- United States

- /

- Industrials

- /

- NYSE:BBU

Brookfield Business Partners (NYSE:BBU) Valuation in Focus After Major Corporate Simplification Plan Announcement

Reviewed by Simply Wall St

Brookfield Business Partners (NYSE:BBU) has unveiled a major corporate simplification plan, including its intention to convert to a Canadian corporation. This structural move is generating heightened attention among investors and market watchers.

See our latest analysis for Brookfield Business Partners.

Brookfield Business Partners has seen notable momentum, with a 38% share price return in the past 90 days and an impressive 64% total shareholder return over the last year. The market’s positive reaction to its simplification plan, combined with continued investor optimism, points to building confidence in its future direction.

If this shift in market sentiment has you interested in growth stories beyond the industrial sector, it could be the right moment to expand your search and discover fast growing stocks with high insider ownership

But with analyst price targets only modestly above the current share price and a recent surge in performance, investors may wonder if Brookfield Business Partners still offers upside. They may also question whether this rally already reflects anticipated growth.

Price-to-Sales Ratio of 0.2x: Is it justified?

Brookfield Business Partners trades at a price-to-sales (P/S) ratio of 0.2x, markedly lower than both its industry and peer group. This low multiple suggests that the market is discounting the company’s future sales far more than it does for competitors.

The price-to-sales ratio measures how much investors are willing to pay per dollar of sales. In capital-intensive sectors like industrials, it is a common metric to assess value, especially for businesses that may not be consistently profitable. A low P/S ratio can mean the stock is undervalued, but it can also reflect concerns around future sales, operational risks, or profitability challenges.

Compared to the global industrials industry average of 0.8x and the peer group average of 1.2x, Brookfield Business Partners stands out as a deep value play on this metric. However, it is also trading in line with the estimated fair price-to-sales ratio of 0.2x. This may indicate the market is accurately factoring in current realities and expectations.

Explore the SWS fair ratio for Brookfield Business Partners

Result: Price-to-Sales Ratio of 0.2x (UNDERVALUED)

However, negative annual revenue growth and recent net losses highlight potential challenges that could temper the bullish sentiment around Brookfield Business Partners.

Find out about the key risks to this Brookfield Business Partners narrative.

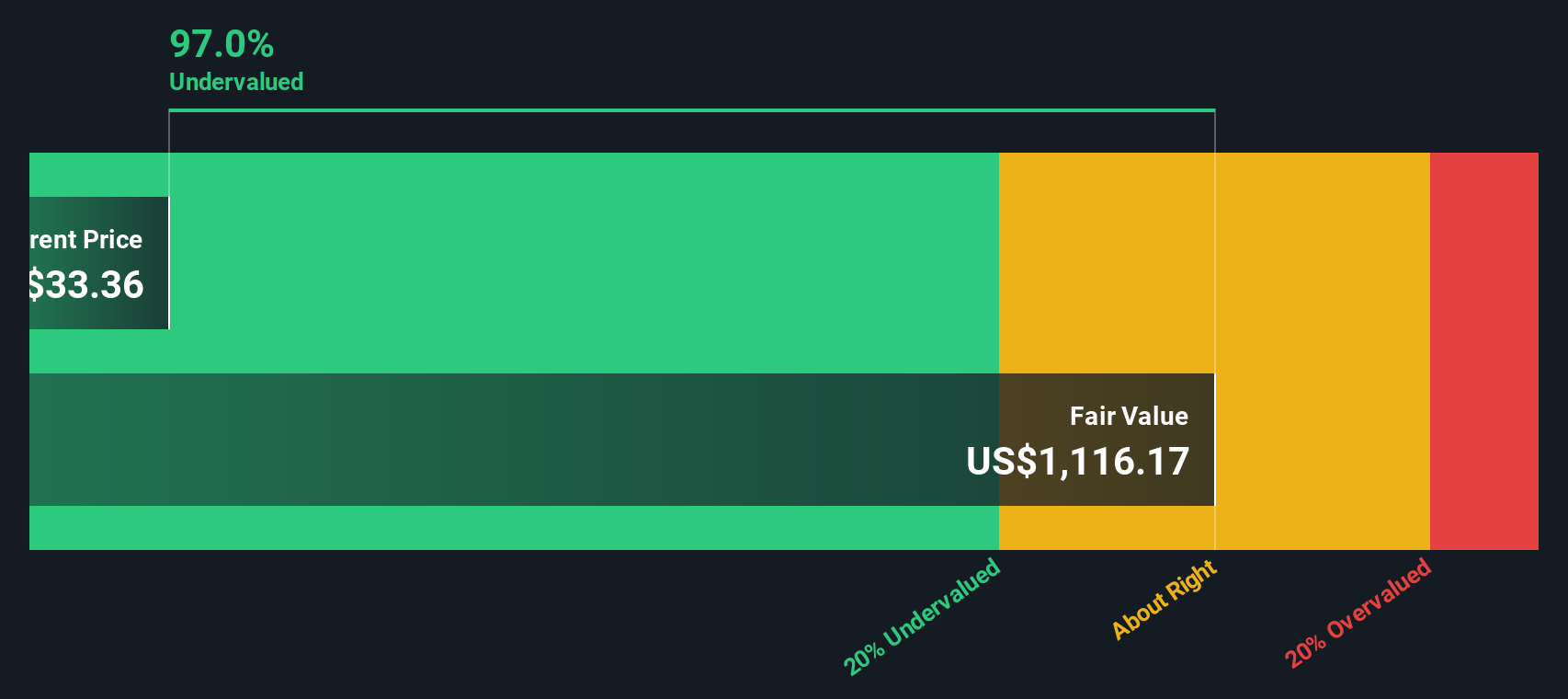

Another Perspective: DCF Model Paints a Different Picture

While the price-to-sales ratio suggests Brookfield Business Partners trades at a discount, our DCF model offers a strikingly different perspective. According to this method, the current share price is significantly below the estimated fair value, which signals substantial undervaluation based on projected future cash flows. But does the DCF see something that the market is missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Brookfield Business Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Brookfield Business Partners Narrative

If you find yourself wanting to dig deeper or looking at the numbers from another angle, you can craft your own perspective in just a few minutes. Do it your way

A great starting point for your Brookfield Business Partners research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Give your portfolio a boost by targeting sectors poised for strong growth, juicy yields, or explosive innovation. These are opportunities you do not want to overlook.

- Capitalize on cutting-edge breakthroughs in artificial intelligence by accessing these 27 AI penny stocks. These options offer robust growth prospects and strong momentum in the tech space.

- Secure a steady income stream with these 17 dividend stocks with yields > 3%, specially curated for stocks offering attractive dividends and stable earnings potential, with yields above 3%.

- Seize unique prospects in the rapidly evolving world of decentralized finance through these 80 cryptocurrency and blockchain stocks. This list features companies at the forefront of blockchain and cryptocurrency advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Business Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBU

Brookfield Business Partners

A private equity firm specializing in growth capital, divestitures, and acquisitions.

Good value with worrying balance sheet.

Market Insights

Community Narratives