- United States

- /

- Aerospace & Defense

- /

- NYSE:CRS

Can Carpenter Technology’s (CRS) Debt Refinance Reveal a New Phase of Financial Discipline?

Reviewed by Sasha Jovanovic

- On November 10, 2025, Carpenter Technology Corporation announced a US$700 million private offering of senior notes due 2034, aiming to redeem and repay existing higher-yielding senior notes and for general corporate purposes.

- This debt refinancing plan could help lower future interest expenses and strengthen Carpenter's financial flexibility, potentially enhancing its ability to fund growth initiatives.

- We'll examine how Carpenter's move to refinance with longer-term debt could impact its investment outlook and margin improvement potential.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Carpenter Technology Investment Narrative Recap

To be a shareholder in Carpenter Technology, you likely need to believe in the company's ability to capitalize on global aerospace and electrification trends, while successfully executing its capacity expansion initiatives. The recent US$700 million senior notes offering and debt refinancing should support short-term financial flexibility, but the core catalyst and main risk, Carpenter’s exposure to cyclical aerospace and defense demand, remain largely unchanged in the near term.

Of the company’s recent announcements, the October 23, 2025 guidance update stands out, projecting a 26% to 33% increase in operating income for fiscal 2026 and reaffirming robust demand conditions, particularly from aerospace. This aligns with the refinancing announcement, as lower interest expenses may improve margins and help offset the large capital outlays needed for the brownfield expansion.

But investors should also be alert to the flip side: if aerospace demand cools or project execution slips, the debt load could weigh on Carpenter's returns and margins...

Read the full narrative on Carpenter Technology (it's free!)

Carpenter Technology's narrative projects $3.6 billion in revenue and $672.3 million in earnings by 2028. This requires 7.7% yearly revenue growth and a $296.5 million earnings increase from the current $375.8 million.

Uncover how Carpenter Technology's forecasts yield a $376.10 fair value, a 15% upside to its current price.

Exploring Other Perspectives

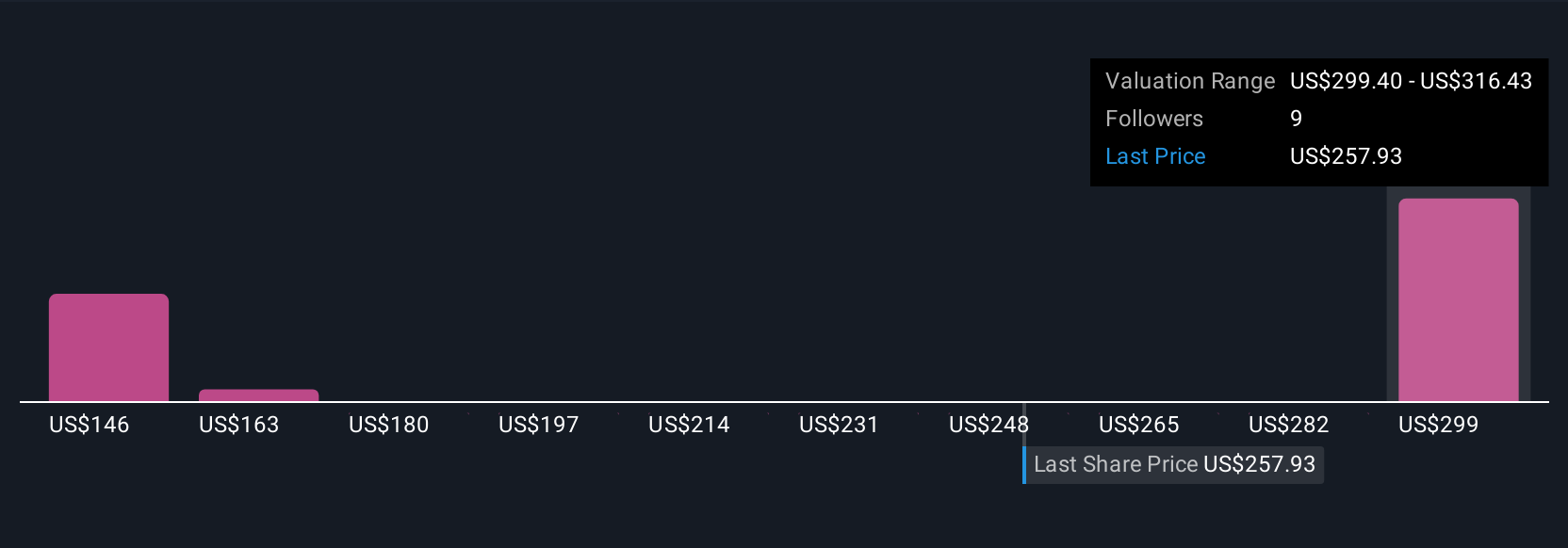

Four members of the Simply Wall St Community provide fair value estimates for Carpenter Technology stock from US$135.62 to US$376.10, showing strikingly different views. Exposure to cyclical aerospace and defense markets remains central, inviting readers to consider several alternate opinions on growth and volatility.

Explore 4 other fair value estimates on Carpenter Technology - why the stock might be worth less than half the current price!

Build Your Own Carpenter Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carpenter Technology research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Carpenter Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carpenter Technology's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRS

Carpenter Technology

Engages in the manufacture, fabrication, and distribution of specialty metals in the United States, Europe, the Asia Pacific, Mexico, Canada, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives