- United States

- /

- Aerospace & Defense

- /

- NYSE:CDRE

Cadre Holdings (CDRE): Evaluating Valuation as Expense Pressures and Flat Earnings Spark Investor Attention

Reviewed by Kshitija Bhandaru

Cadre Holdings (CDRE) is in the spotlight after recent commentary pointed to rising expenses, flat earnings per share, and shrinking free cash flow margins. These developments have prompted fresh questions about profitability and operational efficiency.

See our latest analysis for Cadre Holdings.

Even as Cadre Holdings works through cost concerns, its momentum has not gone unnoticed. The stock's share price has surged nearly 24% over the past three months and is up 26% year-to-date, though the one-year total shareholder return stands at 7%. This suggests shorter-term optimism despite lingering questions over fundamentals.

If you are interested in spotting other companies showing fresh momentum and solid growth prospects, discover fast growing stocks with high insider ownership as your next step.

With shares up sharply in the past quarter, the key question now is whether Cadre Holdings is trading below its true value or if the market has already accounted for all future growth, which could leave limited room for upside.

Most Popular Narrative: Fairly Valued

Cadre Holdings currently trades in line with the most widely followed analyst fair value estimate, with its last close price nearly matching the narrative target. This alignment intensifies the spotlight on what is actually driving that valuation and whether the market has it right.

Strategic innovation and premium new product introductions are enabling pricing power greater than inflation, leading to margin expansion and positioning Cadre for increased gross profit and earnings as adoption of advanced tactical and safety gear accelerates.

Ever wonder what financial leap could justify this pricing? There is a dramatic forecast at the heart of this story: potential record profit margins and bold earnings growth projections, all mapped to an aggressive future multiple. Want the full narrative? Do not miss out on the details behind this striking fair value call.

Result: Fair Value of $40.60 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risk in scaling the nuclear segment and ongoing uncertainty around contract timing could quickly shift the outlook for Cadre Holdings.

Find out about the key risks to this Cadre Holdings narrative.

Another View: Market Multiples Tell a Different Story

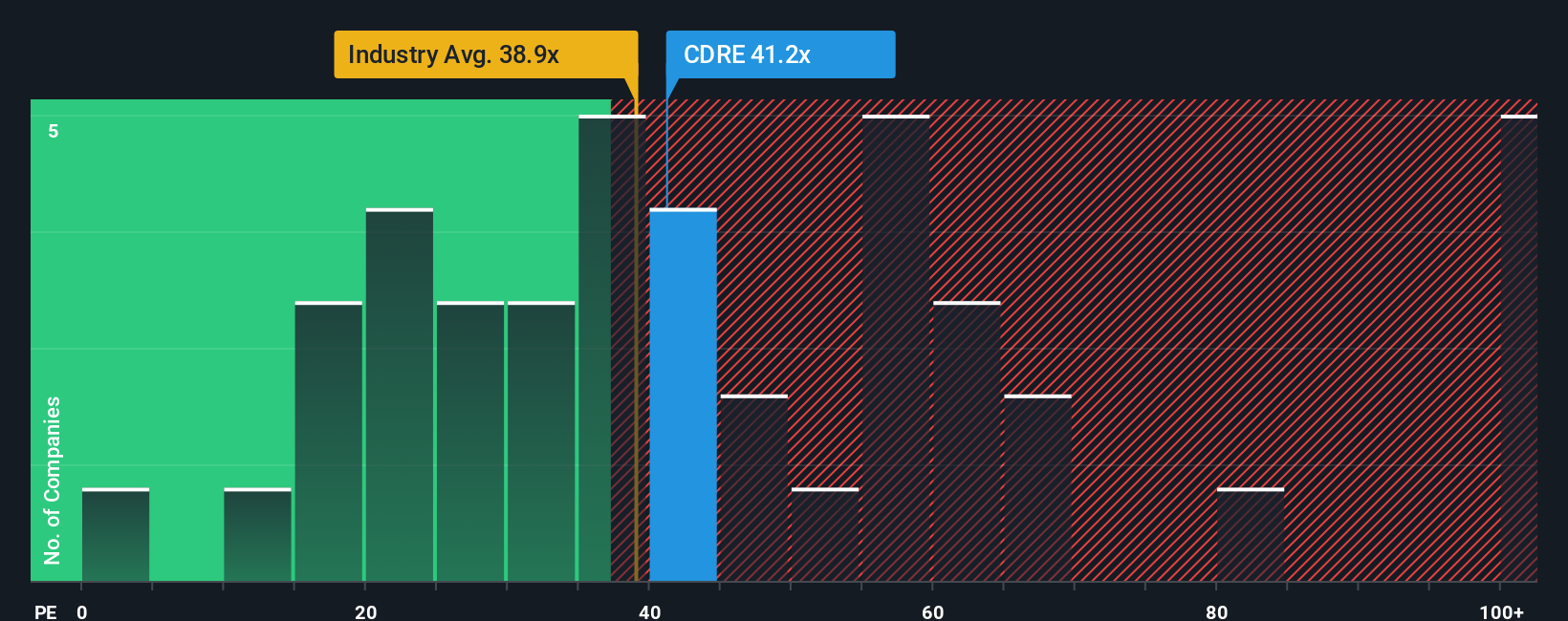

Looking at where Cadre Holdings trades versus typical companies, its price-to-earnings ratio is 43.3x, which is higher than both its industry average of 40x and its own fair ratio of 27.2x. This means investors are paying a premium compared to peers. Does this add risk, or is it justified by future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cadre Holdings Narrative

If you feel the story here does not add up, or want to investigate more deeply, you can explore the numbers and craft your own perspective in just a few minutes. Do it your way.

A great starting point for your Cadre Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Searching for Your Next Great Investment?

Smart investors always look beyond the obvious opportunities. If you are serious about finding stocks with real upside, your next winner could be just a click away.

- Tap into high-yielding opportunities by checking out these 18 dividend stocks with yields > 3%. This resource features companies delivering strong income with yields above 3%.

- Seize the growing momentum in artificial intelligence by uncovering these 24 AI penny stocks, which highlights advances in automation, efficiency, and innovation.

- Take advantage of undervalued prospects right now by reviewing these 871 undervalued stocks based on cash flows, helping you identify stocks trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CDRE

Cadre Holdings

Manufactures and distributes safety equipment and other related products that provides protection to users in hazardous or life-threatening situations in the United States and internationally.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives