- United States

- /

- Aerospace & Defense

- /

- NYSE:BWXT

Is BWX Technologies Still Attractive After a 77.7% Surge and Defense Contract Buzz?

Reviewed by Bailey Pemberton

- Curious if BWX Technologies might still be a great value, especially after its impressive run? Let's dig into the numbers and see what is actually going on beneath the surface.

- The stock soared 77.7% so far this year and is up an incredible 279.9% over the last five years. However, it did slip by 7.3% in the past week.

- There has been renewed attention following BWX Technologies' involvement in key defense contracts and growing demand for its nuclear solutions, which has fueled both optimism and debate about its growth prospects. With geopolitical dynamics and increased private investment in nuclear technologies making headlines, investor sentiment has shifted rapidly.

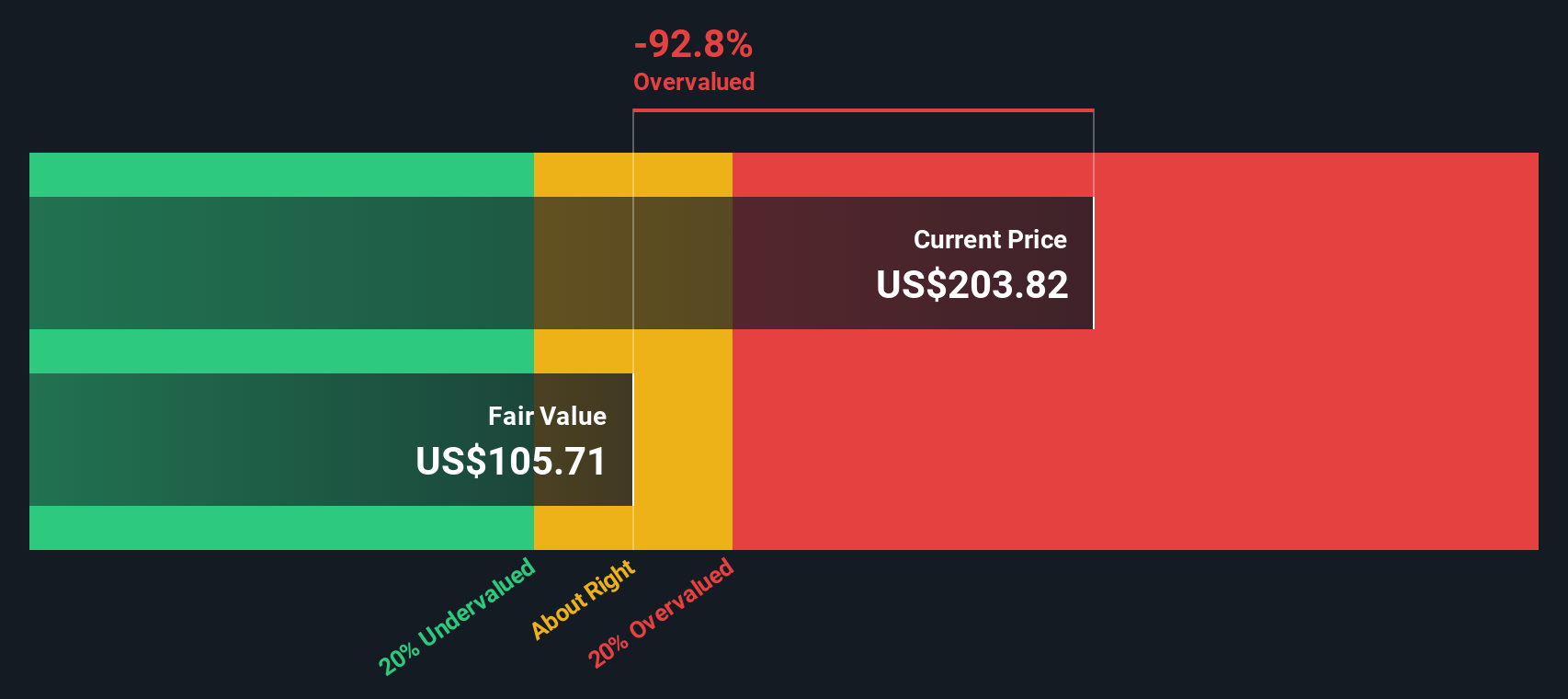

- On our valuation scorecard, BWX Technologies currently scores 0 out of 6 possible checks for being undervalued. This suggests caution is warranted if you are focused on value investing. Next, we will break down what this score really means by looking at several different valuation methods, and later share a smarter way to cut through the noise when weighing a stock’s true worth.

BWX Technologies scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: BWX Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth today based on projections of all its future cash flows. These future cash flows are discounted back to the present day to account for risk and the time value of money. This method is widely used to provide a fundamental valuation that is independent of current market sentiment.

For BWX Technologies, the model calculates intrinsic value using a two-stage Free Cash Flow to Equity approach. Currently, the company generates Free Cash Flow (FCF) of about $448.2 million. Analyst estimates cover up to five years, and projections are extended to 2035 using assumed growth rates. By 2028, FCF is projected to reach $419.3 million, while ten-year projections estimate FCF to climb to roughly $734.7 million by 2035, all in US dollars.

The DCF model assigns BWX Technologies an estimated fair value of $128.55 per share. When compared to recent market prices, the stock is trading at a 54.1% premium over its intrinsic value according to these calculations. This suggests the market may be somewhat optimistic about future cash flows or is pricing in growth beyond what is currently forecasted.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests BWX Technologies may be overvalued by 54.1%. Discover 836 undervalued stocks or create your own screener to find better value opportunities.

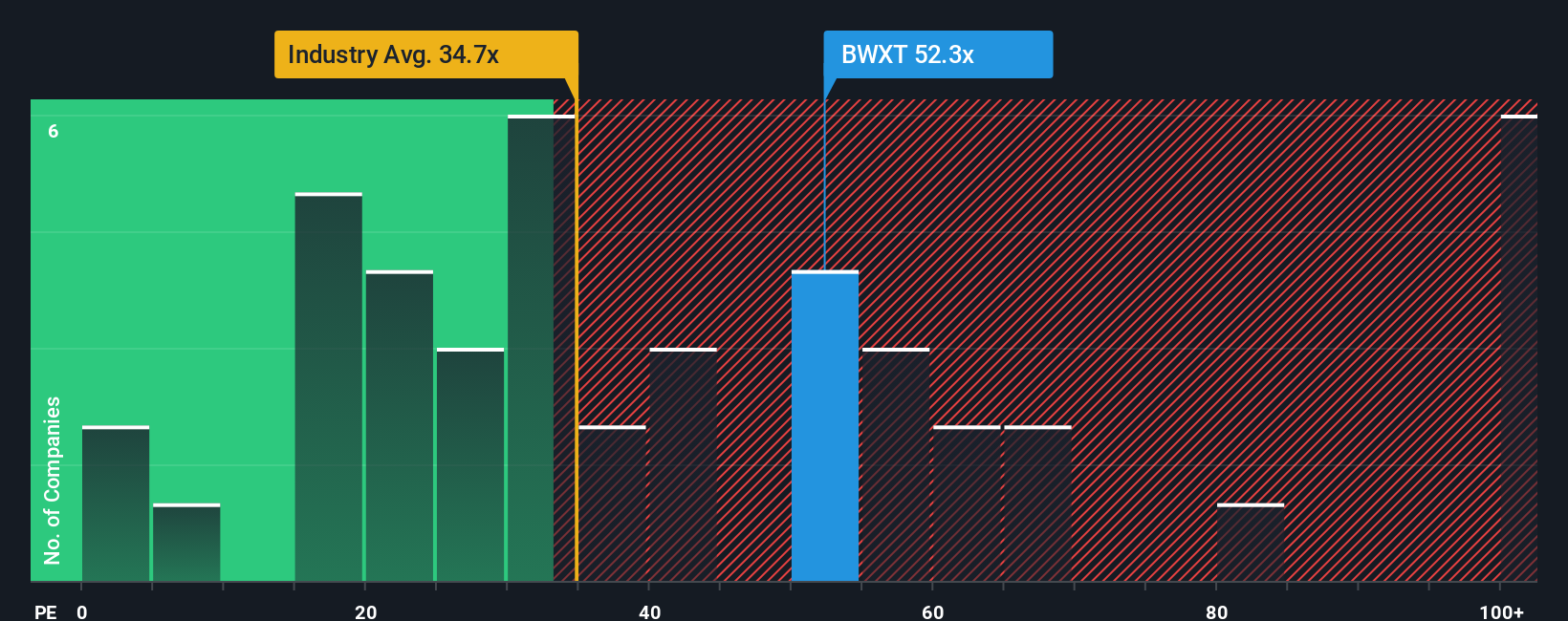

Approach 2: BWX Technologies Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies because it directly connects a company’s current share price to its underlying earnings. When a business is consistently generating profits, the PE ratio allows investors to quickly judge how much they are paying for each dollar of earnings. This makes it especially relevant for assessing mature, earnings-generating firms like BWX Technologies.

The interpretation of what constitutes a “fair” PE ratio depends on several factors. Higher growth prospects and lower risk can typically justify a higher PE, while slower-growing or riskier companies tend to trade at lower multiples. Comparing a company’s PE to its industry average or close peers can indicate whether it might be relatively expensive or inexpensive, but these comparisons do not reflect the specific characteristics of individual company growth, risk, or profitability.

BWX Technologies currently trades at a PE ratio of 59.0x, which is significantly above the Aerospace & Defense industry average of 37.5x and the peer average of 39.2x. Simply Wall St’s proprietary “Fair Ratio,” which takes into account the company’s earnings growth, risk factors, profit margins, industry dynamics, and size, arrives at a fair PE of 29.3x for BWX Technologies. This approach provides a more tailored estimate than simply comparing broad industry or peer averages.

Because the actual PE of 59.0x is well above the Fair Ratio of 29.3x, BWX Technologies appears significantly overvalued on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1402 companies where insiders are betting big on explosive growth.

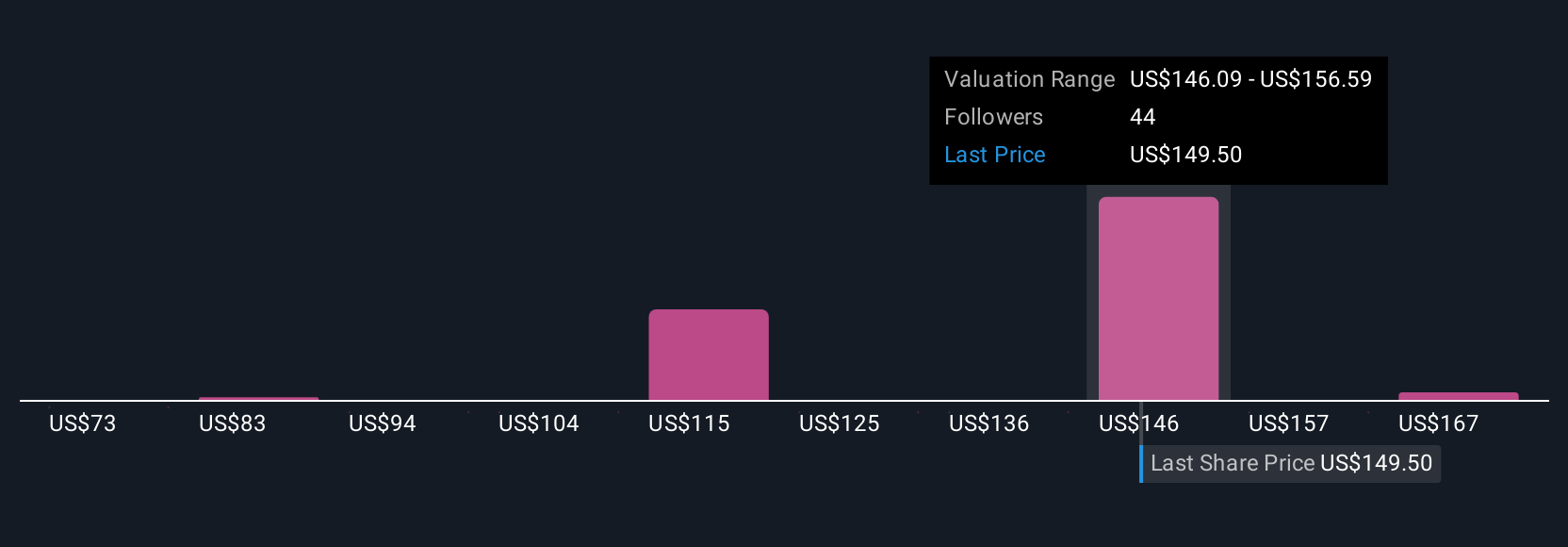

Upgrade Your Decision Making: Choose your BWX Technologies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, powerful tool that lets you create your own story about BWX Technologies, connecting your beliefs about its future (such as fair value, revenue growth, and profit margins) with what the numbers are actually showing.

Narratives bring together your perspective on a company, link it directly to a custom financial forecast, and then translate that into your personal fair value for the stock. Available on Simply Wall St’s Community page and used by millions of investors, Narratives make it easy for anyone to turn complex market data into an accessible, actionable view. Narratives update dynamically as fresh news or earnings get released.

By comparing your Fair Value to the current share price, Narratives help you decide whether BWX Technologies is worth buying, holding, or selling based on your own expectations (not just analyst consensus). For example, one Narrative projects a fair value as high as $220, citing industry leadership and contract strength, while another sees a more conservative value of $120, reflecting concerns over profit margins and defense budget risks.

Do you think there's more to the story for BWX Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BWX Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BWXT

BWX Technologies

Manufactures and sells nuclear components in the United States, Canada, and internationally.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives