- United States

- /

- Machinery

- /

- NYSE:DE

What Deere (DE)'s Forthcoming Q4 Results Reveal About Its Path to Technology Leadership

Reviewed by Sasha Jovanovic

- Deere & Company has announced it will release its fourth quarter 2025 financial results on November 26, 2025, along with an earnings call to discuss its financial and operating performance with analysts and investors.

- Recent analyst reports have highlighted expectations of significant earnings growth for Deere by 2027, attributing optimism to new international trade agreements and continued advancements in precision agriculture technology.

- With analyst upgrades underlining Deere’s market resilience and technology leadership, we’ll explore how this may influence the company’s investment outlook.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Deere Investment Narrative Recap

To be a shareholder in Deere today is to back the company’s market leadership in agricultural technology and its ability to harness new international trade agreements for long-term growth, while staying mindful of unpredictable end-market demand in North America and mounting tariff headwinds. The announcement of Deere's upcoming fourth quarter 2025 results creates anticipation, but barring a significant earnings surprise, it’s unlikely to materially shift the central short-term catalyst, global adoption of precision agriculture, or alleviate the main risk of continued sales volatility in its largest market.

Among recent developments, UBS’s projection of 30% earnings growth by 2027 stands out, built on Deere's solid positioning with positive trade deals and expanding precision ag solutions. This aligns with optimism around technology-driven sales and the company’s stable international footprint, reinforcing software and automation as key revenue drivers even as analysts debate the durability of North American demand cycles.

On the other hand, investors should not ignore how prolonged weakness in North America could challenge Deere's ability to sustain its current earnings momentum if...

Read the full narrative on Deere (it's free!)

Deere's narrative projects $45.1 billion in revenue and $8.6 billion in earnings by 2028. This outlook assumes a 0.7% annual revenue decline and a $3.4 billion increase in earnings from the current $5.2 billion.

Uncover how Deere's forecasts yield a $525.40 fair value, a 10% upside to its current price.

Exploring Other Perspectives

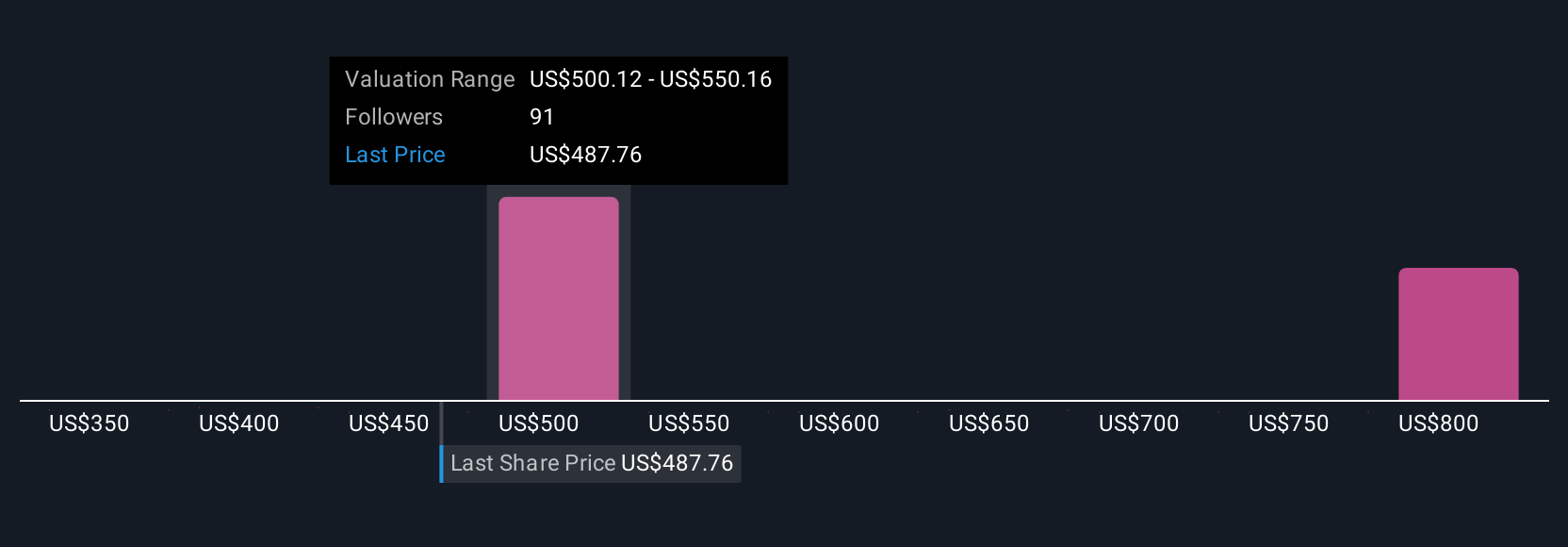

Six individual Simply Wall St Community fair value estimates for Deere span US$430 to US$831, with the broad range adding perspective on current consensus. While analyst projections focus on the revenue potential from automation, diverging community outlooks highlight that market participants see substantial uncertainty around the impact of end-market volatility.

Explore 6 other fair value estimates on Deere - why the stock might be worth as much as 75% more than the current price!

Build Your Own Deere Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Deere research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Deere research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Deere's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DE

Deere

Engages in the manufacture and distribution of various equipment worldwide.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives