- United States

- /

- Machinery

- /

- NYSE:DCI

Will Donaldson Company’s (DCI) New Director Shape Its Strategy Beyond Filtration?

Reviewed by Sasha Jovanovic

- Donaldson Company, Inc. held its annual meeting of stockholders on November 21, 2025, where shareholders elected four directors, including new member Dan Shine, and approved key governance measures.

- The retirement of Will Oberton after 19 years and the appointment of an accomplished executive from Thermo Fisher Scientific marks a significant board transition that could influence future strategy.

- With the addition of a new director from a life sciences background, we’ll assess how Donaldson’s investment narrative may evolve.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Donaldson Company Investment Narrative Recap

To be a Donaldson Company shareholder, you typically need to believe in its ability to expand recurring revenue from aftermarket filtration solutions and to execute successfully in structurally growing segments like Life Sciences, despite near-term earnings headwinds. The recent board transition with the election of Dan Shine is unlikely to materially shift the company’s short-term catalysts, which remain focused on product innovation and stabilization of earnings. The biggest risk, slowing demand in high-margin bioprocessing, remains unchanged by the latest news.

Among recent announcements, Donaldson’s declaration of a regular cash dividend of US$0.30 per share, the 70th consecutive year of payouts, stands out for investors seeking consistency. This decision reinforces the company’s focus on cash flow durability and could offset concerns around unpredictable segment growth, providing continuity while the board introduces new perspectives.

On the flip side, investors should also be alert to how long-term reliance on aftermarket parts might be challenged if...

Read the full narrative on Donaldson Company (it's free!)

Donaldson Company's outlook anticipates $4.1 billion in revenue and $534.5 million in earnings by 2028. This is based on a projected 3.9% annual revenue growth rate and a $167.5 million increase in earnings from the current $367.0 million.

Uncover how Donaldson Company's forecasts yield a $83.60 fair value, a 8% downside to its current price.

Exploring Other Perspectives

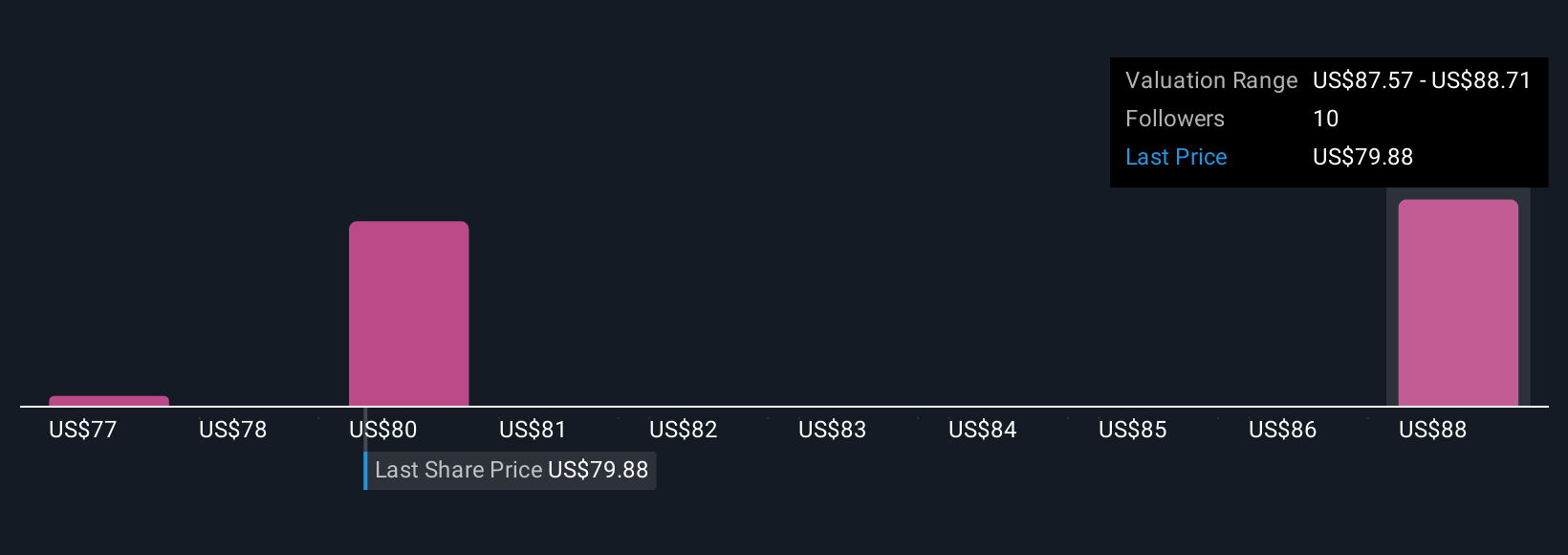

Three Simply Wall St Community members provided fair value estimates from US$77.32 to US$88.50 per share. Still, with recurring revenue growth facing industry shifts, many see opportunities for both caution and optimism in Donaldson’s future.

Explore 3 other fair value estimates on Donaldson Company - why the stock might be worth as much as $88.50!

Build Your Own Donaldson Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Donaldson Company research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Donaldson Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Donaldson Company's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DCI

Donaldson Company

Manufactures and sells filtration systems and replacement parts worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success