- United States

- /

- Machinery

- /

- NYSE:CYD

Assessing China Yuchai International (NYSE:CYD) Valuation Following Increased Stake in HL Global Enterprises

Reviewed by Simply Wall St

China Yuchai International (NYSE:CYD) recently raised its stake in HL Global Enterprises to 49.11%. By expanding its influence over HLGE's operations, the company signals a clear intent to deepen its involvement in the hospitality sector.

See our latest analysis for China Yuchai International.

China Yuchai's latest move to boost its stake in HL Global Enterprises arrives as shares continue a remarkable surge, highlighted by a 295.54% year-to-date share price return and a three-year total shareholder return topping 500%. With momentum clearly accelerating, investors seem to be reacting positively to both the strategic expansion in hospitality and changes in the boardroom.

If you’re looking for other companies making bold moves and showing strong momentum, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares up nearly 300% year-to-date, some investors may wonder whether China Yuchai’s surge is justified by fundamentals or if the current valuation is already factoring in all the upside, which could leave limited room for new buyers.

Most Popular Narrative: 17.6% Overvalued

China Yuchai International’s most popular narrative shows a fair value of $33.91, sharply below the last close of $39.87. This sizable gap raises questions about whether market optimism is running ahead of fundamentals and sets the foundation for a deeper look at the numbers that underpin this valuation.

The current high valuation may reflect investor optimism about China Yuchai's ability to sustain extraordinary export growth and market share gains despite signs that replacement and expansion demand in trucks, buses, and construction vehicles may plateau as the effects of urbanization and infrastructure investment in China and ASEAN normalize. This could create downside risk to future revenue growth if end-market demand reverts to mean levels.

Want to know what powers this bold valuation call? One metric in this narrative stands out: a double-digit expansion in top-line growth, wrapped with tighter profit margins and a future profit multiple that is much lower than what the market pays for its industry peers. Ready to uncover which financial forecasts push the fair value this high? Dive into the full narrative for the inside story.

Result: Fair Value of $33.91 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, robust outperformance compared to industry peers or successful diversification into alternative fuels could quickly challenge expectations that China Yuchai's growth is peaking.

Find out about the key risks to this China Yuchai International narrative.

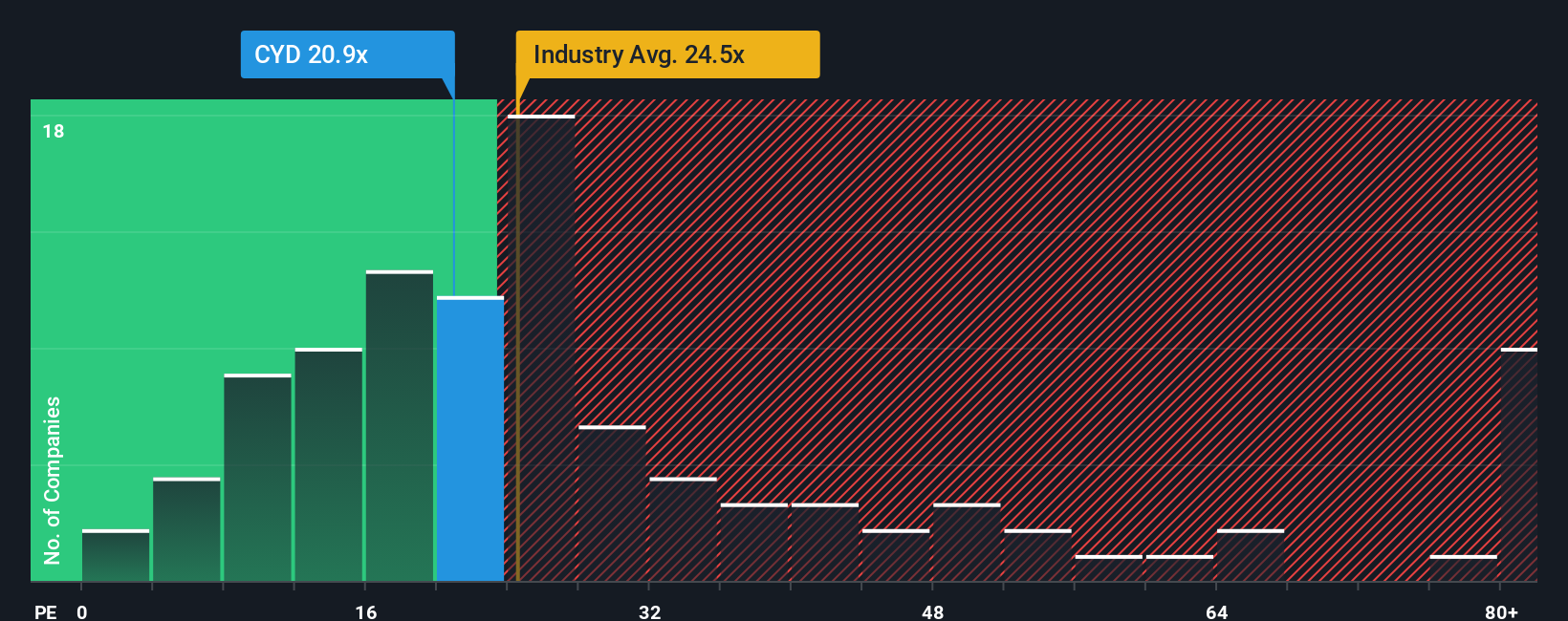

Another View: High Growth, But What About the Market’s Ratio?

Looking at typical price-to-earnings ratios provides a different angle. China Yuchai trades on a ratio of 23.8 times earnings, right in line with the US Machinery industry’s 23.8, but well above its peer average of 15.4. Its ratio also sits well below what our analysis suggests is a fair ratio of 40.2. This puts the company in a tricky spot: it looks expensive compared to peers but potentially undervalued if the market moves toward its fair ratio. Is there real upside left, or is risk building at these heights?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own China Yuchai International Narrative

If you see the story differently or want to test your own assumptions with the data, building your personalized narrative takes less than three minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding China Yuchai International.

Looking for More Investment Ideas?

Don’t limit yourself. Spark new investment inspiration with handpicked stock lists designed to match every strategy. Miss out now and you could easily overlook tomorrow’s winners.

- Unleash your curiosity and target untapped innovation by checking out these 27 quantum computing stocks, poised to disrupt major industries with real-world quantum breakthroughs.

- Secure long-term income potential and stability by zeroing in on these 16 dividend stocks with yields > 3%, which consistently deliver yields above 3% for income-focused investors.

- Catalyze your approach to AI-driven growth by reviewing these 24 AI penny stocks, reshaping market opportunities with artificial intelligence at their core.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CYD

China Yuchai International

Manufactures, assembles, and sells diesel and natural gas engines for trucks, buses, pickups, construction and agricultural equipment, and marine and power generation applications.

Excellent balance sheet and good value.

Market Insights

Community Narratives