- United States

- /

- Electrical

- /

- NYSE:BE

Bloom Energy (BE): Examining Valuation After Recent Surge in Share Price and Investor Interest

Reviewed by Simply Wall St

See our latest analysis for Bloom Energy.

Despite a volatile week, Bloom Energy's 90-day share price return of 84.56% and a remarkable year-to-date rise of 332.78% have fueled fresh momentum and caught the market’s attention. While short-term swings have challenged some nerves, long-term investors are enjoying standout total shareholder returns of 271.7% over twelve months and an impressive 375% over three years. These are signs that confidence in the company’s growth potential remains robust as debates swirl around its current valuation.

If Bloom’s accelerating momentum has you scanning for other tech-fueled growth stories, it could be the ideal time to see the full list of innovative opportunities with our See the full list for free.

With shares surging and strong results in tow, the big question now is whether Bloom Energy's current price factors in all its future promise or if there may still be a smart entry point for investors.

Most Popular Narrative: 9.6% Undervalued

Bloom Energy's current share price stands below its widely followed narrative fair value, highlighting a potential mispricing. This gap has led many investors to question whether the market truly appreciates the company's future revenue and profit potential.

Widespread grid constraints and long interconnection timelines for traditional utility-scale power provide a time-to-power advantage for Bloom's solutions. This boosts its competitive edge in mission-critical markets and is expected to expand the company's addressable market, positively impacting future top-line growth.

How does this narrative justify such an ambitious target? The key lies in forward-looking financial assumptions and a future profit multiple that turns industry heads. If you want to know the bold growth thesis, click through and uncover the drivers behind this surprising fair value estimate.

Result: Fair Value of $111.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, breakthroughs in zero-emission battery storage and regulatory shifts away from natural gas could quickly reduce Bloom Energy's competitive edge and growth prospects.

Find out about the key risks to this Bloom Energy narrative.

Another View: Looking to the Market Multiples

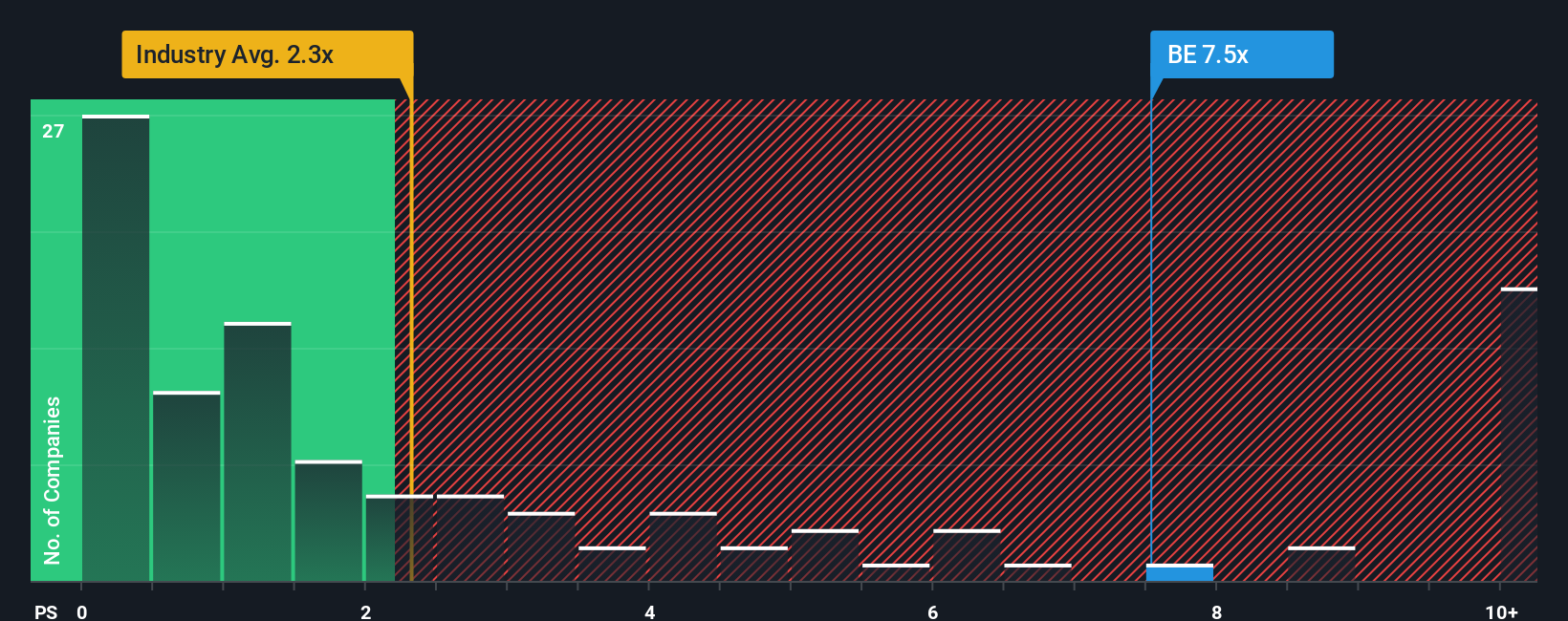

While Bloom Energy appears undervalued by narrative-driven fair value, a closer look at its sales ratio presents a different perspective. The company's price-to-sales ratio is 13.2 times, significantly higher than the US Electrical industry average of 1.9 times and the peer average of 2.8 times. Even when compared to the fair ratio of 9 times, Bloom appears expensive. This premium poses valuation risks if market sentiment shifts, but could it be justified by future performance?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bloom Energy Narrative

If you want to challenge these views or dive even deeper, you can quickly shape your own narrative and make sense of the data in just a few minutes: Do it your way

A great starting point for your Bloom Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Ready for Even More Smart Investment Opportunities?

Do not let your portfolio miss out on tomorrow’s winners. Seize your edge now by harnessing proven ideas tailored to unique trends and market strengths.

- Unlock income potential with these 15 dividend stocks with yields > 3% as they consistently deliver attractive yields above 3% and can help power your long-term gains.

- Ride the AI boom by tracking these 25 AI penny stocks which are setting the pace in artificial intelligence and revolutionizing entire industries.

- Capitalize on value by targeting these 928 undervalued stocks based on cash flows trading below their intrinsic worth and positioned for strong upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bloom Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BE

Bloom Energy

Designs, manufactures, sells, and installs solid-oxide fuel cell systems for on-site power generation in the United States and internationally.

Exceptional growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success