- United States

- /

- Aerospace & Defense

- /

- NYSE:BWXT

BWX Technologies (BWXT): Net Margins Dip as Valuation Premium Tests Growth Narrative

Reviewed by Simply Wall St

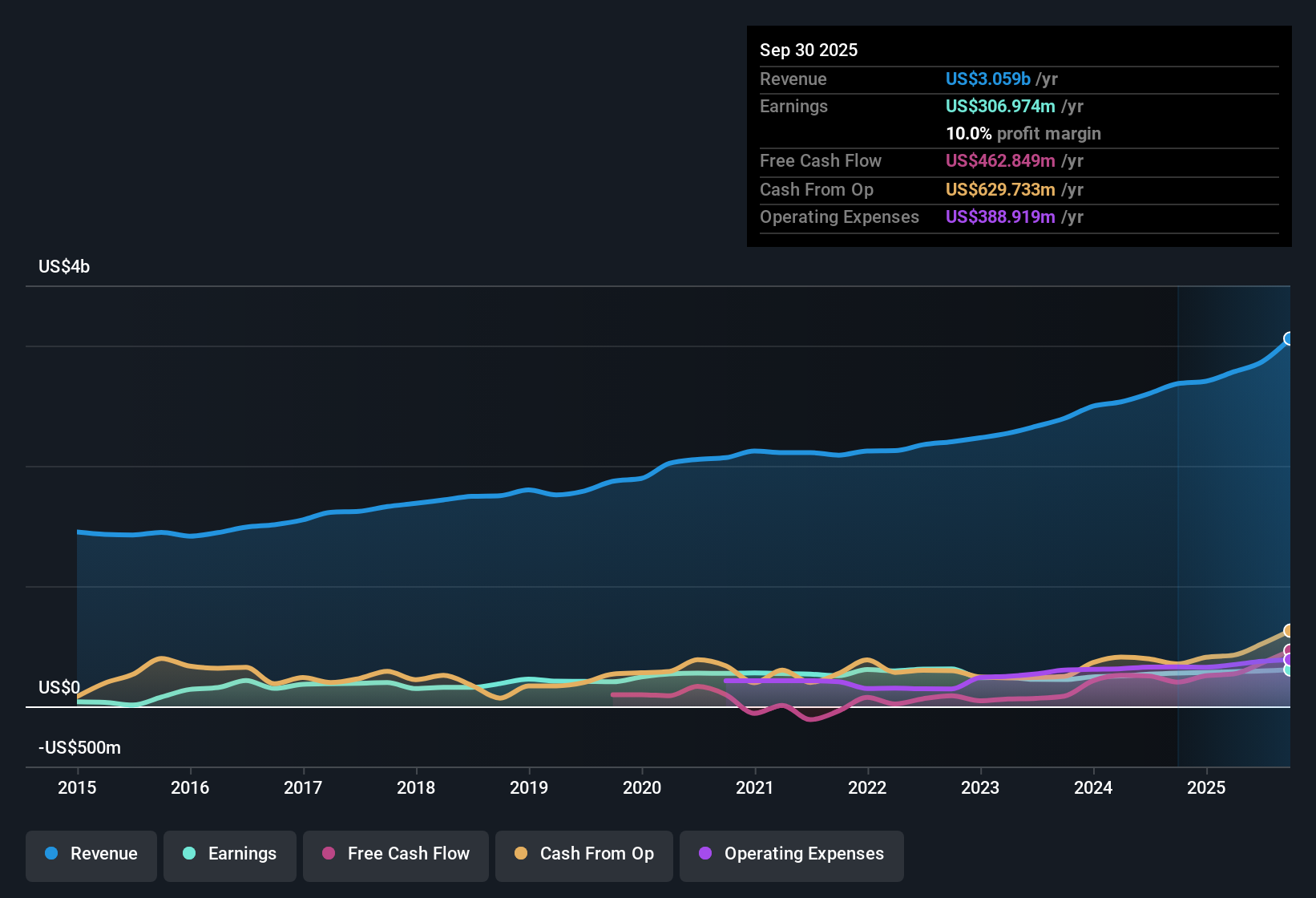

BWX Technologies (NYSE:BWXT) is expected to deliver annual earnings growth of 10.8% and revenue growth of 8.7%. These rates trail the broader US market averages of 16% and 10.5%, respectively. Net profit margins sit at 10%, marking a slight dip from last year’s 10.3%. Notably, the company’s earnings have jumped 10.9% over the past year compared to a five-year average of just 0.2% per year. With the stock trading well above the fair value estimate and at a price-to-earnings ratio higher than its peers, investors are weighing ongoing growth rewards against minor balance sheet risks and cautious sentiment around the current results.

See our full analysis for BWX Technologies.The next step is to see how these results measure up to the key narratives investors are following. Some long-standing views could be reinforced while others may be put to the test.

See what the community is saying about BWX Technologies

Backlog Surges as Defense Contracts Secure $6 Billion

- BWXT reports a record backlog totaling $6 billion, up 70% year over year and including over $4.7 billion in major Navy submarine and carrier propulsion agreements signed within the past eight months.

- Analysts' consensus view heavily supports long-term profit and revenue visibility, citing the size and multi-year nature of these government contracts.

- Analysts highlight 23% sequential backlog growth, lending credibility to recurring revenue projections as military nuclear demand accelerates.

- Consensus also credits expansion into microreactors and advanced fuels, which could further boost high-margin opportunities beyond defense work.

- To see how both bullish and cautious views assess BWXT's backlog strength, read the full consensus narrative for deeper insights.📊 Read the full BWX Technologies Consensus Narrative.

Commercial Revenue Trails Despite Overall Segment Growth

- While acquisitions drove segment growth, organic revenue in BWXT’s commercial operations declined, highlighting lumpy civil nuclear service demand even as the overall opportunity pipeline expands.

- Analysts' consensus view raises a red flag over potential volatility, noting:

- Profitability in commercial operations faces pressure, as adjusted EBITDA margins fell year over year on lower field services activity and a less favorable business mix.

- Segment growth is currently reliant on recent acquisitions, which may temporarily mask weaker organic demand.

Valuation Jumps Well Above DCF Fair Value and Peer P/E

- BWXT trades at $200.39, with a 59.7x price-to-earnings ratio, compared to its peer group average of 38.8x and the DCF fair value estimate of $125.56. The share price is also notably higher than the analyst price target of $206.40.

- Analysts' consensus view argues this premium leaves little room for disappointment:

- Consensus cautions that to validate this price, BWXT will need to grow earnings to about $494.7 million by 2028, supporting a future P/E of 41.9x, still above the sector’s current average of 34.4x.

- The risk profile remains moderate, but there are warning signs, including recent insider selling and a flagged balance sheet, that could temper upside if growth or margin expansion fall short.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for BWX Technologies on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different interpretation of the numbers? Share your unique perspective and shape your narrative in just a few minutes. Do it your way

A great starting point for your BWX Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite robust government contracts, BWXT’s premium valuation, reliance on acquisitions, and recent insider selling highlight risks if growth falters or margins disappoint.

Looking for better value and less risk of overpaying? Discover opportunities with these 843 undervalued stocks based on cash flows that may offer stronger upside with more reasonable price tags.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BWX Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BWXT

BWX Technologies

Manufactures and sells nuclear components in the United States, Canada, and internationally.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives