- United States

- /

- Building

- /

- NYSE:AZZ

AZZ (AZZ) Valuation Spotlight: Strong Margins and Rising Free Cash Flow Draw Investor Interest

Reviewed by Simply Wall St

AZZ (NYSE:AZZ) is drawing attention after recent analysis highlighted its strong operating margins along with a clear boost in free cash flow margin. Investors are now watching how this efficiency could translate into future investments or shareholder rewards.

See our latest analysis for AZZ.

AZZ’s latest $98.66 share price reflects a year marked by growing investor confidence. The stock has achieved a 19% share price return so far in 2024 and a 27.39% total shareholder return over the past year. Momentum has clearly been building, supported by solid fundamentals and positive sentiment around operational efficiency.

If you’re ready to spot what’s next, now is a great time to expand your view and discover fast growing stocks with high insider ownership

With AZZ posting impressive gains and its shares still trading below analyst price targets, the key question becomes: Is this efficiency-driven rally just the beginning, or is all the upside already built into the price?

Most Popular Narrative: 21.6% Undervalued

With the narrative’s fair value estimate of $125.89 significantly higher than AZZ’s last close at $98.66, market optimism around operational momentum is matched by a consensus that the stock remains undervalued. The widely followed narrative highlights significant forward opportunities that drive this valuation gap.

AZZ’s new greenfield facility near St. Louis, Missouri is ramping up production, which could drive future revenue growth as it expands capacity and taps into strong local demand. This investment is expected to positively impact earnings as the facility becomes fully operational and contributes to higher sales volumes.

Want to know what’s propelling that premium? The fair value is tied to bold growth in sales, major shifts in profit margins, and a future earnings multiple that stands out. Which forecasted numbers tip the scales? Hit the narrative to unravel the story behind the price.

Result: Fair Value of $125.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tariff uncertainties and the risk of production delays at new facilities could still disrupt AZZ's ambitious growth trajectory.

Find out about the key risks to this AZZ narrative.

Another View: What Does the SWS DCF Model Suggest?

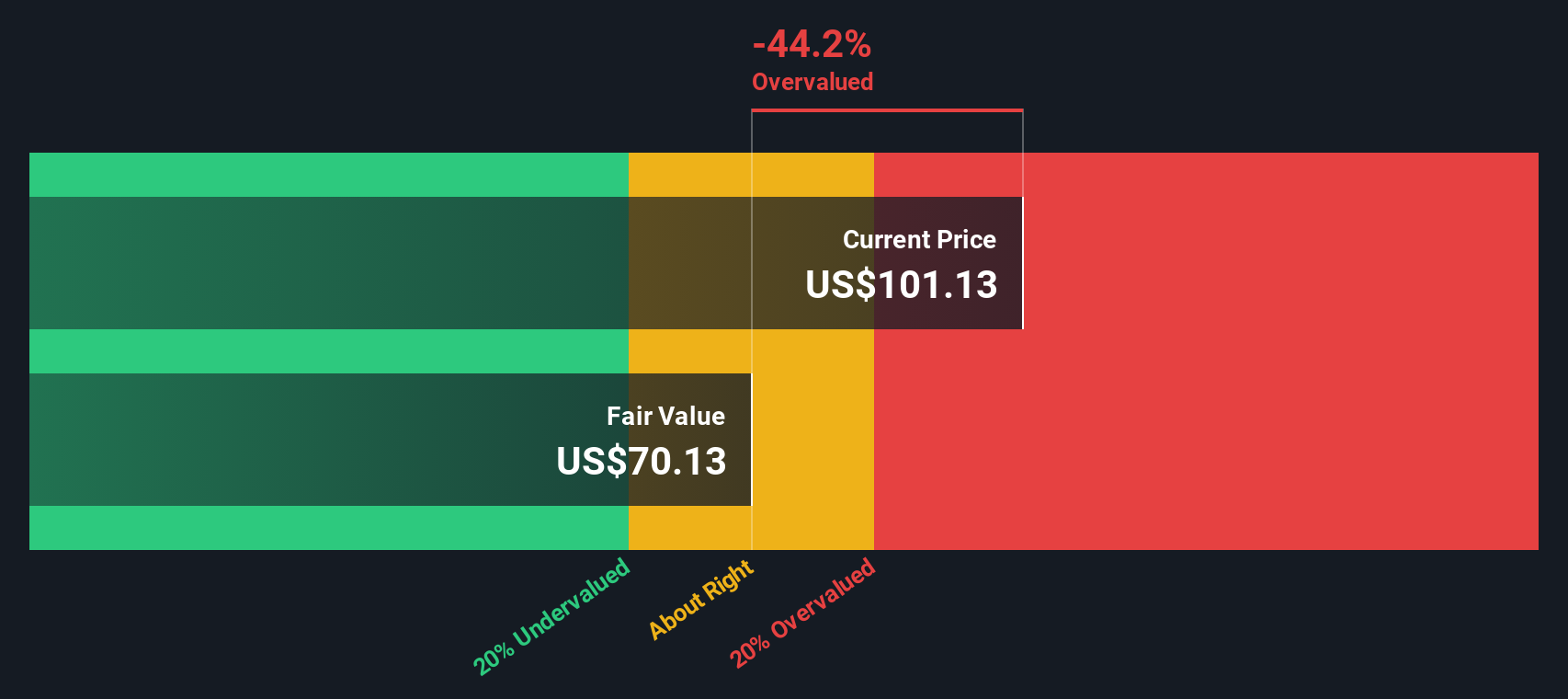

Looking from another angle, our DCF model suggests AZZ may actually be trading above its estimated fair value, which it calculates as $70.02. In practical terms, this means the current market optimism could have pushed the price beyond conservative, cash-flow-based assumptions. Could this optimism last, or will fundamentals catch up?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AZZ for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AZZ Narrative

If you have your own angle or would rather dive into the numbers yourself, you can piece together your own story in minutes. Do it your way.

A great starting point for your AZZ research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

The world’s most exciting opportunities rarely stick around for long. If you’re serious about taking your strategy to the next level, check out these unique stock ideas before the market moves:

- Uncover fresh growth stories when you scan through these 3560 penny stocks with strong financials and find hidden gems with robust fundamentals and solid upside potential.

- Capitalize on future healthcare breakthroughs by starting with these 33 healthcare AI stocks to spot innovation leaders improving patient outcomes and redefining medical technology.

- Lock in powerful income opportunities. Leverage these 17 dividend stocks with yields > 3% to reveal companies delivering steady returns with strong dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AZZ

AZZ

Provides hot-dip galvanizing and coil coating solutions in North America.

Outstanding track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives