- United States

- /

- Construction

- /

- NYSE:CTRI

Is Centuri Holdings’ (CTRI) New Board Addition a Turning Point for Its Institutional Backing?

Reviewed by Sasha Jovanovic

- Centuri Holdings recently completed a follow-on equity offering, raising approximately US$160 million through the sale of 7,441,860 shares at US$21.50 each with several new co-lead underwriters participating.

- An interesting aspect of the event is the concurrent appointment of an Icahn Enterprises executive to Centuri’s board, reflecting increased interest from major institutional investors.

- We’ll explore how the broadening of Centuri’s ownership base, highlighted by Icahn Enterprises’ involvement, affects its investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Centuri Holdings' Investment Narrative?

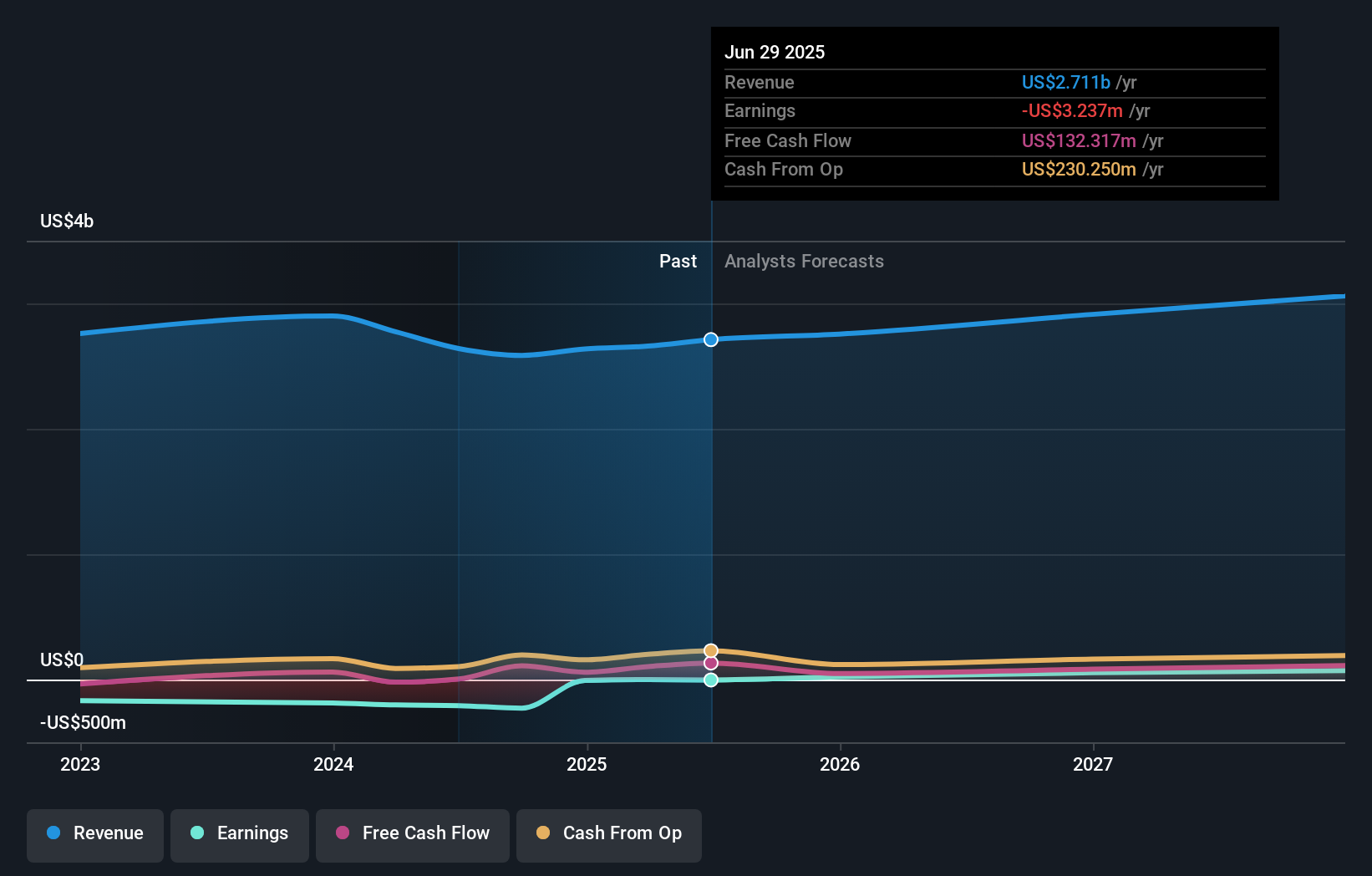

To be a shareholder in Centuri Holdings right now, you need to see value in its position as a utility infrastructure contractor showing improved profitability and steady contract wins, while also navigating a relatively new management team and evolving board dynamic. The latest follow-on equity offering, which brought in about US$160 million, strengthens Centuri’s balance sheet but comes at a modest share price discount, and does not appear to be a game-changer for near-term catalysts. While the addition of multiple new underwriters and an Icahn Enterprises executive to the board points to heightened institutional attention, the immediate effect on high-level risks or catalysts looks muted. Investors should keep an eye on the company’s cash deployment from this offering, especially amid ongoing board turnover, recent insider selling, a below-market return on equity, and the transition from one-off losses. There is new attention from major shareholders, but the biggest risks remain unchanged: management inexperience, low profitability ratios, and slow revenue growth versus peers.

But the board’s changing mix could complicate future decisions, something investors should really watch. Centuri Holdings' share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 4 other fair value estimates on Centuri Holdings - why the stock might be worth less than half the current price!

Build Your Own Centuri Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centuri Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Centuri Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centuri Holdings' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTRI

Centuri Holdings

Operates as a utility infrastructure services company in North America.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives