- United States

- /

- Trade Distributors

- /

- NYSE:BCC

How End-Market Pressures and Weaker Sales at Boise Cascade (BCC) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Boise Cascade recently faced substantial end-market hurdles, with declining sales and reduced returns on capital highlighted in the past year.

- This signals ongoing operational pressures that may challenge the company's near-term financial flexibility and future investment plans.

- We'll now explore how end-market challenges and weaker sales factor into Boise Cascade's investment outlook and forward-looking risks.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Boise Cascade Investment Narrative Recap

To invest in Boise Cascade today, you need to believe in its ability to weather cyclical downturns in construction and housing, while trusting that ongoing modernization and distribution network expansions will set the stage for future growth. The recent news of declining sales and weaker returns on capital is material, as it reinforces the near-term risk that pricing pressures and end-market sluggishness may weigh on earnings and limit the impact of upcoming efficiency projects. Among recent announcements, the Q2 2025 earnings report directly ties into the current challenges: sales dropped by 3% and net income was nearly halved compared to last year. This underlines the critical importance for Boise Cascade to restore profitability, especially as sustained price softness and high fixed costs squeeze margins during weak cycles. Conversely, investors should pay close attention to signs of prolonged volume declines in residential construction, as...

Read the full narrative on Boise Cascade (it's free!)

Boise Cascade's outlook anticipates $7.0 billion in revenue and $285.8 million in earnings by 2028. This projection is based on a 2.4% annual revenue growth rate and a $23.5 million earnings increase from the current earnings of $262.3 million.

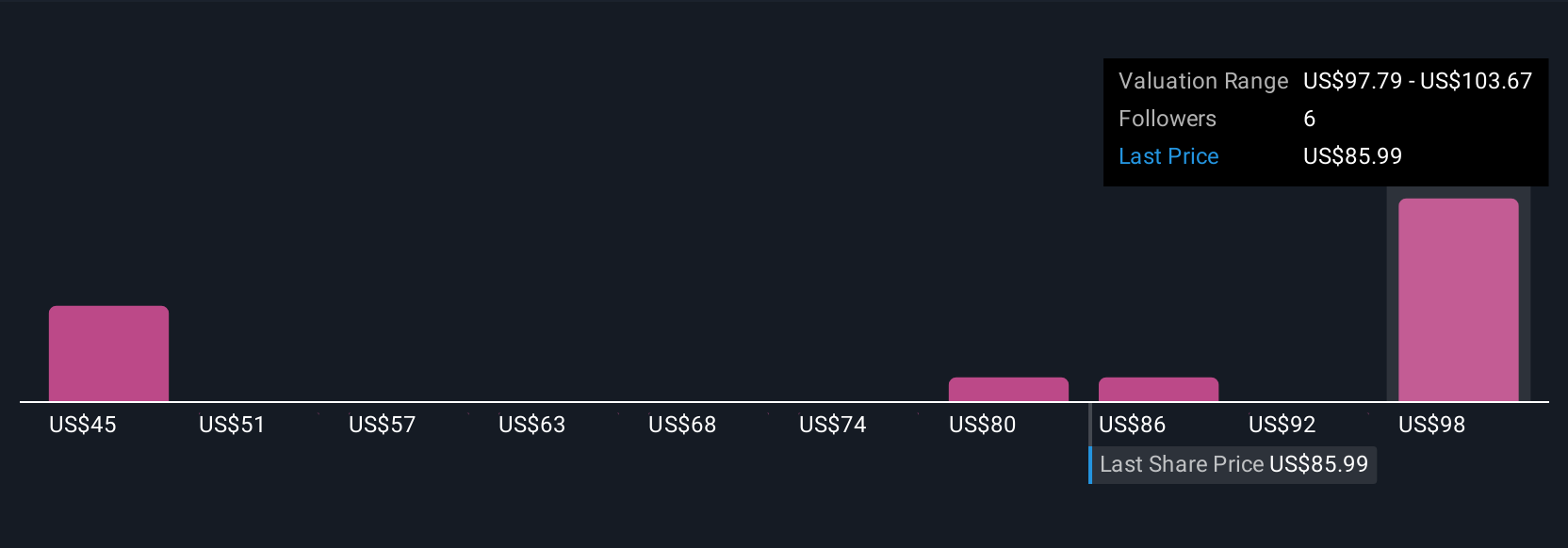

Uncover how Boise Cascade's forecasts yield a $96.33 fair value, a 30% upside to its current price.

Exploring Other Perspectives

Five distinct fair value estimates from the Simply Wall St Community range from US$70.00 up to US$219.34 per share. Amid these varied opinions, recent revenue declines and shrinking profit margins point to the need for careful consideration of ongoing operational pressures before forming your own view.

Explore 5 other fair value estimates on Boise Cascade - why the stock might be worth over 2x more than the current price!

Build Your Own Boise Cascade Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boise Cascade research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Boise Cascade research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boise Cascade's overall financial health at a glance.

No Opportunity In Boise Cascade?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boise Cascade might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BCC

Boise Cascade

Engages in manufacture and sale of engineered wood products (EWP) and plywood, and wholesale distribution of building materials in the United States and Canada.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives