- United States

- /

- Construction

- /

- NYSE:DY

How Dycom's Addition of Stephen LeClair to Its Board May Shape Strategic Moves for DY Investors

Reviewed by Sasha Jovanovic

- Dycom Industries, Inc. announced on November 10, 2025, that Stephen O. LeClair, former CEO and current Executive Chair of Core & Main Inc., has joined its Board of Directors, bringing decades of leadership experience in infrastructure services and corporate growth.

- LeClair’s track record of overseeing Core & Main’s spin-off, IPO, and large-scale growth initiatives signals an emphasis on experienced guidance for Dycom’s evolving strategy.

- Now, we’ll explore how LeClair’s appointment as a director may influence Dycom’s outlook, especially as the company pursues new service lines and operational improvements.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Dycom Industries Investment Narrative Recap

Shareholders in Dycom Industries need to have confidence in the continued expansion of fiber and data center connectivity, and the ability of the company to secure larger service contracts amid industry changes. The recent addition of Stephen O. LeClair to the board brings strong operational experience, but is unlikely to have a material short-term impact on Dycom’s biggest near-term catalyst: accelerating broadband infrastructure spending, or its main risk, which remains customer concentration among large telecom clients.

Among recent announcements, the scheduled Q3 2025 earnings release on November 19, 2025 stands out. With revenue concentration risk still prominent, investor attention may shift toward any signals of diversification in Dycom’s customer base or commentary on contract wins with hyperscalers that could offset dependency on its largest clients.

Yet, in contrast to growth headlines, investors should be aware of Dycom’s exposure if large telecom customers reduce spending or shift contracts…

Read the full narrative on Dycom Industries (it's free!)

Dycom Industries' narrative projects $6.6 billion revenue and $424.6 million earnings by 2028. This requires 9.7% yearly revenue growth and a $163.6 million earnings increase from $261.0 million today.

Uncover how Dycom Industries' forecasts yield a $308.44 fair value, a 6% upside to its current price.

Exploring Other Perspectives

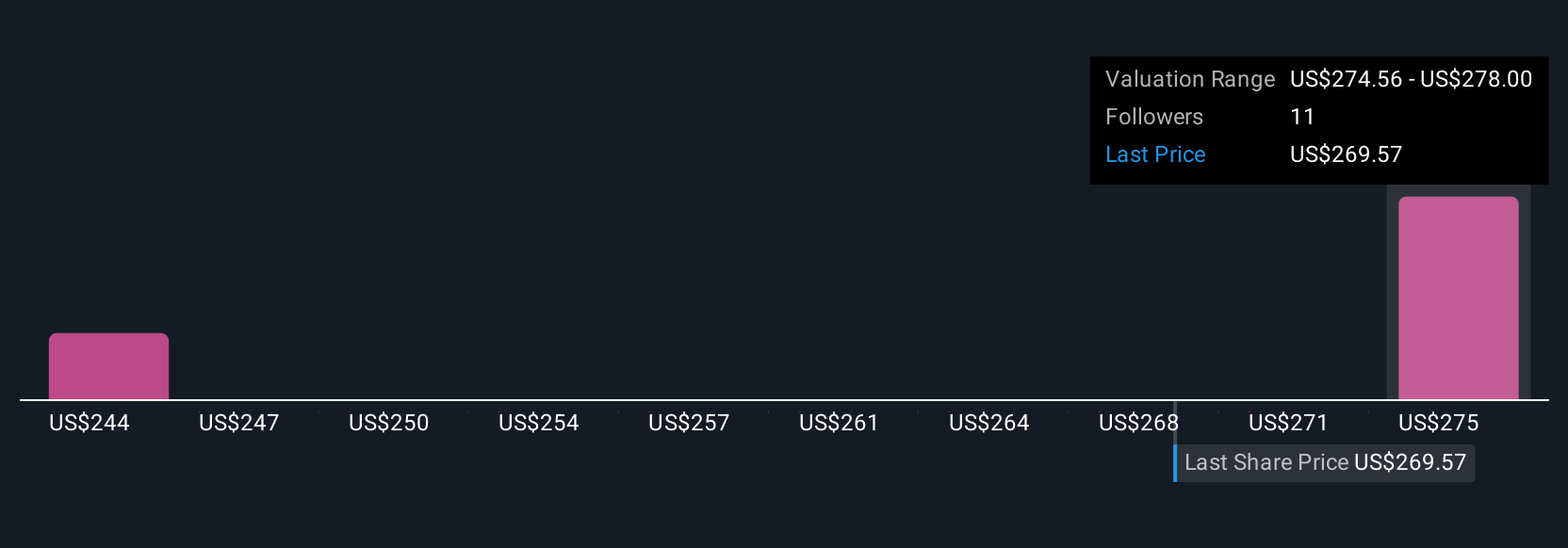

Simply Wall St Community members currently estimate Dycom’s fair value between US$235 and US$308 from only 2 perspectives, suggesting a wide spread. With customer concentration risk top of mind, you can see how views on Dycom’s long term stability may differ widely across the market.

Explore 2 other fair value estimates on Dycom Industries - why the stock might be worth as much as 6% more than the current price!

Build Your Own Dycom Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dycom Industries research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dycom Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dycom Industries' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DY

Dycom Industries

Provides specialty contracting services to the telecommunications infrastructure and utility industries in the United States.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives