- United States

- /

- Building

- /

- NYSE:CSW

CSW Industrials (CSWI): Evaluating the Stock’s True Value After Recent Share Price Decline

Reviewed by Simply Wall St

CSW Industrials (CSW) shares have eased recently, falling nearly 5% over the past month and 4% in the past week. Investors are weighing its recent performance, particularly after several quarters of steady revenue and income growth.

See our latest analysis for CSW Industrials.

CSW Industrials’ shares have retreated steadily this year, and after last week’s sharper drop, the short-term momentum appears to be fading. While the 1-year total shareholder return is down 36.9%, long-term investors have still seen the stock more than double their money over five years.

If recent volatility has you rethinking your approach, it could be the perfect moment to discover fast growing stocks with high insider ownership

With the stock currently trading almost 19% below analyst price targets, investors are asking whether CSW Industrials is now undervalued or if the recent dip means expectations for future growth are already captured in the current price.

Most Popular Narrative: 17.3% Undervalued

With the most widely followed narrative setting a fair value well above CSW Industrials’ last close, the valuation debate is heating up. There is no shortage of strong views on what drives this expected upside.

Growing regulatory drivers around building efficiency, indoor air quality, and refrigerant standards (e.g., American Innovation and Manufacturing Act) are accelerating HVAC maintenance and compliance retrofits. CSWI's strengthened value-added product portfolio and recent acquisitions (like Aspen) directly position the company to capture increased demand, supporting higher revenue growth and potential share gains in the future.

Curious what aggressive growth assumptions push this fair value so high? Everything rides on a future foundation of consistent, double-digit expansion and a profit multiple that challenges sector norms. Want to know the wild card that really tips the balance? The answers are inside the full narrative.

Result: Fair Value of $287.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as margin pressure from cost inflation and heavy reliance on acquisitions could undermine the bullish growth narrative if these factors persist or intensify.

Find out about the key risks to this CSW Industrials narrative.

Another View: What Multiples Say

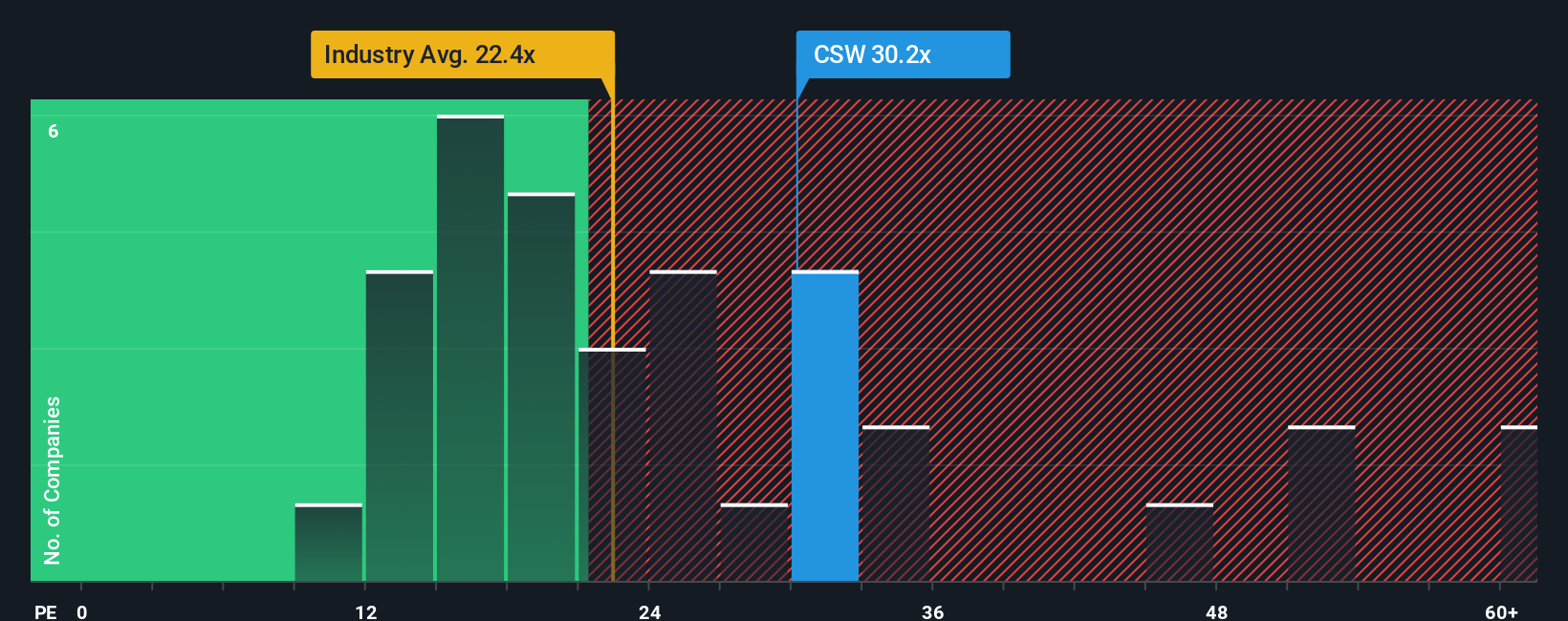

Looking at valuation purely through the lens of price-to-earnings ratios, CSW Industrials stands out as expensive. Its ratio of 27.7x outpaces both the US Building industry average of 20.8x and its peer average of 17.4x, while the fair ratio sits lower at 22.7x. This gap suggests greater valuation risk unless the company can deliver on its ambitious growth plans. Does the market see something others have missed? Could expectations be running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CSW Industrials Narrative

If you view things differently or want to draw your own conclusions, you can craft a personalized narrative for CSW Industrials in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding CSW Industrials.

Looking for more investment ideas?

Why stop at CSW Industrials when other unique opportunities are just a click away? Find out what else could be shaping tomorrow’s market leaders and stay ahead before everyone else does.

- Unlock long-term growth by tapping into these 841 undervalued stocks based on cash flows packed with stocks trading below their intrinsic value, giving you an edge on bargain investments.

- Boost your passive income by targeting these 18 dividend stocks with yields > 3% offering solid yields above 3% for those who want to build powerful compounding returns.

- Catalyze your portfolio’s potential with these 27 AI penny stocks that are harnessing artificial intelligence to drive innovation and market disruption right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CSW

CSW Industrials

Provides various industrial products in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives