it simple for millions of investors to share, update, and compare viewpoints. Whether you see EMCOR Group as a high-growth leader or as more fairly valued amid industry risks, Narratives empower you to spot buy and sell opportunities by contrasting fair value versus the live stock price. They stay up to date as soon as new earnings, guidance, or big news breaks.

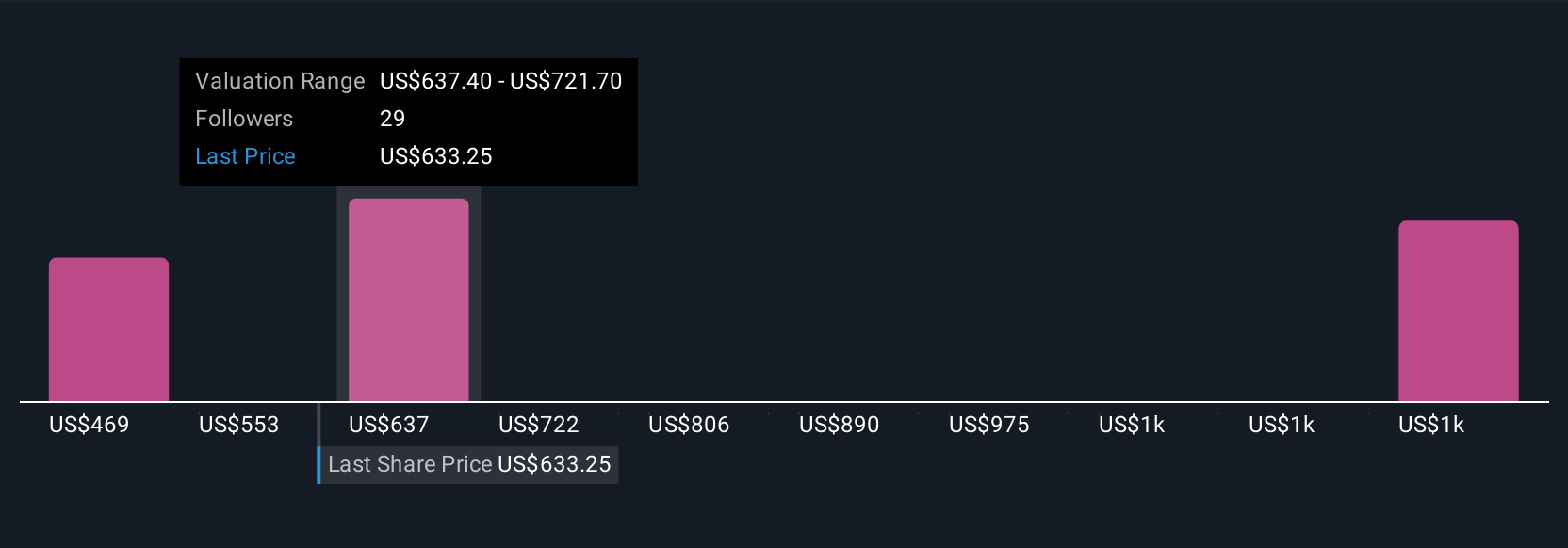

For example, some investors’ Narratives value EMCOR Group at $468.79 per share by using conservative long-term growth and earnings estimates, while others with a bullish outlook have set fair values as high as $758.50, reflecting more optimistic views on margin expansion and demand trends.

For EMCOR Group, we'll make it really easy for you with previews of two leading EMCOR Group Narratives:

Fair Value: $758.50

Undervalued by 18.3%

Revenue Growth Rate: 8.32%

- Anticipates rising reshoring trends and a diversified backlog to drive strong revenue growth, even as profit margins moderate slightly.

- Strategic acquisitions and investments in talent and prefabrication are expected to boost operational efficiency and support margin recovery, helping to weather industry challenges including labor shortages.

- Analysts' consensus price target is 8.6% above the current share price, reflecting long-term faith in EMCOR's U.S.-focused growth strategy and competitive positioning. However, there are risks from integration, sector cyclicality, and limited renewables exposure.

Fair Value: $468.79

Overvalued by 32.3%

Revenue Growth Rate: 9.0%

- Observes that while EMCOR is benefiting from infrastructure, data centers, and reshoring, the stock now trades significantly above its intrinsic value, given a more cautious outlook on risk and valuation multiples.

- Warns that potential economic slowdown, project cyclicality, tight labor markets, and dependence on government and supply chains could pressure earnings and margins.

- Estimates intrinsic value using a 9% revenue growth rate, 6.5% net margin, and historical 20x P/E multiple. This suggests the stock is fairly valued only at much lower prices than today’s.

Do you think there's more to the story for EMCOR Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EMCOR Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EME

EMCOR Group

Provides electrical and mechanical construction and facilities, building, and industrial services in the United States and the United Kingdom.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives