- United States

- /

- Machinery

- /

- NYSE:DOV

How Dover’s (DOV) Ongoing Earnings Outperformance Could Reshape Analyst Expectations for Future Growth

Reviewed by Sasha Jovanovic

- Dover announced it will release third-quarter 2025 earnings on October 23, 2025, with a conference call scheduled that morning, and has drawn analyst expectations for continued earnings growth based on its track record of exceeding estimates in the past year.

- Recent analyst commentary highlights the importance of Dover's upcoming results, as firms reassess the company's market position amid shifting expectations for future growth and returns on capital.

- With heightened attention on Dover’s upcoming earnings release and history of surpassing estimates, we’ll explore how this shapes its investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Dover Investment Narrative Recap

To be a Dover shareholder, you need confidence in its ability to grow earnings by leveraging automation, sustainability, and efficiency trends in industrials, while steering through macroeconomic headwinds and cyclical exposure. While the latest Q3 earnings announcement heightens short-term anticipation, it does not fundamentally change Dover’s main near-term catalyst, whether its recurring earnings momentum can buffer volatility, and does little to lessen persistent risks, particularly around demand swings and margin pressures in core segments.

The recent dividend increase, marking Dover’s 70th straight year of rising payouts, is the standout announcement shaping this quarter’s story. It reinforces a core case for investor loyalty regardless of short-term operating noise and aligns with Dover’s ongoing commitment to shareholder returns alongside its upcoming earnings reveal.

Yet, in contrast, investors should be aware that persistent exposure to cyclical sectors means...

Read the full narrative on Dover (it's free!)

Dover's outlook forecasts $9.1 billion in revenue and $1.1 billion in earnings by 2028. This is based on an assumed annual revenue growth rate of 5.2%, with earnings expected to stay flat, no change from the current $1.1 billion in earnings.

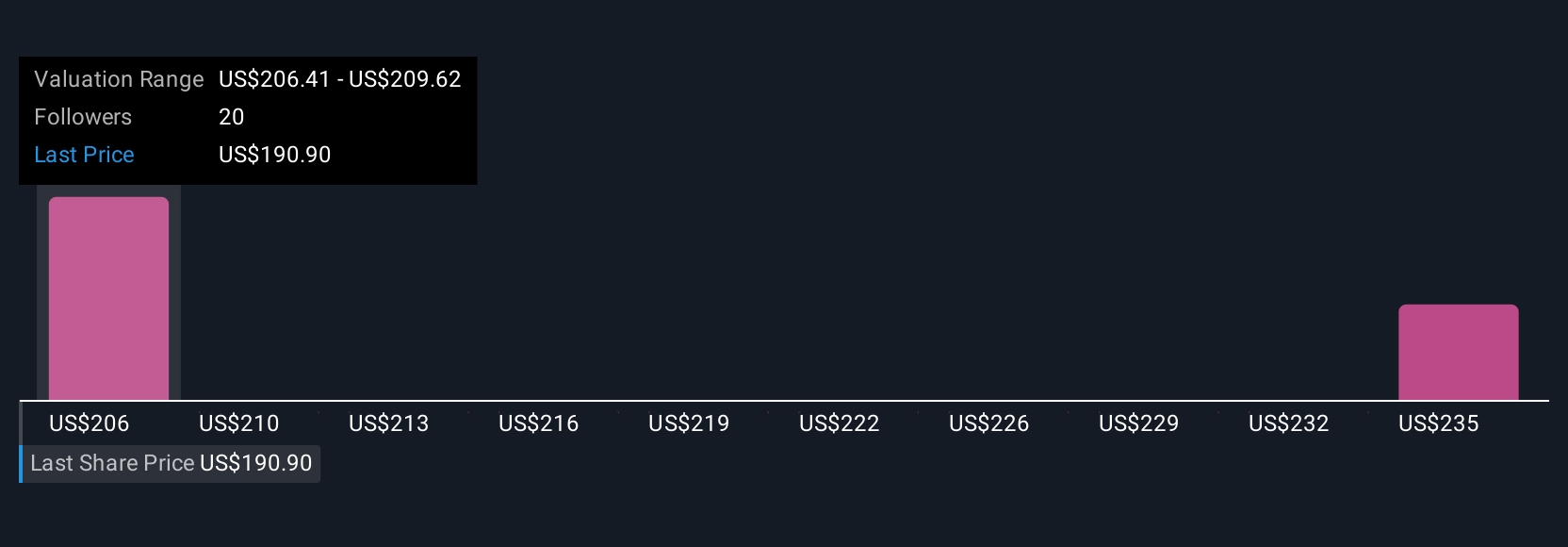

Uncover how Dover's forecasts yield a $213.39 fair value, a 30% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have set fair value estimates for Dover between US$213.39 and US$219.89, based on just 2 unique perspectives. While the upcoming earnings release draws focus to the company’s ability to maintain margin expansion, you can see how opinions on its outlook differ and explore these alternatives in more detail.

Explore 2 other fair value estimates on Dover - why the stock might be worth as much as 33% more than the current price!

Build Your Own Dover Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dover research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Dover research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dover's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOV

Dover

Provides equipment and components, consumable supplies, aftermarket parts, software and digital solutions, and support services worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives