- United States

- /

- Building

- /

- NYSE:CARR

Carrier Global (CARR): Exploring Valuation After Recent Share Price Weakness

Reviewed by Simply Wall St

Carrier Global (CARR) shares have faced steady pressure over the past month, with the stock down 16%. Investors will be watching closely for any company moves that could shift sentiment or provide clearer direction in the coming weeks.

See our latest analysis for Carrier Global.

Carrier Global’s share price has been losing momentum, with a 1-month share price return of -15.8% and a year-to-date decline of over 26%. Factoring in dividends, the total shareholder return over the past year is down more than 32%, suggesting that investor confidence has faded despite recent revenue and profit growth. However, looking at the longer-term total returns, those who held on for three to five years have seen meaningful gains, indicating that periods of weakness are not new for this stock.

If the shifting sentiment in industrials makes you curious about other market stories, it’s a great time to broaden your search and discover fast growing stocks with high insider ownership

Despite recent weakness, shares still trade at a meaningful discount to analyst price targets. Carrier’s value metrics look appealing, prompting investors to ask whether this is a genuine buying opportunity or if the market has already accounted for future growth.

Most Popular Narrative: 31% Undervalued

The widely-followed narrative estimates Carrier Global’s fair value at $72.94, which is well above the recent closing price of $50.36. This sizeable gap is drawing attention to underlying drivers that may justify such optimism.

*Carrier's introduction of differentiated products, such as air-cooled commercial heat pumps and the integration of HEMS technology with Google Cloud's AI, positions them to capture the growing demand for sustainable and smart energy solutions. This could potentially drive future revenue growth. The company's strong performance in the aftermarket space, with double-digit growth and increased attachment rates on chillers, is expected to bolster net margins through high-margin service offerings and customer retention.*

Want to know what assumptions underpin this bold fair value? Analysts are betting on profit margins and revenue trends that could flip expectations. The narrative’s math counts on shifting multiples and ambitious growth. Find out what’s fueling such a premium.

Result: Fair Value of $72.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer residential HVAC sales in the US and profit margin pressures could challenge the bullish outlook and test analyst confidence in the months ahead.

Find out about the key risks to this Carrier Global narrative.

Another View: Are Multiples Sending a Different Message?

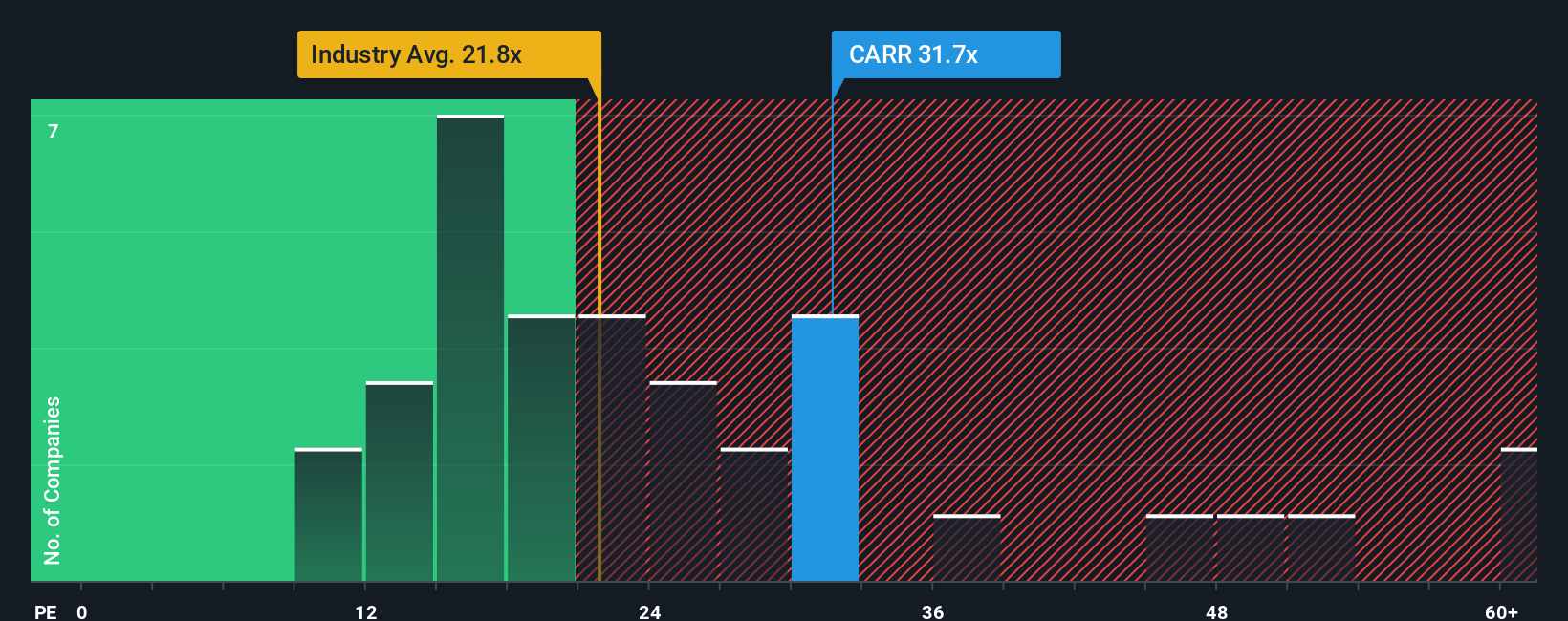

While our DCF model points to Carrier Global as undervalued, the market’s common lens, price-to-earnings, tells a more complicated story. The company trades at 30.8 times earnings, well above both its industry average of 16.7 and its peers at 27.5. Yet the fair ratio, estimated at 38.3, suggests there is still room for upward movement. Does this premium signal justified growth or increased risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Carrier Global Narrative

If you want to dig deeper or think another angle tells a better story, you can build your own perspective in just a few minutes, Do it your way

A great starting point for your Carrier Global research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Unlock your next opportunity by tapping into unique trends and untapped sectors. If you want an edge in your portfolio, these ideas could set you apart.

- Capitalize on market volatility by stepping into these 3594 penny stocks with strong financials that have shown financial strength in turbulent times.

- Boost your passive income potential and stability by targeting these 16 dividend stocks with yields > 3% offering yields above 3%.

- Ride the AI boom and seize growth potential with these 26 AI penny stocks powering innovation and reshaping entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CARR

Carrier Global

Provides intelligent climate and energy solutions in the United States, Europe, the Asia Pacific, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives