- United States

- /

- Electrical

- /

- NYSE:BE

Bloom Energy (BE): Assessing Valuation After Recent Surge in Share Price

Reviewed by Simply Wall St

Bloom Energy (BE) has attracted attention recently as investors watch for shifts in the company's fundamentals and market sentiment. A look at its recent performance reveals some interesting trends that are worth considering.

See our latest analysis for Bloom Energy.

Bloom Energy’s share price has experienced a dramatic run over the last several months, with the latest rally sending it up 90% in just ninety days and a staggering 358% year-to-date. While the stock saw some sharp volatility this week, its one-year total shareholder return stands at 369%. This highlights strong long-term momentum and growing optimism from investors despite recent pullbacks.

If you’re interested in uncovering more market movers, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With such impressive gains and positive momentum, the critical question now is whether Bloom Energy's current price still leaves room for upside, or if the market has already factored in all anticipated growth.

Most Popular Narrative: 4.2% Undervalued

Bloom Energy’s last close of $107.11 sits below the most widely followed fair value calculation of $111.85, hinting at a modest upside. This narrative grounds its view in fast-moving industry dynamics and anticipated improvements to the business model.

“Surging demand for AI and cloud data center power is driving urgent capacity needs, and Bloom's proven partnerships with hyperscalers (Oracle, AWS, Coralogix) are accelerating adoption of its fuel cell technology as a resilient, on-site alternative. This supports sustained revenue growth and improves overall earnings visibility.

Widespread grid constraints and long interconnection timelines for traditional utility-scale power create a time-to-power advantage for Bloom's solutions. This boosts its competitive edge in mission-critical markets and is expected to expand the company's addressable market, positively impacting future top-line growth.”

Curious what powers this view? It is all about bold assumptions for revenue, earnings, and a future profit multiple that rivals some of the hottest growth names. Want to know exactly how optimistic experts are and what could make or break that fair value? Click in to reveal the surprising projections that drove these numbers.

Result: Fair Value of $111.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating advances in zero-emission energy and reliance on natural gas could disrupt Bloom’s growth story and impact long-term profitability forecasts.

Find out about the key risks to this Bloom Energy narrative.

Another View: Much More Expensive Than Peers

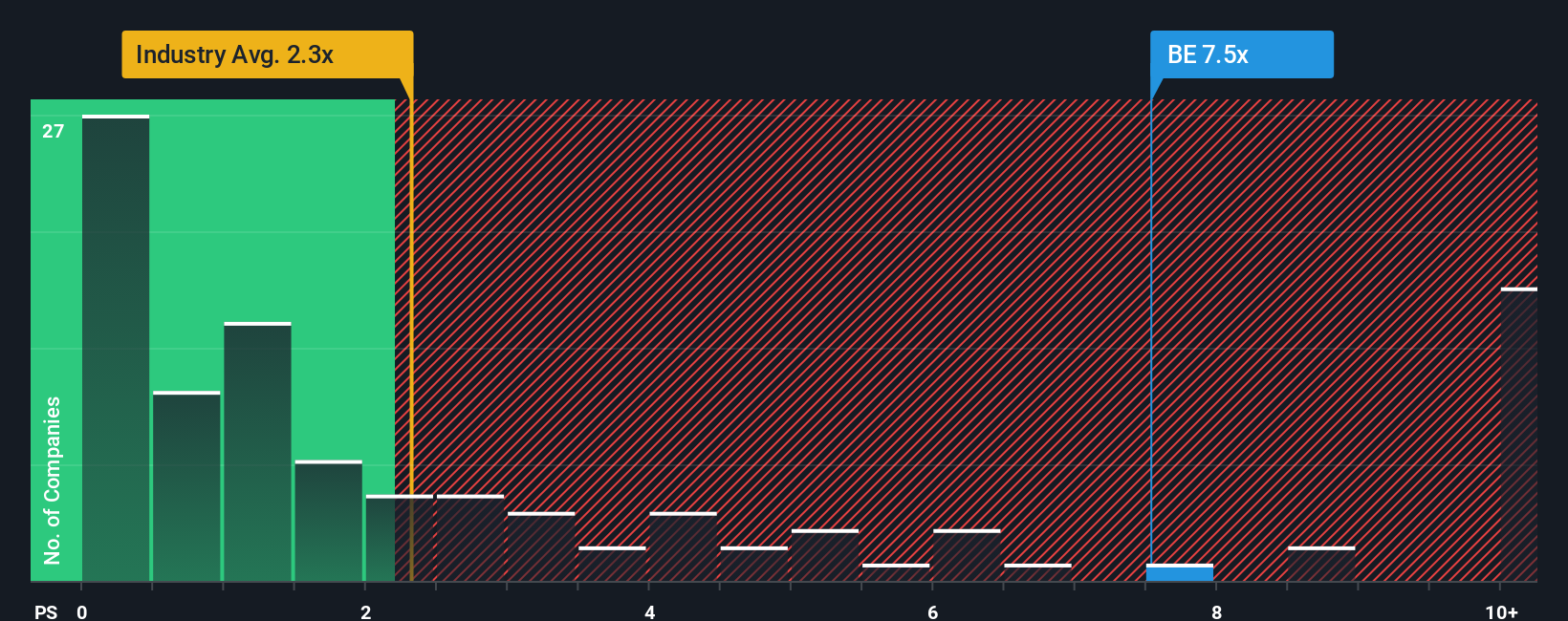

Looking at Bloom Energy’s price-to-sales ratio, the stock trades at 13.9 times sales. This is a significant stretch compared to its industry peers at 1.9x and is also higher than its fair ratio of 9.3x. This large gap shows the market is pricing in a lot of optimism, leaving little room for error.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bloom Energy Narrative

If you see the story differently or want to dig into the numbers yourself, you can shape your own take on Bloom Energy in just a few minutes. Do it your way

A great starting point for your Bloom Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never wait for opportunities to come to them. Get ahead of the crowd now by seizing rare market openings before everyone else notices.

- Spot fresh upside with stocks showing strong financials and growth by evaluating these 3580 penny stocks with strong financials that can unlock surprising returns.

- Accelerate your portfolio with exposure to leading-edge breakthroughs by scanning these 27 AI penny stocks as they ride the wave of artificial intelligence innovation.

- Collect steady income and peace of mind by targeting these 18 dividend stocks with yields > 3% offering yields higher than 3% so your capital works harder for you.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bloom Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BE

Bloom Energy

Designs, manufactures, sells, and installs solid-oxide fuel cell systems for on-site power generation in the United States and internationally.

Exceptional growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives