- United States

- /

- Construction

- /

- NYSE:ECG

A Look at Everus Construction Group’s (ECG) Valuation Following Raised Guidance and Strong Q3 Results

Reviewed by Simply Wall St

Everus Construction Group (ECG) reported stronger-than-expected third-quarter results, with both earnings and revenue up sharply from last year. Management also raised its outlook for full-year revenue and income, indicating continued momentum for the company.

See our latest analysis for Everus Construction Group.

Everus Construction Group’s momentum has accelerated this year, with the share price returning 41.2% year-to-date and a one-year total shareholder return of 53.2%. After another earnings beat and raised guidance, the stock recently set a new all-time high. This underscores growing investor confidence and the company’s strengthening market position.

If you’re curious what other companies are showing similar momentum, now is the perfect time to broaden your horizon and discover fast growing stocks with high insider ownership

With such impressive financial momentum and a record-setting share price, investors are now left to ask whether Everus Construction Group remains undervalued or if the current market already reflects expectations for further growth. This creates a potential buying dilemma.

Price-to-Earnings of 27.6x: Is it justified?

ECG is trading at a price-to-earnings (P/E) ratio of 27.6x, which is below the US Construction industry average of 33.6x. With the last close at $97.81, this multiple suggests the market may be discounting ECG’s future earnings less heavily than its industry peers, making the stock look reasonably valued relative to competitors.

The price-to-earnings ratio compares the company’s share price to its per-share earnings and is a classic measure of valuation. For a construction firm like ECG, this multiple reflects investor expectations for sustainable profit growth, especially after reporting high recent earnings momentum. A P/E ratio in this range usually implies the market sees ongoing growth or relative stability ahead.

Compared to broader industry benchmarks, ECG’s P/E multiple is attractively lower than the sector’s average of 33.6x. This hints that it could be an appealing value within the construction space. Relative to the estimated Fair Price-to-Earnings Ratio of 28x, ECG sits right at the level the market could trend towards, which supports the case for its current valuation.

Explore the SWS fair ratio for Everus Construction Group

Result: Price-to-Earnings of 27.6x (ABOUT RIGHT)

However, continued growth is not guaranteed. Any slowdown in annual revenue or profit could challenge the current upbeat outlook for Everus Construction Group.

Find out about the key risks to this Everus Construction Group narrative.

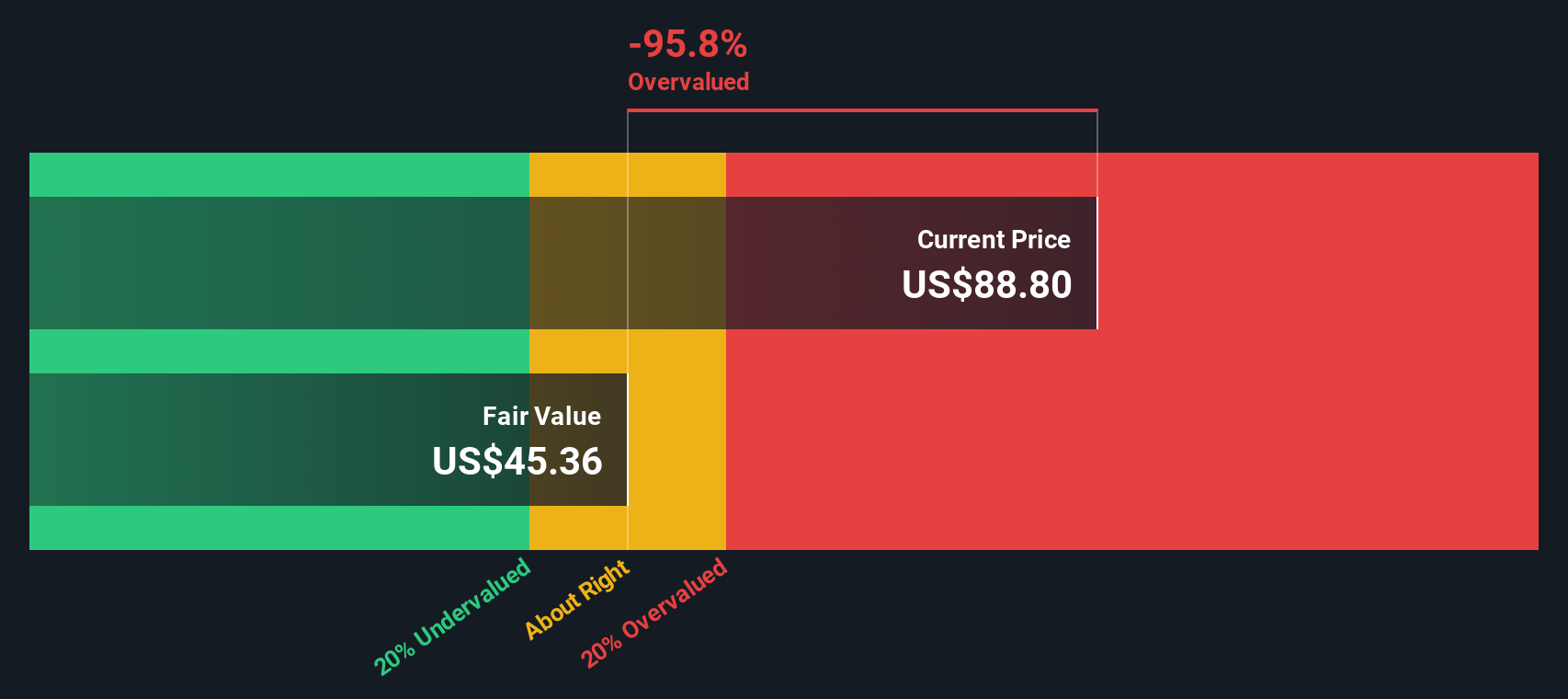

Another View: The DCF Model Raises Questions

While Everus Construction Group looks reasonably valued using earnings multiples, our DCF model presents a different perspective. The SWS DCF model estimates fair value at just $40.43 per share, which is well below the current price of $97.81. This suggests the stock could be considerably overvalued if growth stalls. Could the upbeat market optimism be overlooking real risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Everus Construction Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Everus Construction Group Narrative

If you prefer to dig into the numbers yourself or challenge the conclusions here, you can easily craft your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Everus Construction Group.

Looking for more investment ideas?

Don’t let great opportunities pass you by. Make your next smart move by checking out some of the most promising stocks and trends on Simply Wall Street.

- Tap into big growth potential and spot tomorrow’s winners in the market by reviewing these 876 undervalued stocks based on cash flows.

- Unlock income-generating opportunities by seeing which companies are offering strong returns with these 16 dividend stocks with yields > 3%.

- Get ahead of breakthroughs that could change everything by tracking innovation in computing with these 28 quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Everus Construction Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ECG

Everus Construction Group

Provides contracting services in the United States.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives