- United States

- /

- Electrical

- /

- NYSE:BE

Investors Appear Satisfied With Bloom Energy Corporation's (NYSE:BE) Prospects As Shares Rocket 44%

Bloom Energy Corporation (NYSE:BE) shares have continued their recent momentum with a 44% gain in the last month alone. The annual gain comes to 128% following the latest surge, making investors sit up and take notice.

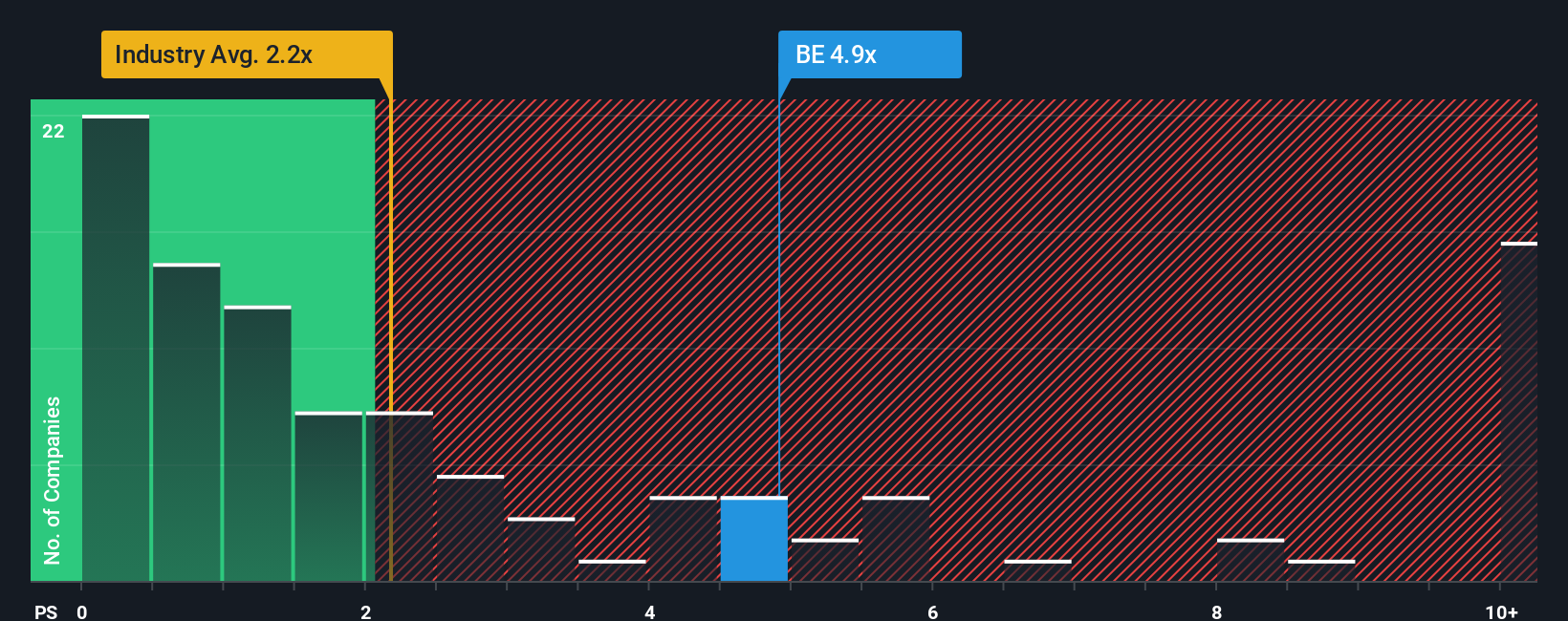

After such a large jump in price, you could be forgiven for thinking Bloom Energy is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.9x, considering almost half the companies in the United States' Electrical industry have P/S ratios below 2.2x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Bloom Energy

How Has Bloom Energy Performed Recently?

With revenue growth that's superior to most other companies of late, Bloom Energy has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bloom Energy.Is There Enough Revenue Growth Forecasted For Bloom Energy?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Bloom Energy's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 21% last year. The latest three year period has also seen an excellent 60% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 19% per annum over the next three years. With the industry only predicted to deliver 16% per annum, the company is positioned for a stronger revenue result.

With this information, we can see why Bloom Energy is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Bloom Energy's P/S Mean For Investors?

The strong share price surge has lead to Bloom Energy's P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Bloom Energy maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electrical industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

You need to take note of risks, for example - Bloom Energy has 4 warning signs (and 1 which is a bit unpleasant) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Bloom Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BE

Bloom Energy

Designs, manufactures, sells, and installs solid-oxide fuel cell systems for on-site power generation in the United States and internationally.

Exceptional growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives