- United States

- /

- Industrials

- /

- NYSE:BBUC

Assessing Brookfield Business Corporation (NYSE:BBUC) Valuation Following Declines in Sales and Assets in Latest Financial Report

Reviewed by Simply Wall St

Brookfield Business (NYSE:BBUC) just released its latest interim financial report, revealing a drop in both sales and total assets, along with widening net losses from the previous year. This update highlights key financial headwinds for the company.

See our latest analysis for Brookfield Business.

Despite the recent dip in quarterly sales and a widening net loss, Brookfield Business’s share price has posted an impressive 36.1% return so far this year and a 26.97% total shareholder return over the past twelve months. This momentum suggests investors are still focusing on the company’s long-term growth potential, even as short-term pressures continue to play out.

If you’re interested in companies showing resilience or upside in challenging markets, this is a great chance to discover fast growing stocks with high insider ownership

The question for investors now is whether Brookfield Business’s current valuation offers an attractive entry point given its recent declines, or if the market has already accounted for its future prospects in the share price.

Price-to-Sales Ratio of 0.3x: Is it justified?

Brookfield Business shares are currently trading at a price-to-sales (P/S) ratio of 0.3x, significantly lower than the average for both industry peers and the broader sector, even with its recent stock rally.

The price-to-sales ratio compares a company’s market capitalization to its total revenue. This provides a way to gauge how much investors are willing to pay for each dollar of sales. The metric is particularly relevant for Brookfield Business, which is presently unprofitable, as it highlights the company’s valuation independent of its recent net losses.

With a P/S ratio far below the global Industrials industry average of 0.8x and the peer average of 0.5x, Brookfield Business appears undervalued on this metric. The current figure suggests the market is taking a cautious stance and discounting the company’s sales due to persistent losses and an absence of visible profit growth drivers. If market sentiment shifts or profitability recovers, there is potential for the multiple to trend closer to industry norms.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 0.3x (UNDERVALUED)

However, persistent net losses and the lack of visible profit growth drivers remain key risks. These factors could challenge the case for Brookfield Business’s undervaluation.

Find out about the key risks to this Brookfield Business narrative.

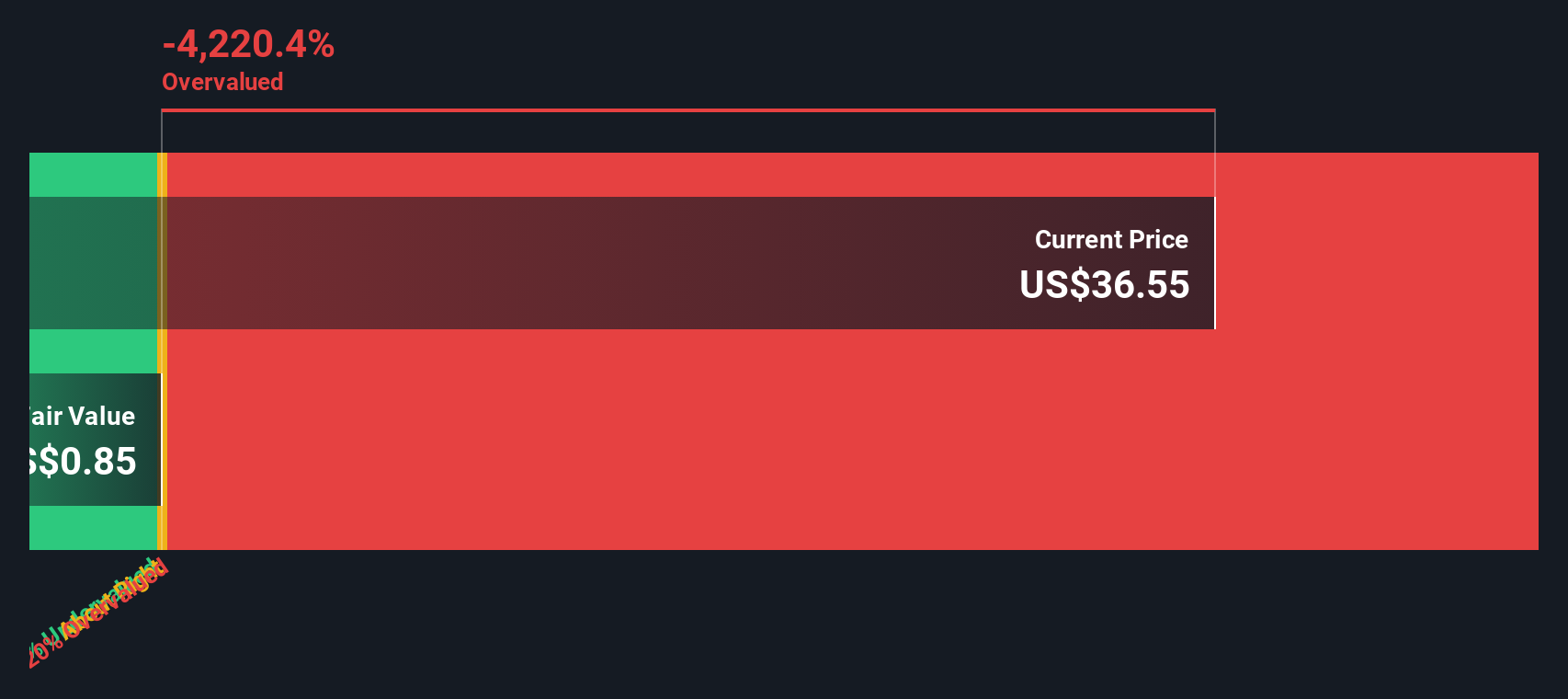

Another View: Discounted Cash Flow Sends a Different Signal

While Brookfield Business looks undervalued based on its price-to-sales ratio, the SWS DCF model presents a starkly different perspective. According to this method, the company’s shares are trading well above our estimate of fair value. This raises questions about whether investors may be overly optimistic about a turnaround, or if the market is factoring in information that models do not reflect.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Brookfield Business for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Brookfield Business Narrative

If you have a different perspective or want to test your own assumptions, take a few minutes to explore the numbers and craft your own outlook. Do it your way

A great starting point for your Brookfield Business research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let a single opportunity pass you by. Use the Simply Wall Street screener to unlock powerful stock picks tailored for trends, value, and tomorrow’s winners.

- Boost your income potential by tapping into these 16 dividend stocks with yields > 3% with generous yields above 3% for a steady flow of dividends.

- Catch the next wave of innovation by uncovering market leaders in artificial intelligence through these 26 AI penny stocks.

- Seize bargains in today’s market by targeting these 905 undervalued stocks based on cash flows that stand out based on discounted cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Business might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBUC

Brookfield Business

Owns and operates services and industrials operations in the United States, Australia, Brazil, the United Kingdom, and internationally.

Slightly overvalued with very low risk.

Similar Companies

Market Insights

Community Narratives