- United States

- /

- Construction

- /

- NYSE:ECG

A Fresh Look at Everus Construction Group (ECG) Valuation After Bullish Pattern and Upbeat Earnings Estimates

Reviewed by Simply Wall St

The emergence of a bullish hammer chart pattern in Everus Construction Group (ECG) has caught investor attention, as it points to a potential shift in momentum following a stretch of bearish trading. Recent revisions in earnings estimates further highlight shifting expectations for the company.

See our latest analysis for Everus Construction Group.

Everus Construction Group’s 30.9% share price return year-to-date shows momentum is building. The latest bullish pattern and higher earnings estimates add fuel to an already strong 40.3% total return over the past year. Investors seem to be recalibrating risk and growth expectations, which is a positive sign considering recent sector shifts and the upbeat run in construction-related stocks.

If this turnaround has you searching for what else is out there, it could be the perfect moment to expand your watchlist and discover fast growing stocks with high insider ownership

Amid technical signals and rising analyst optimism, the question for investors is clear: does Everus Construction Group remain undervalued with more room to run, or has the market already factored in its future growth prospects?

Price-to-Earnings of 25.6x: Is it justified?

Everus Construction Group is currently trading at a price-to-earnings (P/E) ratio of 25.6x, which stands below both its industry average and its own estimated fair P/E. With its last closing price at $90.71, the stock appears attractively valued when compared to sector standards.

The P/E ratio reflects what investors are willing to pay today for a dollar of the company’s earnings. In the construction industry, this multiple is often used to determine whether a company is priced reasonably compared to peers and to evaluate current growth momentum. A lower P/E can indicate that the stock is less expensive relative to anticipated earnings.

Compared to the US Construction industry average P/E of 33.1x, Everus Construction Group’s 25.6x ratio suggests a relative discount. The fair P/E ratio estimate for the company is 27.6x, which may indicate the market could eventually re-rate the shares higher if fundamentals support growth expectations.

Explore the SWS fair ratio for Everus Construction Group

Result: Price-to-Earnings of 25.6x (UNDERVALUED)

However, slower revenue growth and any shift in sector sentiment could challenge Everus Construction Group’s current momentum and influence future valuation expectations.

Find out about the key risks to this Everus Construction Group narrative.

Another View: Discounted Cash Flow Sends a Different Signal

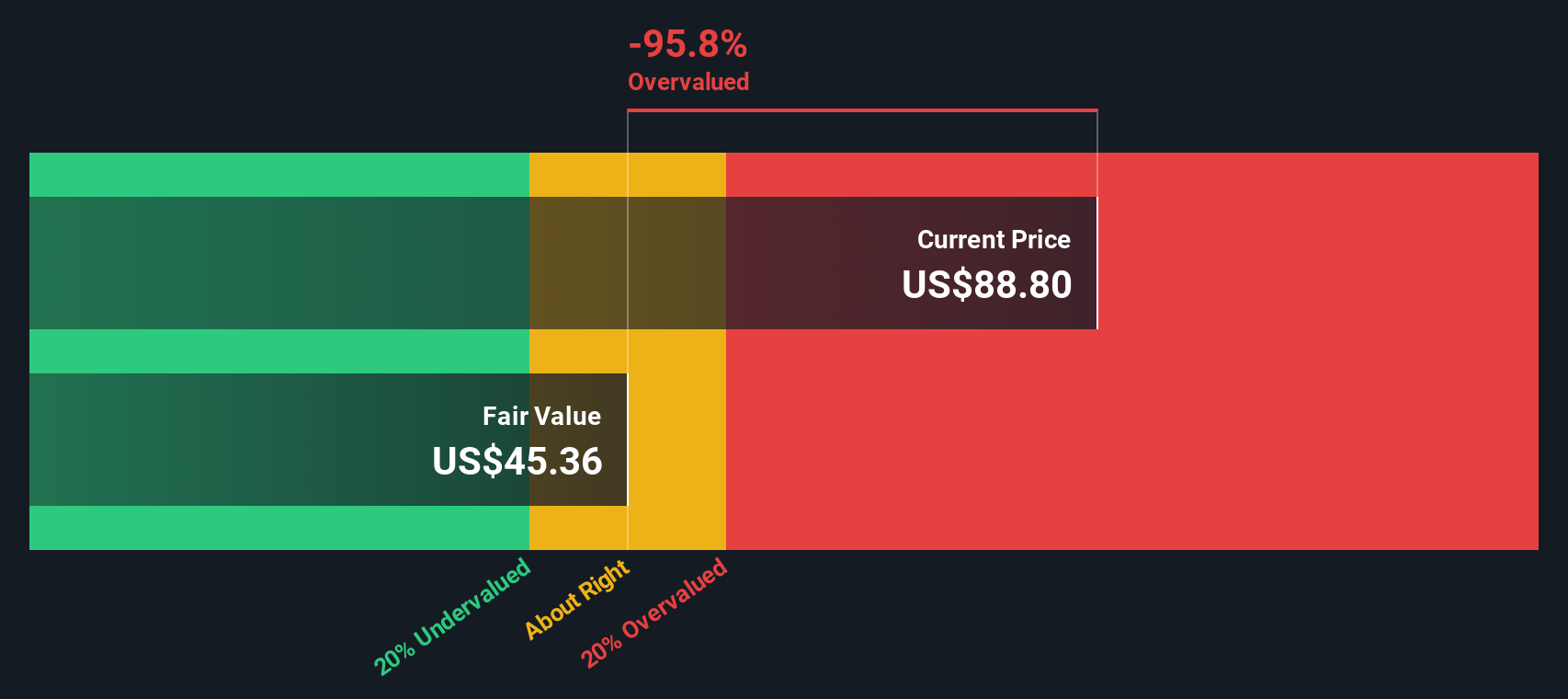

Taking a look at the SWS DCF model, there is a sharp contradiction to what cash flow fundamentals indicate. While the price-to-earnings ratio suggested Everus Construction Group is undervalued, our DCF estimate signals the stock is trading well above fair value. Are investors overlooking crucial details, or is the market anticipating more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Everus Construction Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Everus Construction Group Narrative

If you have your own insights or want to interpret the numbers differently, you can quickly build your own view and shape your unique outlook. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Everus Construction Group.

Looking for More Investment Ideas?

Stay ahead of the pack and expand your perspective with unique stock ideas that go beyond the ordinary. Missing these could mean missing your next big opportunity.

- Unlock growth potential by reviewing these 25 AI penny stocks that are driving AI innovation and changing how entire industries compete.

- Boost your income prospects as you browse these 15 dividend stocks with yields > 3% offering attractive yields for those seeking more cash flow from their portfolio.

- Catalyze your strategy with these 927 undervalued stocks based on cash flows packed with companies trading below their intrinsic worth and ready for a re-rating.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Everus Construction Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ECG

Everus Construction Group

Provides contracting services in the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success