- United States

- /

- Building

- /

- NYSE:BLDR

Builders FirstSource (BLDR): Reviewing Valuation After Recent Share Price Pullback

Reviewed by Kshitija Bhandaru

See our latest analysis for Builders FirstSource.

Builders FirstSource’s share price has pulled back in 2024, with a year-to-date return of -13.69%, reflecting some of the caution seen across the building products sector. While recent weeks have brought only modest day-to-day movement, investors weighing the stock’s potential will notice its long-term performance remains exceptional. The stock has achieved a 117.6% three-year and 275.2% five-year total shareholder return, even after its drop from last year’s highs.

If you’re watching for the next breakout in the markets, now is a timely moment to broaden your search and discover fast growing stocks with high insider ownership

With Builders FirstSource trading below analyst price targets but showing only modest recent growth, the question is whether investors are overlooking value or if the company’s strong track record is already fully reflected in the stock price.

Most Popular Narrative: 12.7% Undervalued

The most widely followed narrative puts Builders FirstSource’s fair value at $140.32, which is nearly $18 higher than its last closing price of $122.54. This suggests the market may be discounting the company’s recovery potential, sparking a debate about whether value is being overlooked or risks are well understood.

The company is investing heavily in digital transformation and value-added solutions (for example, digital tools, ERP integration, prefabricated components) that are expected to drive higher-margin growth, increase operating efficiency, and strengthen customer relationships as the market recovers, improving both future revenue and net margins.

Want to know what justifies such a premium? The narrative leans on transformative investments and aggressive expansion moves, pointing to a future financial profile that could surprise even seasoned analysts. Which bold projections did they use to reach this impressive number? Unlock the details and see the reasoning behind this valuation.

Result: Fair Value of $140.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in housing starts and unpredictable commodity pricing could quickly challenge these optimistic projections and change the company’s growth trajectory.

Find out about the key risks to this Builders FirstSource narrative.

Another View: Market Value Through Earnings Ratios

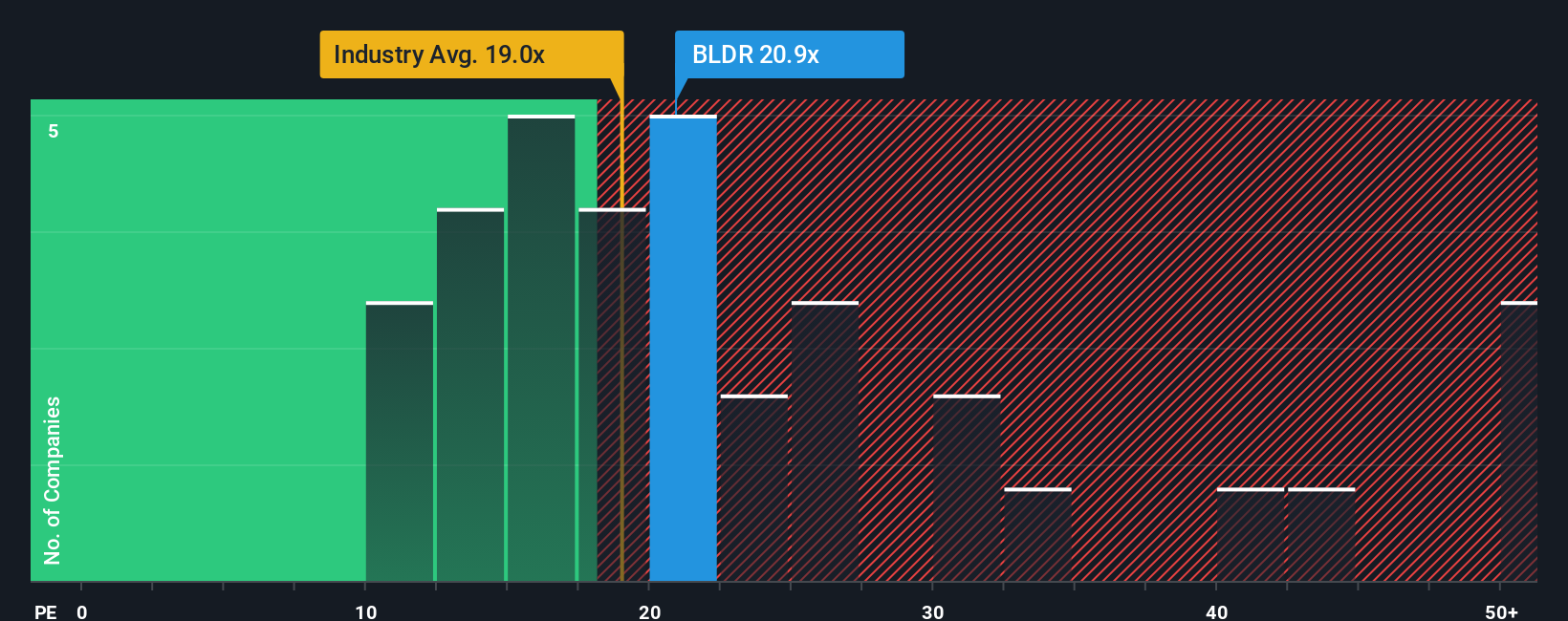

Stepping back from analyst price targets, the company's price-to-earnings is an important sanity check. Builders FirstSource trades at 17.9x earnings, which is lower than both its industry average of 20.4x and the peer group at 21.1x. If the market shifts toward its fair ratio of 24.4x, the stock could see meaningful re-rating. But does that imply a margin of safety or a market that is being too optimistic?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Builders FirstSource for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Builders FirstSource Narrative

If you have a different perspective or want to dig deeper into the numbers yourself, you can easily shape your own view in just a few minutes with Do it your way.

A great starting point for your Builders FirstSource research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Act now and expand your watchlist with stocks that align with your goals, so you’ll never miss a potential standout opportunity in today’s shifting markets.

- Accelerate your search for high potential by targeting these 878 undervalued stocks based on cash flows that might be flying under the radar with attractively low valuations and solid growth stories.

- Jump ahead of trends and gain an edge by tapping into these 24 AI penny stocks powering breakthroughs in artificial intelligence and reshaping multiple sectors.

- Boost your income strategy with these 18 dividend stocks with yields > 3% featuring yields above 3 percent that can strengthen your portfolio’s payouts while balancing growth and stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Builders FirstSource might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLDR

Builders FirstSource

Manufactures and supplies building materials, manufactured components, and construction services to professional homebuilders, sub-contractors, remodelers, and consumers in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion