- United States

- /

- Machinery

- /

- NYSE:CR

Crane (CR): Evaluating Valuation After Recent Share Price Slide and Acquisition Moves

Reviewed by Simply Wall St

See our latest analysis for Crane.

While Crane’s share price has cooled recently, with a 1-day dip of 1.7% and a 7% slide over the past month, momentum over the past year looks more nuanced. The total shareholder return for the past year is slightly negative. Looking at a longer horizon, Crane has delivered a remarkable 162.9% total return over three years and an impressive 302.3% over five years, reflecting both past growth and the underlying confidence that has built up around the business.

If these shifting trends have you looking for new opportunities, now could be the perfect time to broaden your perspective and check out fast growing stocks with high insider ownership

But with shares trading nearly 9% below their recent highs and double-digit upside to some analyst targets, the key question is whether Crane is undervalued or if the market has already priced in future growth.

Most Popular Narrative: 16.9% Undervalued

Compared to the last close at $176.16, the most widely followed narrative values Crane shares at $211.88. This represents a sizable premium based on future growth and profit expansion forecasts. There is real conviction behind this outlook, fueled by a combination of end-market trends and a strategic push into high-growth segments.

Crane's recent acquisition of PSI (Druck, Panametrics, Reuter-Stokes) positions the company to capture rising demand for advanced sensing and fluid control in both aerospace and process industries, directly benefiting from infrastructure modernization and growing automation, supporting sustained revenue and future margin expansion.

What is really behind this big valuation gap? The fair value hinges on whether bold earnings growth, higher margins, and an ambitious market multiple can all be achieved. Are these projections grounded, or are analysts betting on a transformation that has not yet played out? Take a closer look to see the numbers and logic underpinning this premium price call.

Result: Fair Value of $211.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing integration risks with recent acquisitions and exposure to cyclical end-markets could present challenges for Crane’s ambitious long-term targets and valuation outlook.

Find out about the key risks to this Crane narrative.

Another View: Are Shares Too Expensive by Comparison?

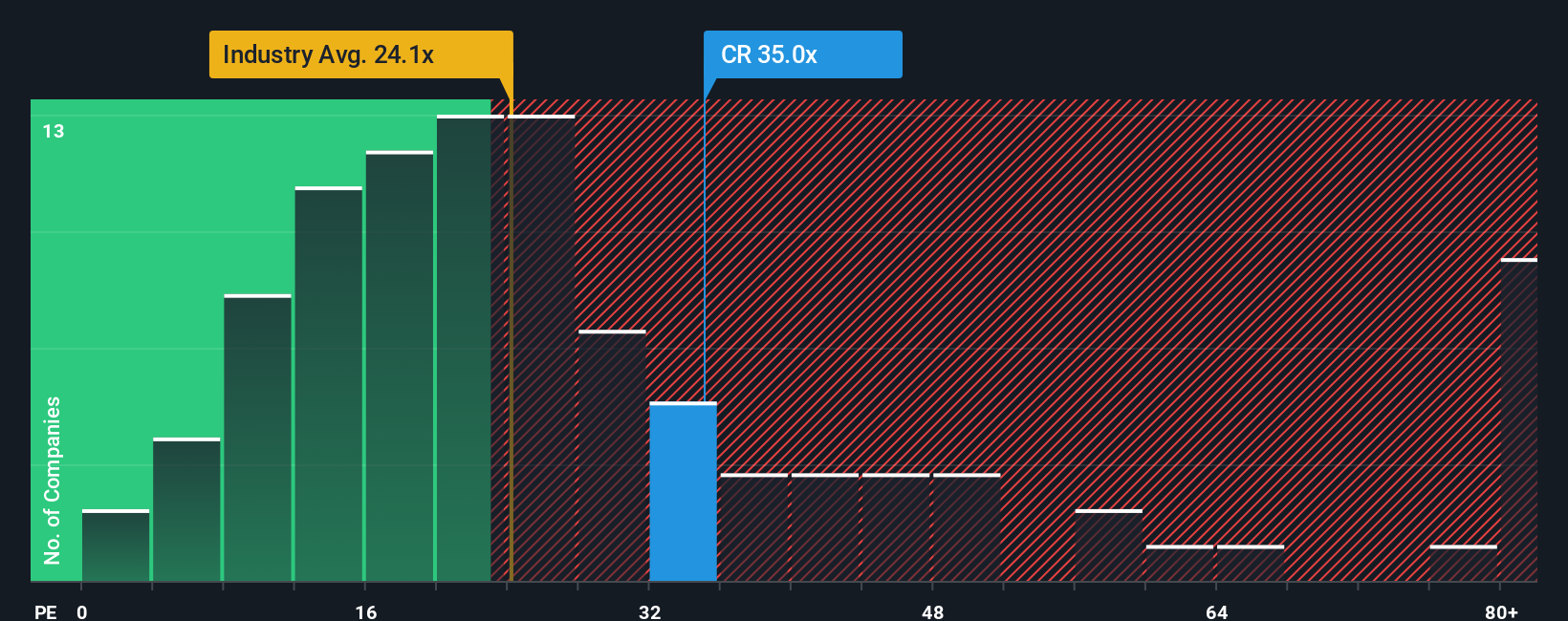

While some see Crane as undervalued based on growth expectations, the price-to-earnings ratio tells a more cautious story. At 31.7x, Crane trades well above its industry peers at 23.3x and even higher than its fair ratio of 25.6x. This raises the risk that shares could see compression if market sentiment shifts. Is the premium justified or is caution warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Crane Narrative

If you see the numbers differently or enjoy researching your own angles, you can easily shape your own view and narrative in just a few minutes, so why not Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Crane.

Looking for More Investment Opportunities?

Smart investors always keep their watchlists fresh. To uncover your next winning idea, head straight to handpicked stock selections using these powerful tools:

- Boost your portfolio’s yield by targeting proven income-payers with these 16 dividend stocks with yields > 3%. These offer robust dividends above 3% and strong fundamentals.

- Spot tomorrow’s technology giants early by tapping into these 26 AI penny stocks, positioned at the forefront of AI innovation and automation.

- Capitalize on market mispricings and maximize value with these 919 undervalued stocks based on cash flows. These trade below their true worth based on cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CR

Crane

Manufactures and sells engineered industrial products in the United States, Canada, the United Kingdom, Continental Europe, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives