- United States

- /

- Electrical

- /

- NYSE:BE

Is Bloom Energy Still an Opportunity After a 299% Rally and New Partnerships?

Reviewed by Bailey Pemberton

- Wondering if Bloom Energy is still a bargain or if the opportunity has sailed? You are not alone; a lot of eyes are on this stock’s valuation right now.

- After a scorching rally of 299.6% year-to-date and an impressive 290.1% gain over the last year, the stock has dipped nearly 10% in the past month. This signals shifting outlooks or perhaps a cooling-off period.

- Recent headlines have highlighted surging demand for fuel cell technology as global energy markets pivot toward renewables. Bloom Energy has landed new partnerships and expanded its reach, which have been key in fueling price momentum and attracting a surge of investor attention.

- Right now, Bloom Energy has a valuation score of 2 out of 6. This means it only looks undervalued on two out of six key checks, but does that paint the whole picture? Stick around as we dive into different valuation approaches, and keep an eye out for the one perspective you definitely do not want to miss at the end of this article.

Bloom Energy scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Bloom Energy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow, or DCF, model projects a company's future cash flows and discounts them back to their present value, aiming to estimate what the business is truly worth today. For Bloom Energy, current Free Cash Flow stands at $94.6 Million. Analysts provide estimates out through 2029, with Free Cash Flow expected to reach approximately $1.5 Billion by that year. It is important to note that estimates beyond five years are extrapolated rather than analyst-sourced, offering useful but less certain insight into possible future growth.

Bloom Energy’s growth trajectory is steep, with ten-year projections showing a consistent rise each year. This reflects the company's robust outlook in the renewable energy space. Using the 2 Stage Free Cash Flow to Equity model, the DCF analysis pegs Bloom Energy’s intrinsic or fair value at $147.93 per share. This suggests that the stock is trading at about a 36.9% discount compared to its estimated intrinsic value, indicating a strong case for being undervalued at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bloom Energy is undervalued by 36.9%. Track this in your watchlist or portfolio, or discover 919 more undervalued stocks based on cash flows.

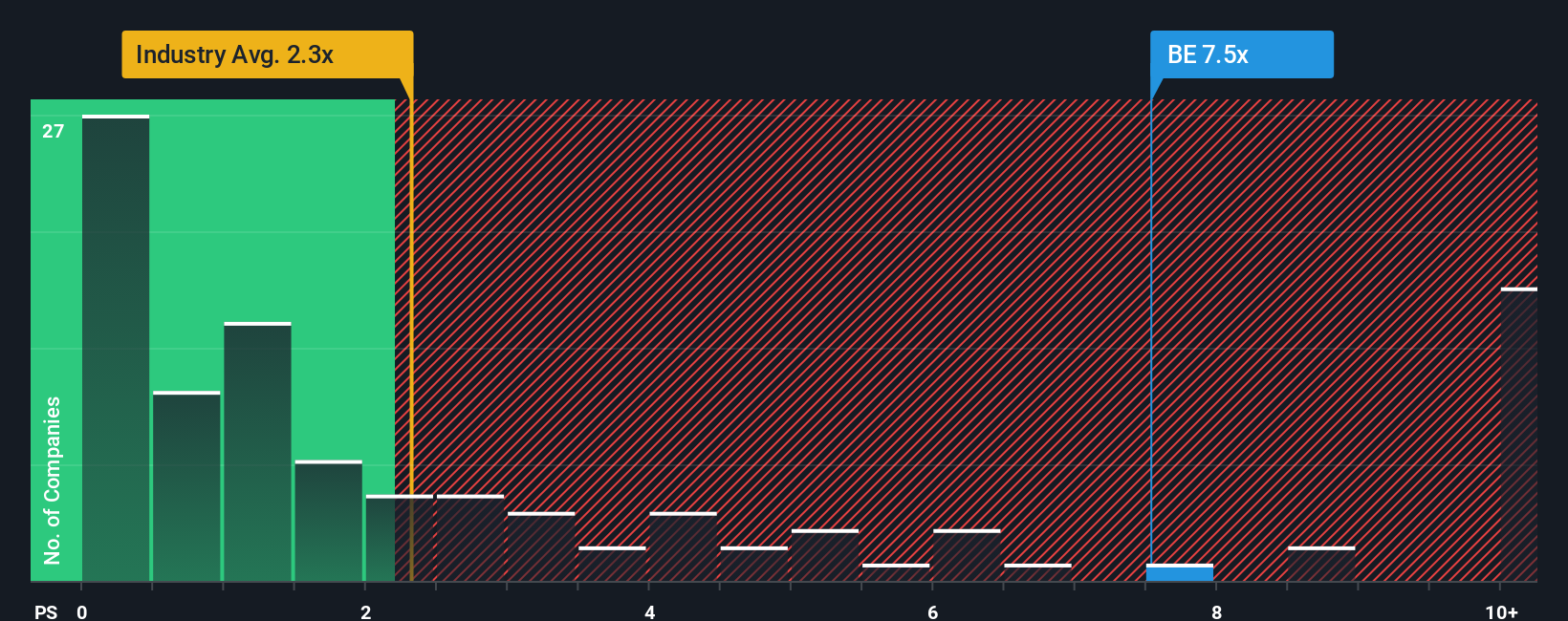

Approach 2: Bloom Energy Price vs Sales

The Price-to-Sales (P/S) ratio is often the preferred valuation metric for companies like Bloom Energy that are rapidly growing but not consistently profitable. Unlike the Price-to-Earnings ratio, which requires positive net earnings, the P/S ratio gives a clearer snapshot of how the market values each dollar of a company’s sales. This makes it especially useful for high-growth, technology-driven businesses in the energy sector.

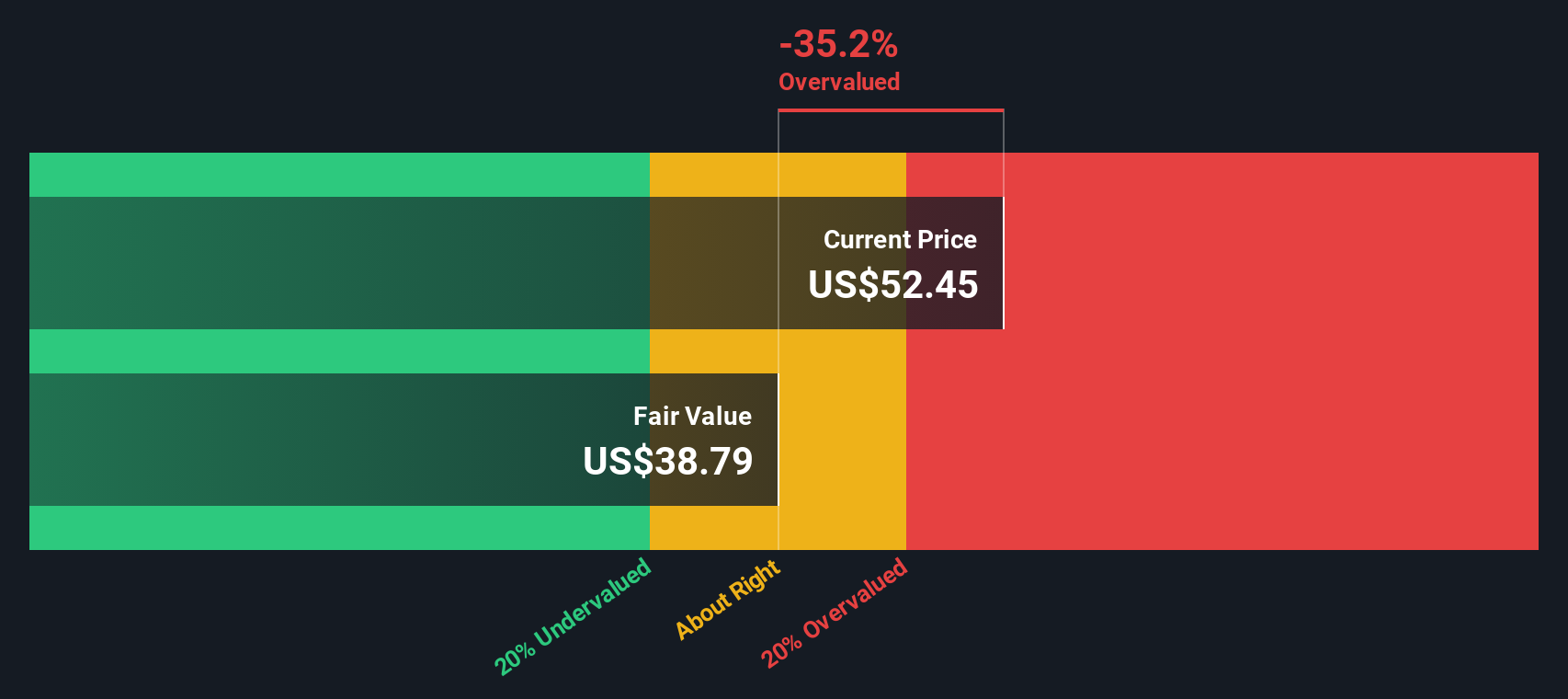

Typically, a company with high growth expectations or industry-leading technology can warrant a higher P/S multiple, while higher risks or thinner margins might call for a lower one. It is important to compare this figure to broader benchmarks for context. Currently, Bloom Energy’s P/S ratio stands at 12.14x, which is much higher than both the average of its peers at 2.63x and the broader Electrical industry average of 1.84x.

Simply Wall St’s proprietary “Fair Ratio” offers a more nuanced benchmark. Rather than using simple peer or industry averages, the Fair Ratio for Bloom Energy is calculated at 9.34x. It incorporates important factors such as projected revenue growth, current profit margins, risk factors, and market capitalization, allowing for a more tailored and forward-looking assessment instead of a broad-brush comparison.

Comparing the Fair Ratio with Bloom Energy’s current P/S multiple, the stock does appear slightly overvalued, trading above what would be justified based on its profile and prospects.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1421 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bloom Energy Narrative

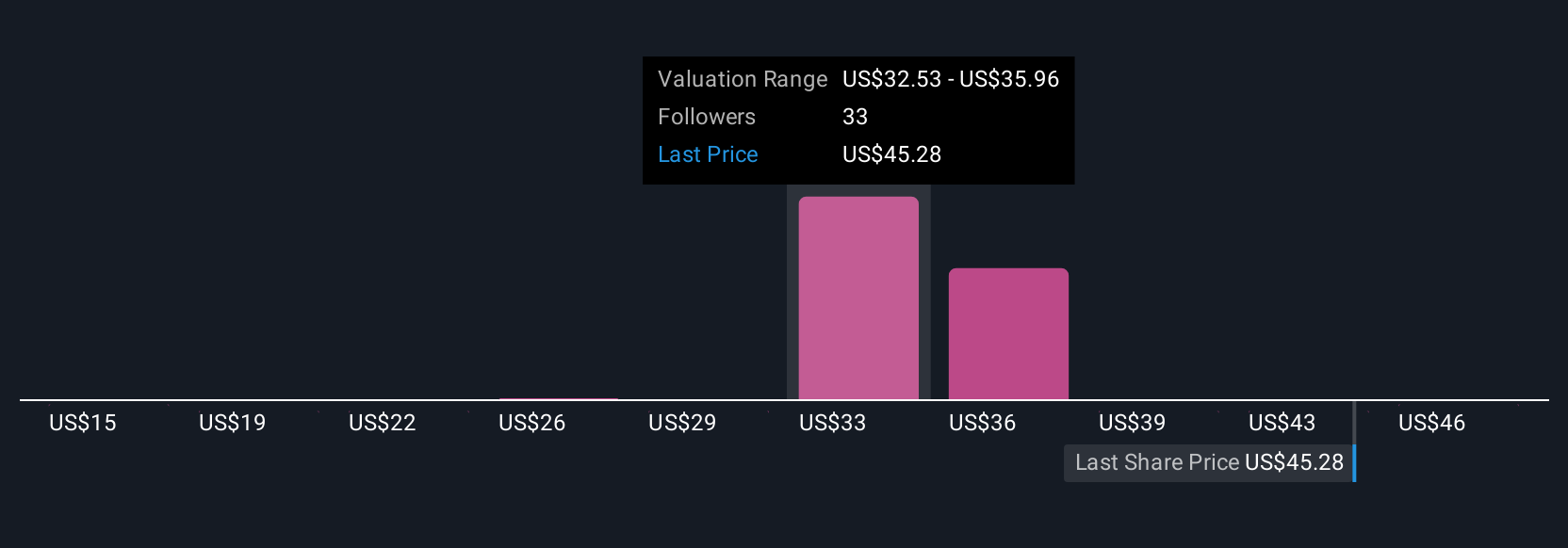

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. In investing, a Narrative is more than just numbers; it is the story and context you believe about a company’s future, your view of what will drive its growth, profit, and long-term potential. This perspective is directly tied to your forecasts, risk assumptions, and what you see as fair value.

Narratives are a practical and powerful tool, as they connect the company’s story with a customized financial forecast and a resulting fair value, making sense of both data and your investment conviction. On Simply Wall St’s Community page, millions of investors can easily craft, update, and share these dynamic Narratives to reflect their own insights or respond instantly to changing news and earnings releases.

With Narratives, you get an actionable framework: compare your Fair Value estimate, which is shaped by your story and numbers, to today’s share price to decide when to buy or sell. You can then adjust your view as new information arrives. For example, one Bloom Energy investor might forecast surging demand for on-site power and set a fair value of $48 per share. Another investor, more concerned about execution risks and competition, pegs fair value much lower at $10. Narratives let you capture your outlook and act on it, confidently and transparently.

Do you think there's more to the story for Bloom Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bloom Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BE

Bloom Energy

Designs, manufactures, sells, and installs solid-oxide fuel cell systems for on-site power generation in the United States and internationally.

Exceptional growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives