- United States

- /

- Machinery

- /

- NYSE:CMI

Assessing Cummins (CMI) Valuation Following Lower Q3 2025 Earnings and Shifting Investor Sentiment

Reviewed by Simply Wall St

Cummins (CMI) released its third quarter 2025 earnings, revealing both sales and net income decreased from the previous year. The results are likely prompting investors to reassess the company’s outlook and share valuation.

See our latest analysis for Cummins.

Despite headline numbers showing year-over-year drops in sales and net income, Cummins shares have demonstrated unexpected resilience, rising over 17% in the last 90 days and delivering a total shareholder return of 36.8% over the past year. The recent spike suggests that, while market concerns remain, investors may see room for long-term value or believe the worst is already priced in.

If you’re keeping an eye on what’s moving in the industrial sector, it’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With recent financial declines followed by a strong stock rebound, the key question for investors is whether Cummins is now undervalued and positioned for future gains, or if the market has already accounted for its next chapter of growth.

Most Popular Narrative: Fairly Valued

With Cummins last closing at $476.01, the most widely followed narrative sets a fair value at $469.04, which is almost identical. This near match highlights how closely fundamental business improvements and market pricing are tracking each other.

"Tightening global emissions regulations and anticipated adoption of new product platforms (such as EPA27-compliant engines) create an opportunity for pricing power and market share stabilization as fleets upgrade, supporting future revenue growth and premium product margins as regulatory clarity emerges."

Curious what’s propelling Cummins to this price point? There is a bold set of growth targets and margin bets woven deep into the current narrative, along with assumptions that could catch even veteran analysts off guard. Want to see which parts are expected to outperform and which pivotal metrics drive this verdict? Investigate further to uncover the story behind these consensus projections.

Result: Fair Value of $469.04 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in key North American truck demand or new international tariff uncertainties could quickly challenge Cummins’ positive narrative and valuation outlook.

Find out about the key risks to this Cummins narrative.

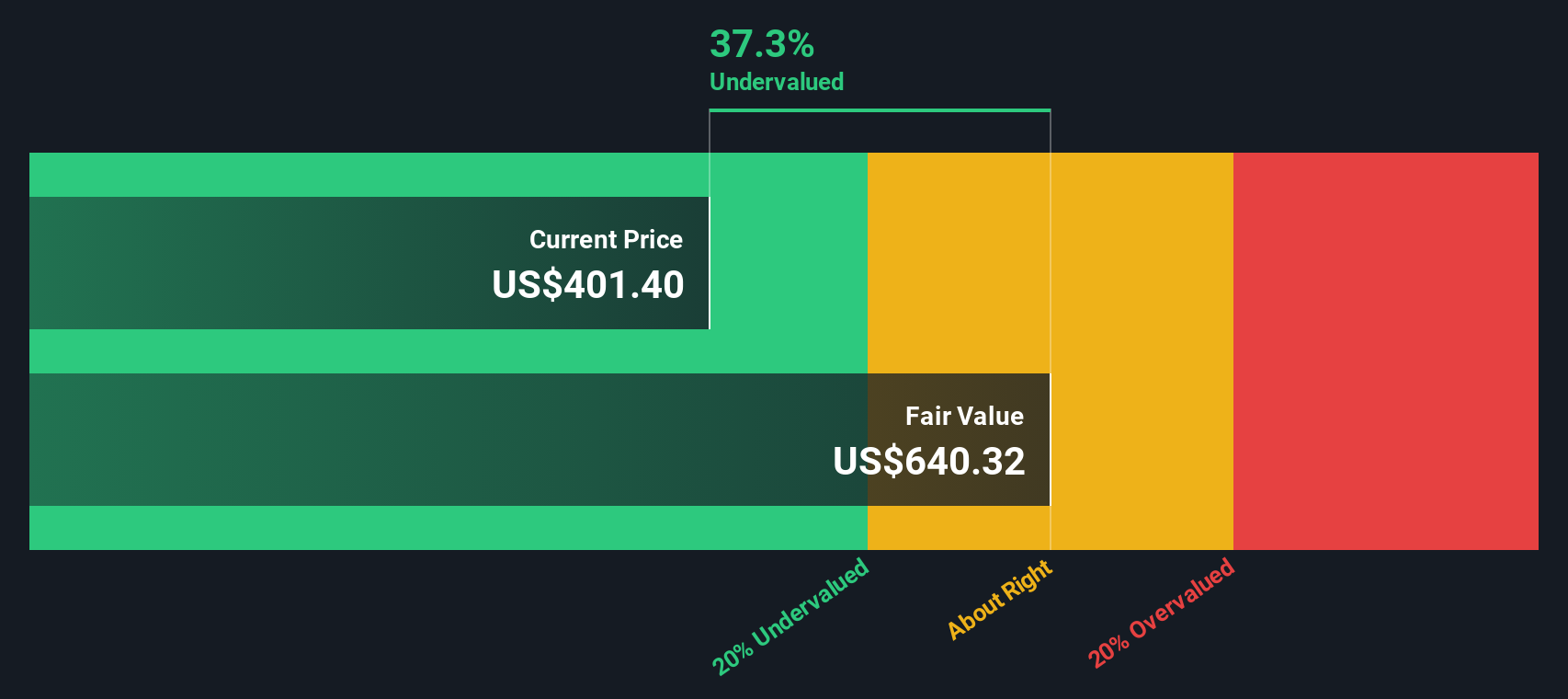

Another View: Discounted Cash Flow Says Undervalued

While the most popular narrative judges Cummins as fairly valued at around $469, our DCF model presents a much different picture. According to this approach, Cummins shares are actually trading well below their intrinsic value, with a fair value estimate of $749.27. This suggests a significant perceived upside. Could the market be underappreciating Cummins’ long-term cash flow potential, or is there something the DCF model might be missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cummins for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 856 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cummins Narrative

If these interpretations do not quite fit your perspective or you want to dig deeper, you can easily craft your own analysis in just a few minutes. Do it your way

A great starting point for your Cummins research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Standout Investment Opportunities?

You are missing out if you settle for just one great stock. Make your next smart move by scanning new possibilities using the Simply Wall Street Screener and uncover what seasoned investors are already tracking.

- Tap into future-shaping momentum by evaluating AI leaders with these 25 AI penny stocks. These companies are redefining industries through automation and intelligent tech.

- Turn market uncertainty into a chance for growth by reviewing these 856 undervalued stocks based on cash flows, which features companies trading well below their intrinsic value.

- Boost your income potential by checking out these 15 dividend stocks with yields > 3%, featuring reliable businesses offering strong yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMI

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives