Rich Tobin has been the CEO of Dover Corporation (NYSE:DOV) since 2018, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for Dover

How Does Total Compensation For Rich Tobin Compare With Other Companies In The Industry?

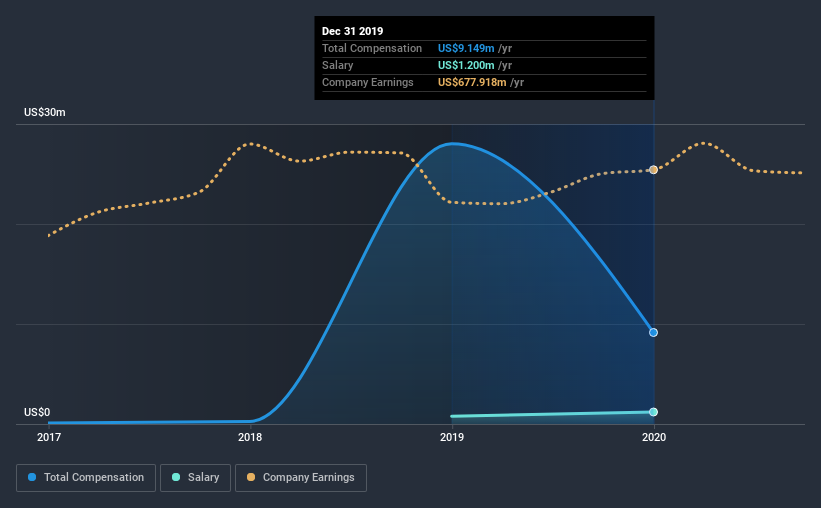

At the time of writing, our data shows that Dover Corporation has a market capitalization of US$16b, and reported total annual CEO compensation of US$9.1m for the year to December 2019. We note that's a decrease of 67% compared to last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$1.2m.

On comparing similar companies in the industry with market capitalizations above US$8.0b, we found that the median total CEO compensation was US$8.3m. So it looks like Dover compensates Rich Tobin in line with the median for the industry. What's more, Rich Tobin holds US$7.1m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | US$1.2m | US$777k | 13% |

| Other | US$7.9m | US$27m | 87% |

| Total Compensation | US$9.1m | US$28m | 100% |

On an industry level, around 16% of total compensation represents salary and 84% is other remuneration. Dover sets aside a smaller share of compensation for salary, in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Dover Corporation's Growth

Over the past three years, Dover Corporation has seen its earnings per share (EPS) grow by 5.3% per year. Its revenue is down 6.8% over the previous year.

We would prefer it if there was revenue growth, but the modest EPSgrowth gives us some relief. It's hard to reach a conclusion about business performance right now. This may be one to watch. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Dover Corporation Been A Good Investment?

We think that the total shareholder return of 53%, over three years, would leave most Dover Corporation shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

As we noted earlier, Dover pays its CEO in line with similar-sized companies belonging to the same industry. But the company has been found wanting in terms of EPS growth over the past three years. Meanwhile, shareholder returns have remained positive over the same time frame. So while shareholders shouldn't be overly concerned about CEO compensation, we suspect most would prefer to see improved performance, before a bump in pay.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 2 warning signs for Dover that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Dover, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSE:DOV

Dover

Provides equipment and components, consumable supplies, aftermarket parts, software and digital solutions, and support services worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion