- United States

- /

- Aerospace & Defense

- /

- NYSE:CDRE

Cadre Holdings, Inc.'s (NYSE:CDRE) Share Price Not Quite Adding Up

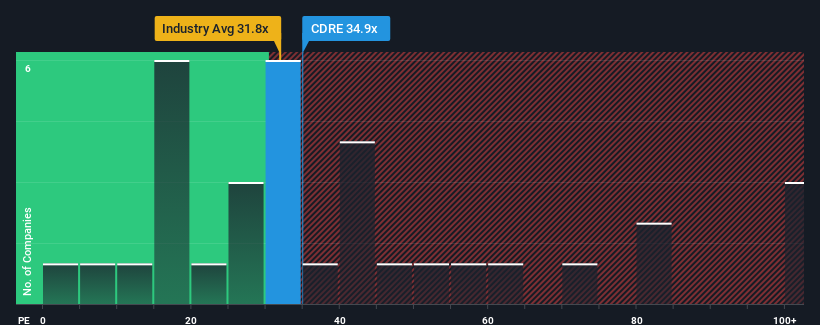

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 17x, you may consider Cadre Holdings, Inc. (NYSE:CDRE) as a stock to avoid entirely with its 34.9x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Cadre Holdings certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Cadre Holdings

Is There Enough Growth For Cadre Holdings?

Cadre Holdings' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 64%. However, this wasn't enough as the latest three year period has seen a very unpleasant 36% drop in EPS in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 12% per annum as estimated by the seven analysts watching the company. With the market predicted to deliver 10.0% growth per annum, the company is positioned for a comparable earnings result.

In light of this, it's curious that Cadre Holdings' P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Bottom Line On Cadre Holdings' P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Cadre Holdings' analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Cadre Holdings you should know about.

If you're unsure about the strength of Cadre Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CDRE

Cadre Holdings

Manufactures and distributes safety equipment and other related products that provides protection to users in hazardous or life-threatening situations in the United States and internationally.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives