- United States

- /

- Building

- /

- NYSE:BLDR

Will Builders FirstSource’s (BLDR) Major Buyback Offset Lower Q2 Earnings in Its Capital Strategy?

Reviewed by Simply Wall St

- Builders FirstSource recently reported its second quarter 2025 results, showing declines in both sales and net income compared to the previous year, and completed a significant share buyback, repurchasing over 6.35 million shares for US$908.35 million since August 2024.

- This combination of lower earnings and active share repurchases highlights how the company is managing profitability challenges while returning capital to shareholders.

- We'll now examine how the completion of a large share buyback may change the outlook for Builders FirstSource going forward.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 24 best rare earth metal stocks of the very few that mine this essential strategic resource.

Builders FirstSource Investment Narrative Recap

To be a shareholder in Builders FirstSource, you need confidence in the company’s ability to manage through softer demand and margin headwinds, while leveraging its scale and investments in value-added and digital offerings. The recent decline in sales and earnings, alongside the completed share buyback, does not materially alter the primary near-term catalyst, operational improvement and stabilization in housing demand, or the major risk, which remains persistent weakness in new construction activity and continued margin pressure.

Among recent announcements, the updated 2025 revenue guidance stands out: management now expects net sales between US$14.8 billion and US$15.6 billion, down from previous forecasts. This shift aligns closely with the themes in the recent results and highlights the importance of watching for recovery in demand, still a key catalyst that could drive results higher going forward.

In contrast, investors should be aware that gross profit margins continue to face pressure from competitive dynamics and...

Read the full narrative on Builders FirstSource (it's free!)

Builders FirstSource's narrative projects $17.8 billion revenue and $984.5 million earnings by 2028. This requires 3.3% yearly revenue growth and a $69.1 million earnings increase from $915.4 million today.

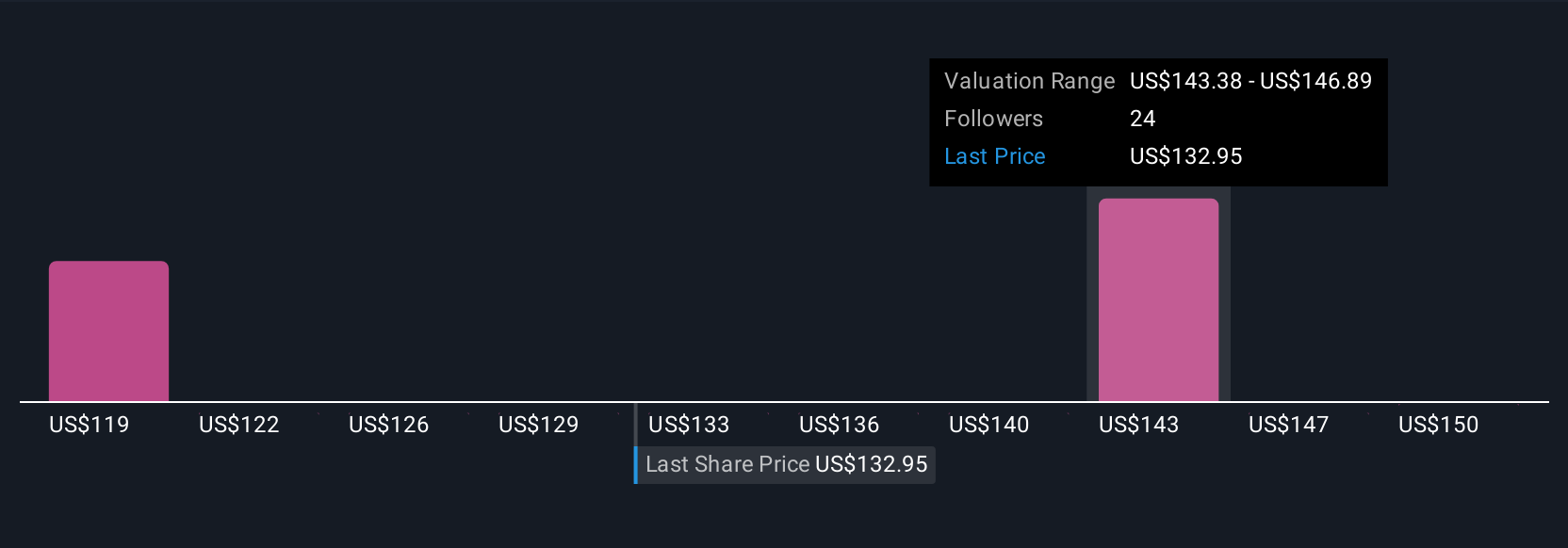

Uncover how Builders FirstSource's forecasts yield a $144.21 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community span US$144.21 to US$181.96 based on 4 perspectives. Despite wide-ranging views, many remain focused on how ongoing competitive and housing market pressures could shape Builders FirstSource’s financial results, consider seeking a variety of viewpoints on what matters most now.

Explore 4 other fair value estimates on Builders FirstSource - why the stock might be worth as much as 43% more than the current price!

Build Your Own Builders FirstSource Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Builders FirstSource research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Builders FirstSource research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Builders FirstSource's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Builders FirstSource might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLDR

Builders FirstSource

Manufactures and supplies building materials, manufactured components, and construction services to professional homebuilders, sub-contractors, remodelers, and consumers in the United States.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives