- United States

- /

- Aerospace & Defense

- /

- NYSE:BA

Does Boeing’s 9.2% Weekly Drop Signal a New Opportunity in 2025?

Reviewed by Bailey Pemberton

- Wondering if Boeing is really a bargain, or if the recent buzz is just noise? Let’s break down the stock’s current setup with a focus on what truly matters: value.

- Despite some recent turbulence, Boeing has delivered a strong 30.0% return over the past year. However, it dipped 9.2% this week and is down 6.6% over the past month.

- News around ongoing production challenges and regulatory updates has influenced price swings, prompting both optimism and caution among investors. Headlines about aircraft orders and delivery timelines continue to shape the conversation, giving insight into changing growth and risk perceptions.

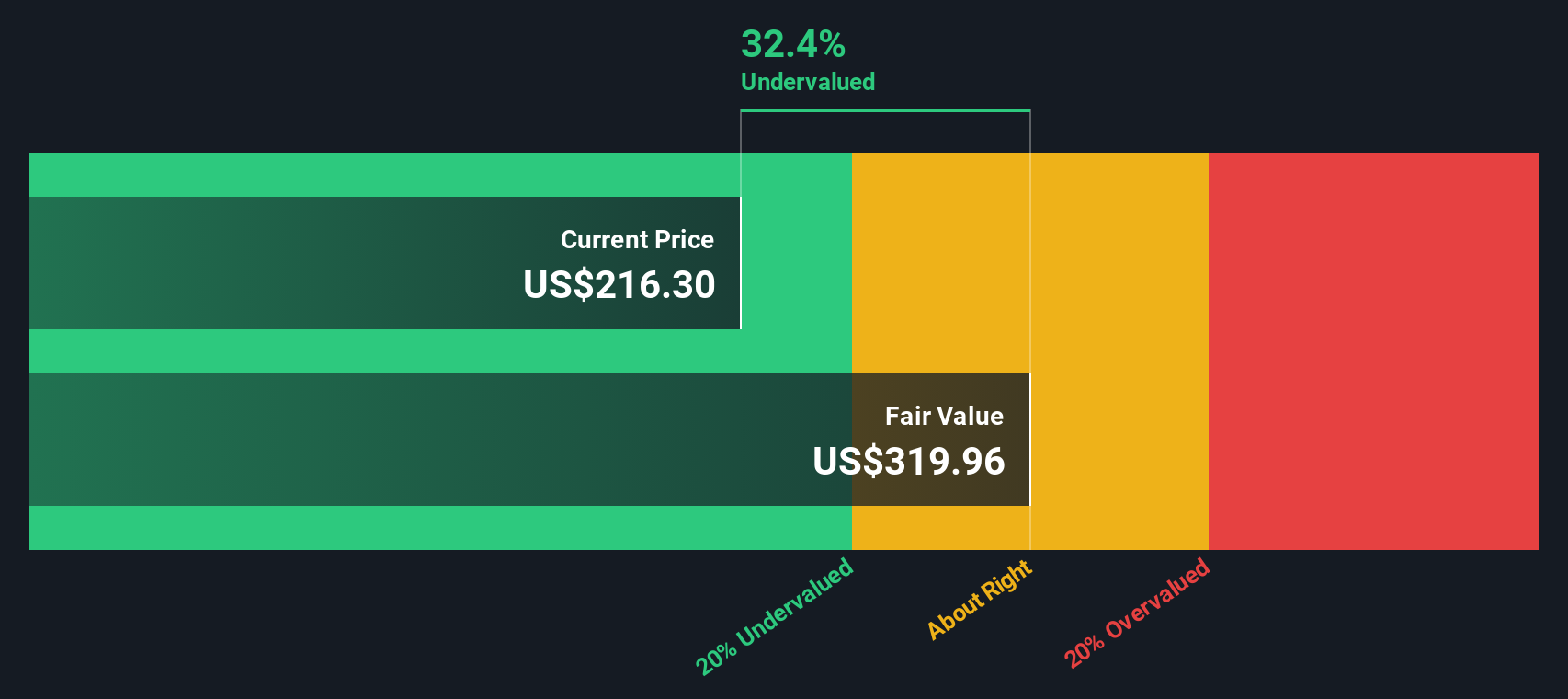

- Boeing currently scores a 6 out of 6 on our valuation checks, suggesting potential undervaluation across the board. We will look at how different valuation models stack up, because the most useful perspective might not be what you expect.

Find out why Boeing's 30.0% return over the last year is lagging behind its peers.

Approach 1: Boeing Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and then discounting those figures back to today's dollars. This approach is widely used because it looks beyond headlines and market sentiment by focusing on real cash generation potential.

Currently, Boeing's Free Cash Flow (FCF) over the last twelve months is negative at $5.91 Billion, reflecting ongoing financial challenges. However, the DCF model projects significant improvement over the coming years. Analyst forecasts point to Boeing generating $3.79 Billion in FCF by 2026, rising steadily to $13.16 Billion by 2029 and continuing to grow based on Simply Wall St extrapolations through 2035.

Based on these extrapolated projections, the DCF model arrives at an estimated fair value for Boeing of $345.01 per share. With the DCF model implying the stock is trading at a 41.7% discount to intrinsic value, current prices suggest the market may be undervaluing Boeing's future cash-generating prospects.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Boeing is undervalued by 41.7%. Track this in your watchlist or portfolio, or discover 832 more undervalued stocks based on cash flows.

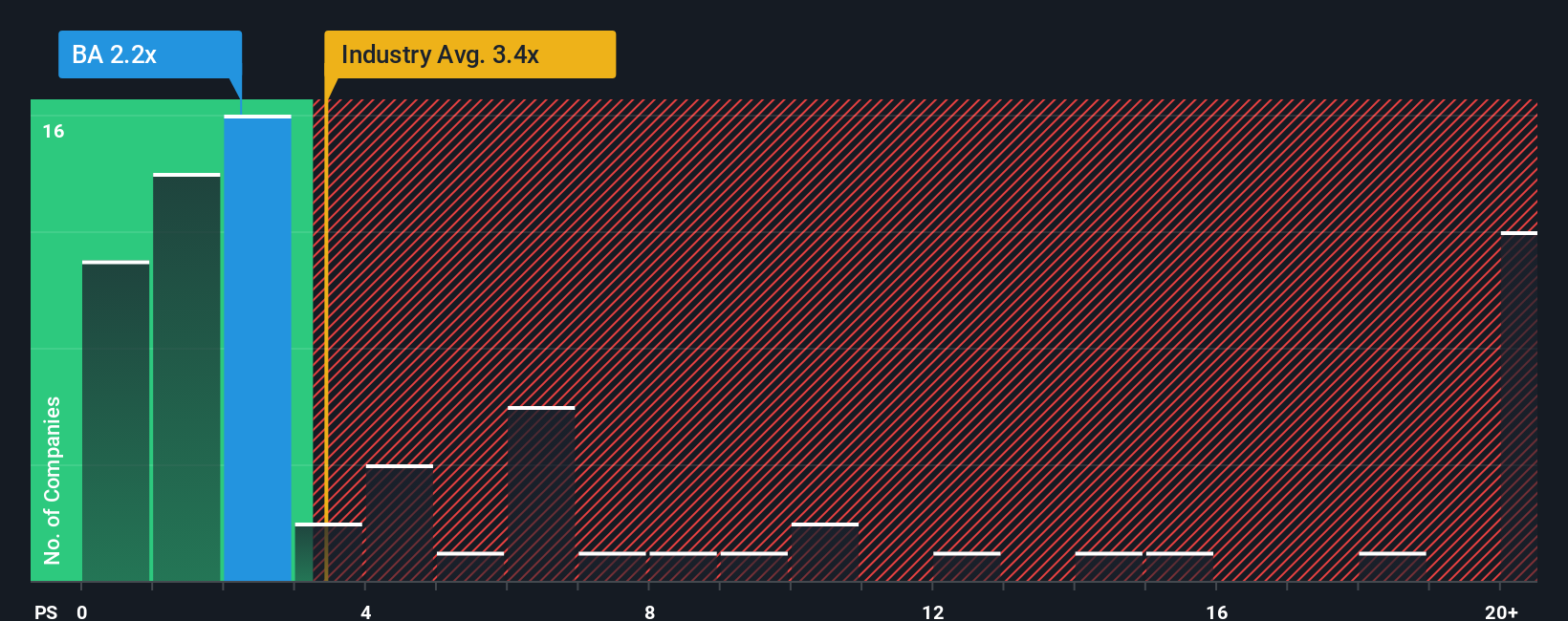

Approach 2: Boeing Price vs Sales (P/S) Multiple

The Price-to-Sales (P/S) multiple is a useful tool for valuing companies like Boeing, especially when profitability is volatile or negative. Since Boeing's recent earnings have been pressured by industry headwinds, the P/S ratio gives investors a way to evaluate valuation based on the company's revenue rather than profits, making it particularly appropriate in times of recovery or restructuring.

Normal or fair P/S ratios can vary significantly depending on expectations for future growth and the overall risk profile of the company. Higher growth companies often deserve a higher P/S, while riskier or slower-growth firms generally trade at lower multiples. For aerospace and defense, other benchmarks matter too: the current industry average P/S is 3.15x, and Boeing’s closest peers average 2.04x. In comparison, Boeing's current P/S multiple is 1.89x, which is below both the industry and peer averages.

To refine this analysis, Simply Wall St offers a proprietary “Fair Ratio” in this case, 1.89x which is tailored for Boeing’s unique combination of sales growth, profit margins, industry dynamics, market cap, and risks. This makes the Fair Ratio a more nuanced guide than blunt comparisons to industry or peer averages because it accounts for specifics that affect Boeing’s actual business outlook and valuation potential.

Comparing Boeing's current P/S multiple of 1.89x to its Fair Ratio of 1.89x, the two figures align almost exactly. This suggests that, based on revenue and the context of its risks and growth prospects, Boeing stock is priced about right at current levels.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Boeing Narrative

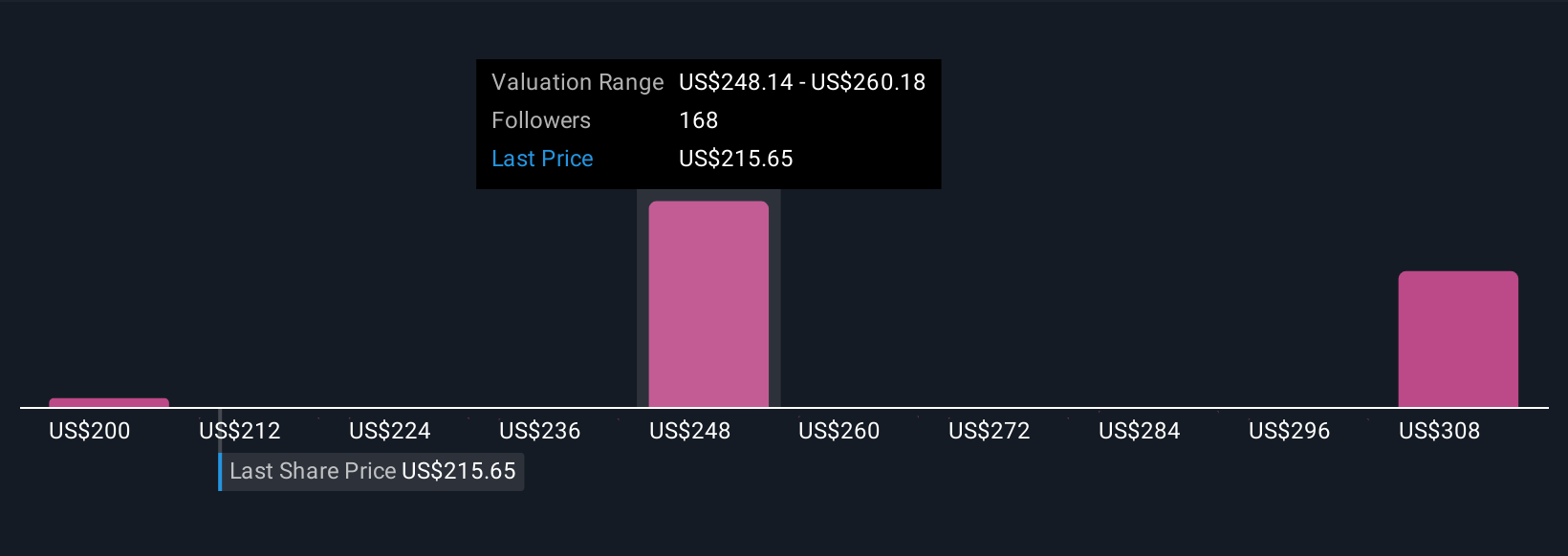

Earlier we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply a story—your personal outlook on Boeing—that connects what you believe about the company’s future with financial forecasts and estimated fair value. Rather than just reacting to numbers, Narratives help you make investing decisions grounded in your view of Boeing’s next chapters, tying together expected revenues, margins, risks, and opportunities.

Available right now on Simply Wall St’s Community page, Narratives make it easy for millions of investors to create, update, and share their perspectives. When new information such as earnings reports or big news comes out, your Narrative (and its fair value estimate) updates automatically, ensuring your outlook stays in sync with real events. This makes it much easier to decide when to buy or sell, since you can compare your Narrative’s fair value with today’s price and instantly spot gaps or opportunities.

For Boeing, this means some investors’ Narratives might reflect optimism about air travel’s robust recovery and set fair values near $287, while others may worry about ongoing setbacks and put fair value as low as $150. This proves there is no single “right answer,” just the story you believe and the numbers to back it up.

Do you think there's more to the story for Boeing? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boeing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BA

Boeing

Designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives