- United States

- /

- Industrials

- /

- NYSE:BBU

Did Brookfield Business Partners' (BBU) Debt Reduction and Asset Recycling Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

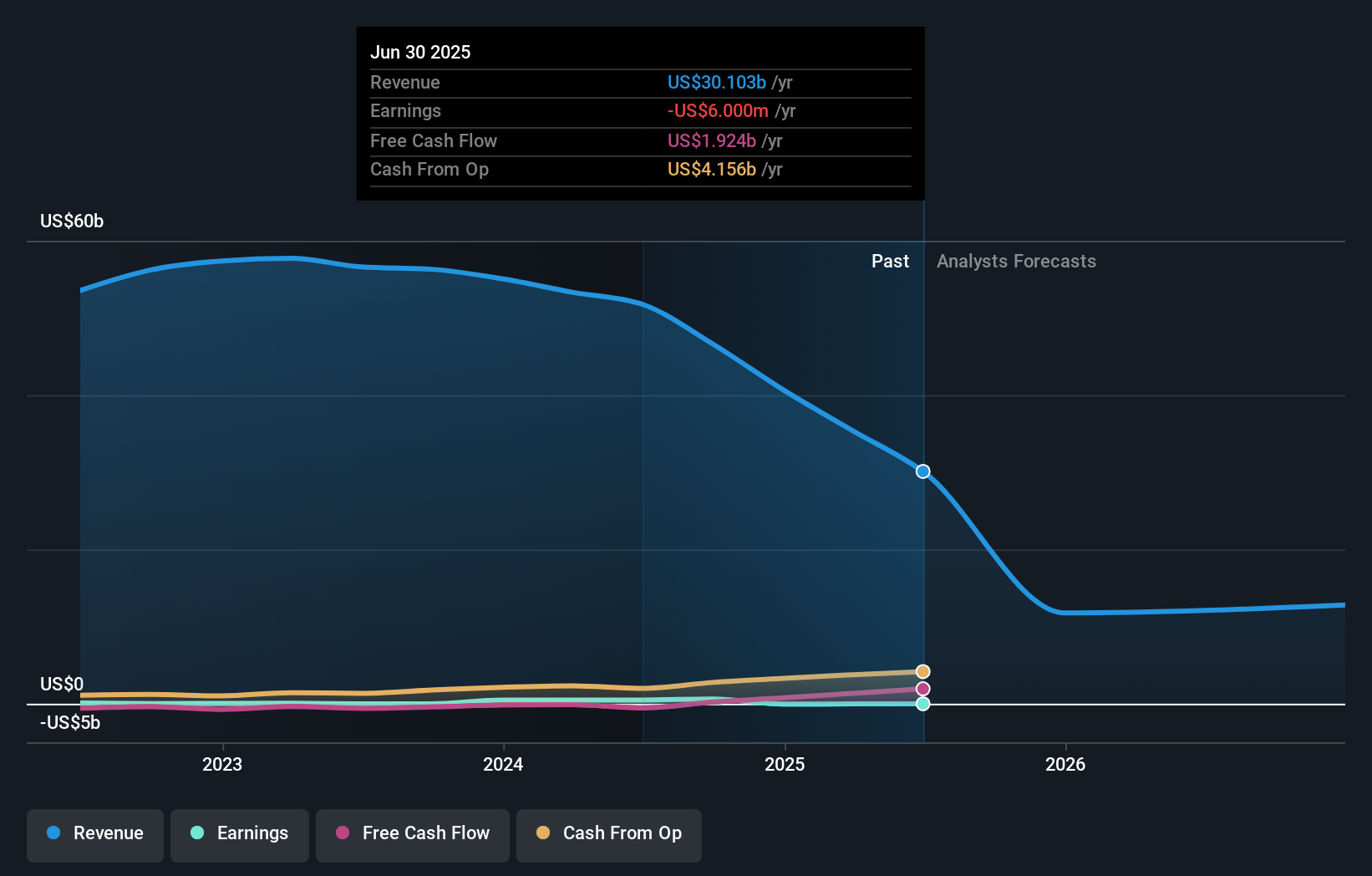

- Brookfield Business Partners recently reported third quarter 2025 earnings, highlighting a reduction in net income to US$25 million loss and lower sales compared to the previous year, alongside the completion of a buyback program and a quarterly dividend announcement.

- An interesting detail is the successful capital recycling program, which generated over US$2 billion, enabled US$1 billion in debt repayments and new investments, and led to a stronger financial structure with higher equity and lower liabilities.

- We’ll explore how Brookfield’s debt reduction and asset recycling efforts contribute to its evolving investment narrative and financial outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Brookfield Business Partners' Investment Narrative?

To be a Brookfield Business Partners shareholder today, you need to believe in the company’s ability to unlock value from active asset management and disciplined capital recycling, even when headline numbers point to tough short-term results. Despite reporting a net loss and another quarter of declining revenue, Brookfield announced a successful US$2 billion capital recycling program, paid down US$1 billion in debt, and completed a share buyback program. This push has improved the balance sheet, with higher equity and lower liabilities, and left management with more flexibility for new investments. The consistent quarterly dividend suggests confidence in future operating cash flows. However, sliding sales and recent losses have clearly shifted focus to how effectively Brookfield can execute on planned asset sales and maintain profitability amid uncertain deal timelines. Recent news supports balance sheet strength, but it doesn’t fully resolve questions on earnings power beyond asset disposals, which could remain a key risk for now.

But if deal execution timing slips, investors need to keep that on their radar. Brookfield Business Partners' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on Brookfield Business Partners - why the stock might be a potential multi-bagger!

Build Your Own Brookfield Business Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookfield Business Partners research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Brookfield Business Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookfield Business Partners' overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Business Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBU

Brookfield Business Partners

A private equity firm specializing in growth capital, divestitures, and acquisitions.

Undervalued with worrying balance sheet.

Market Insights

Community Narratives