- United States

- /

- Machinery

- /

- NYSE:DOV

Dover (DOV): Valuation Insights Following Raised Outlook and Strong Margins in Q3 Results

Reviewed by Simply Wall St

Dover delivered its third-quarter earnings this week, surpassing adjusted profit forecasts even though revenue was slightly below expectations. The company also raised its full-year guidance, which caught investors’ attention and boosted the stock.

See our latest analysis for Dover.

Dover’s upbeat earnings and improved outlook were enough to send the stock soaring 6.2% after results, more than erasing its recent losses. Over the past year, the company’s total shareholder return has dipped 4%, but its 3-year total return stands at a robust 40%. Longer-term momentum remains positive, thanks to efficiency initiatives and expansion into growth markets.

If you’re inspired by Dover’s margin gains and want to uncover what else is moving, now is an opportune moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

Given the upbeat guidance and improved profit margins, is Dover's latest rally a sign that the stock is still undervalued, or has the market already factored in all the future earnings gains and potential upside?

Most Popular Narrative: 16.9% Undervalued

According to the most widely followed narrative, Dover’s fair value is estimated at $213.39, notably higher than the last close price of $177.43. This sharp valuation gap sets up a bullish outlook, hinging on structural change and expansion into high-growth markets.

Expanding in automation, clean energy, and biopharma aligns Dover with high-growth, high-margin markets and supports long-term revenue and margin growth. Strategic acquisitions, divestitures, and operational improvements enhance cost efficiency, profit predictability, and business focus on innovative, recurring revenue streams.

What is driving this premium price? It is not just optimism, but a blend of bold growth projections, margin moves, and a future earnings profile that could disrupt conventional valuations. Want to see the specific assumptions behind this bullish narrative? The full story reveals the unexpected drivers of Dover’s estimated fair value.

Result: Fair Value of $213.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macro uncertainty and intense industry competition could quickly undermine the case for sustained margin growth and future earnings upgrades.

Find out about the key risks to this Dover narrative.

Another View: What Do Earnings Ratios Tell Us?

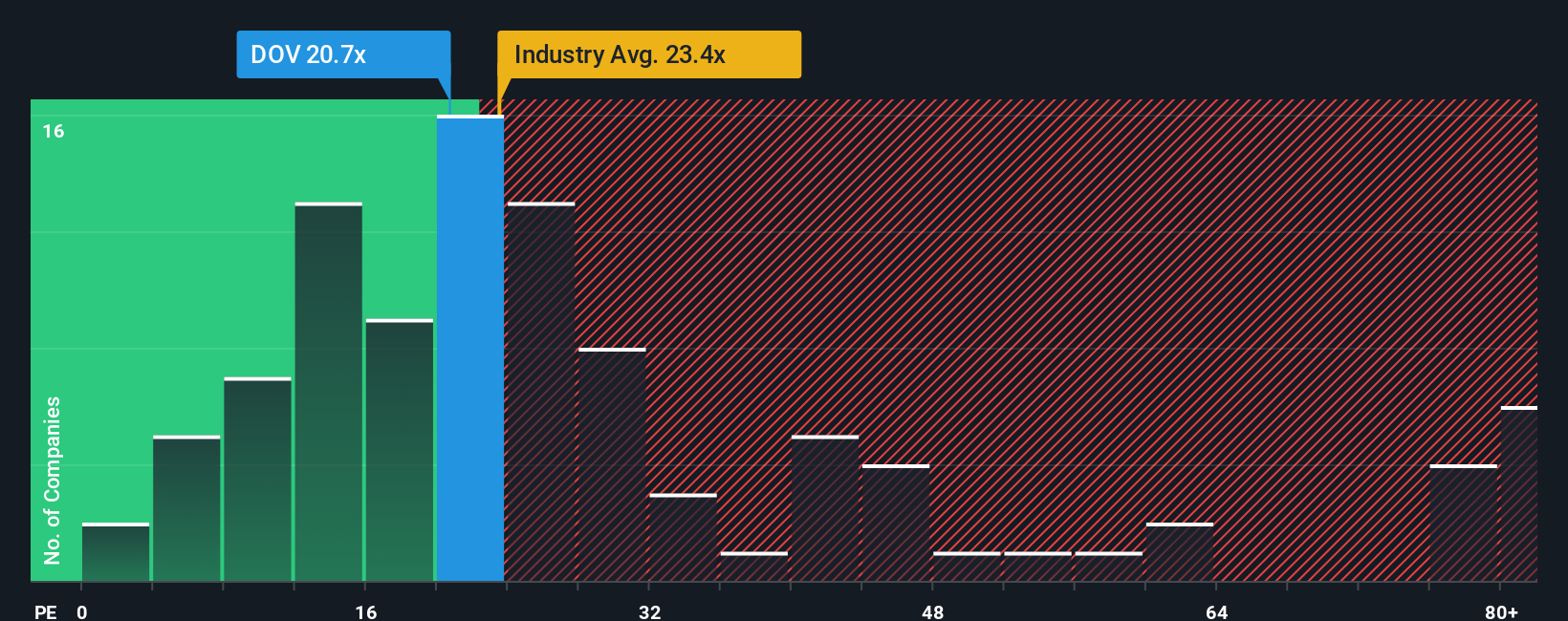

Looking at the numbers through the lens of a common earnings ratio, Dover trades at 22.9 times earnings. That is less expensive than the average for the US Machinery industry at 24.6, but pricier than its closest peers at 22.7. Importantly, the fair ratio is estimated at 26.2, so there is room for upward movement if investors grow more optimistic about Dover's growth story. Still, does the current gap signal a value opportunity or simply reflect typical valuation swings for the sector?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dover Narrative

If you see the story differently or want your own take, why not dig into the data and build your narrative in under three minutes? Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Dover.

Looking for more investment ideas?

Make your portfolio work harder by seizing the latest market shifts with powerful screener tools. Don’t let great opportunities pass you by. Act now:

- Accelerate your search for tomorrow’s winners with these 876 undervalued stocks based on cash flows that could be trading below their true worth based on future cash flows.

- Tap into unstoppable long-term growth by checking out these 27 AI penny stocks at the forefront of artificial intelligence advancements and market disruption.

- Secure reliable income streams through these 17 dividend stocks with yields > 3% offering attractive yields above 3% for steady returns in any market climate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOV

Dover

Provides equipment and components, consumable supplies, aftermarket parts, software and digital solutions, and support services worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives