- United States

- /

- Aerospace & Defense

- /

- NYSE:BA

Why Boeing (BA) Landed Major Aircraft Orders at Dubai Airshow and What It Means for Future Growth

Reviewed by Sasha Jovanovic

- During the past week at the Dubai Airshow, multiple airlines announced significant new aircraft orders from Boeing, including Emirates' order for 65 Boeing 777X jets and major commitments from flydubai, Gulf Air, Ethiopian Airlines, Air Senegal, and Uzbekistan Airways for various 737 MAX and 787 Dreamliner models.

- This series of large-scale purchases highlights Boeing's ability to attract high-profile international customers, particularly in the Middle East and Africa, and demonstrates strong global demand for next-generation commercial aircraft.

- We'll look at how this wave of Dubai Airshow aircraft orders bolsters Boeing's commercial backlog and future growth narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Boeing Investment Narrative Recap

To own Boeing stock, you need to believe that global air travel demand will continue to translate into a robust commercial aircraft backlog and eventual margin recovery, even as the company works through persistent development and production challenges. While headline-grabbing new aircraft orders from the Dubai Airshow add confidence to the near-term revenue outlook and backlog strength, this does not erase the biggest immediate risk: continued negative operating margins and the slow path to profitability in the commercial airplane division. The impact of these orders is positive for the growth narrative, but any benefits will take time to flow through earnings, so the short-term financial outlook remains unchanged.

The standout from the recent news cycle is Emirates' order for 65 additional Boeing 777X jets, which cements Boeing's leadership in the widebody segment and provides long-term visibility for production of its next-generation aircraft. This $500 billion-plus backlog reflects strong market demand, but meaningful improvement to program margins and free cash flow is still dependent on executing these multi-year deliveries efficiently, with minimal setbacks.

On the other hand, investors should not lose sight of Boeing’s ongoing financial risks, especially the potential for persistent losses and high debt to pressure cash flow if aircraft production or certification faces delays...

Read the full narrative on Boeing (it's free!)

Boeing's narrative projects $114.4 billion in revenue and $7.1 billion in earnings by 2028. This requires 14.9% yearly revenue growth and an $18 billion increase in earnings from the current -$10.9 billion.

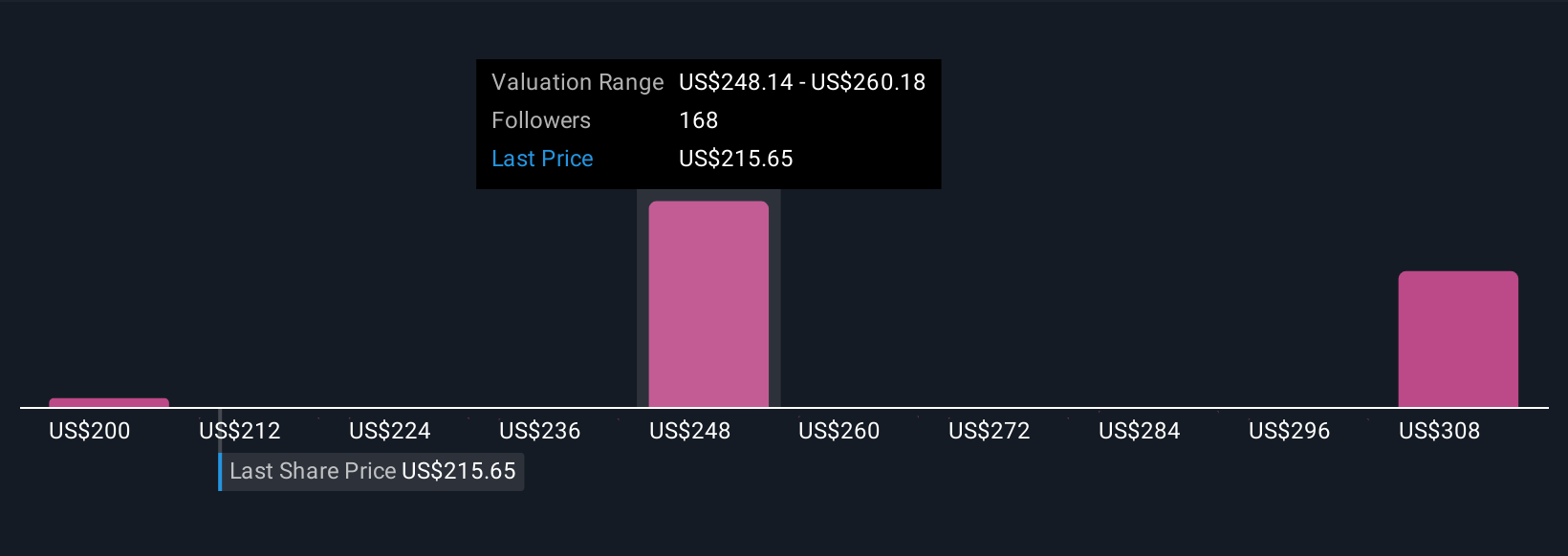

Uncover how Boeing's forecasts yield a $249.32 fair value, a 39% upside to its current price.

Exploring Other Perspectives

Fair value estimates from 19 Simply Wall St Community members range from US$206.79 to US$352.95 per share, reflecting strongly differing opinions. While many recognize Boeing’s record aircraft backlog as a catalyst, the challenge of turning orders into profitable deliveries remains top of mind for many market watchers, consider these differing views as you form your own outlook.

Explore 19 other fair value estimates on Boeing - why the stock might be worth as much as 97% more than the current price!

Build Your Own Boeing Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boeing research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Boeing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boeing's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boeing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BA

Boeing

Designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives