At the end of a somewhat bearish month, The Boeing Company (NYSE: BA) gave us a new earnings report – improving the free cash flow but still not meeting the revenue expectations. Burdened by debt and resurging issues, it looks like the company is still not out in the clear.

View our latest analysis for Boeing

Earnings Report

- Non-GAAP EPS: - US$0.60 (miss by US$0.46)

- GAAP EPS: - US$0.19 (miss by US$0.71)

- Revenue: US$15.28b (miss by US$990m)

Commercial Airplanes backlog of US$290b, with 93 net orders added. However, while all departments missed revenue expectations, commercial airplanes missed the most, with US$4.46b reported vs. US$5.30b consensus.

RBC Capital rates Boeing as Outperform despite mixed news, quoting cyclical tailwinds and a substantial increase in net orders in 2021. Their analyst Ken Herbert gave an upside potential of 27%.

Meanwhile, the Federal Aviation Administration (FAA) announced a new stance on overseeing safety efforts for airplane manufacturing, delegating fewer responsibilities and demanding more transparency.

Technically Speaking

Observing the price movement, you can see that the stock is coming under pressure. With simultaneous lower highs and higher lows, one should expect a resolution and a clear breakout within the next few weeks.

What is Boeing worth?

Our valuation model shows that the intrinsic value for the stock is $321.50, but it is currently trading at US$210 on the share market, meaning that there is still an opportunity to buy now.

However, given that Boeing's share is somewhat volatile (i.e., its price movements are magnified relative to the rest of the market), this could mean the price can sink lower, giving us another chance to buy in the future. This is based on its high beta, which is a good indicator for share price volatility.

What does the future of Boeing look like?

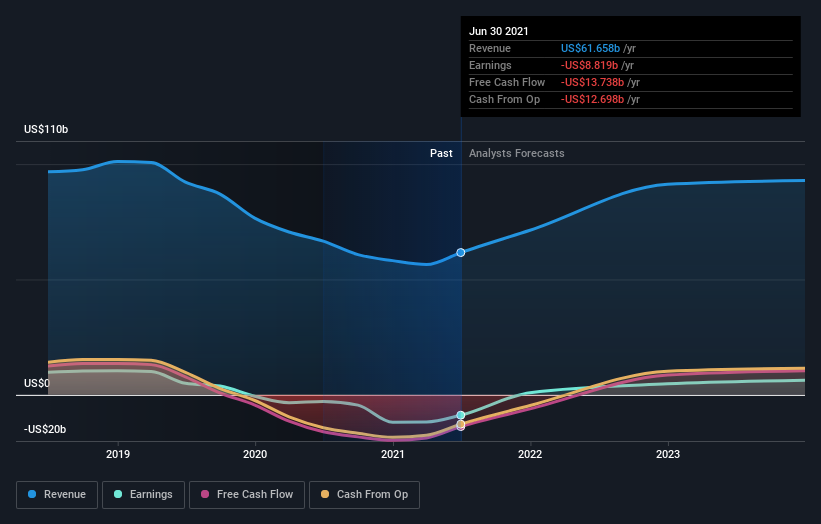

Investors looking for growth in their portfolio may want to consider a company's prospects before buying its shares. Although value investors would argue that it's the intrinsic value relative to the price that matters the most, a more compelling investment thesis would be high growth potential at a reasonable price. With revenues expected to grow by 57% over the next couple of years, optimism is in the future if the company can stay away from issues that bothered them recently.

What this means for you:

Are you a shareholder? Since BA is currently in value territory, it might be worth looking into expanding your position if you are a short-term contrarian.

With a positive outlook on the horizon, it seems like this growth has not yet been fully factored into the share price. Yet, keep in mind there are also other factors such as financial health to consider, which might require patience for a prolonged time.

Are you a potential investor? If you've been keeping an eye on BA for a while, now might be the time to make a leap. Its buoyant future outlook isn't fully reflected in the current share price yet, which means it's not too late to buy BA. But before you make any investment decisions, consider other factors such as the strength of its balance sheet to make a well-informed buy. Look for the critical levels below the market at US$200 and US$180 to see how the price reacts.

While earnings quality is essential, it's equally important to consider the risks facing Boeing at this point. To help with this, we've discovered 2 warning signs (1 is concerning!) that you ought to be aware of before buying any shares in Boeing.

If you are no longer interested in Boeing, you can use our free platform to see our list of over 50 other stocks with high growth potential.

Valuation is complex, but we're here to simplify it.

Discover if Boeing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:BA

Boeing

Designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives