- United States

- /

- Building

- /

- NYSE:AWI

Armstrong World Industries Shares Surge 44.9% in 2025 But Is the Growth Justified?

Reviewed by Bailey Pemberton

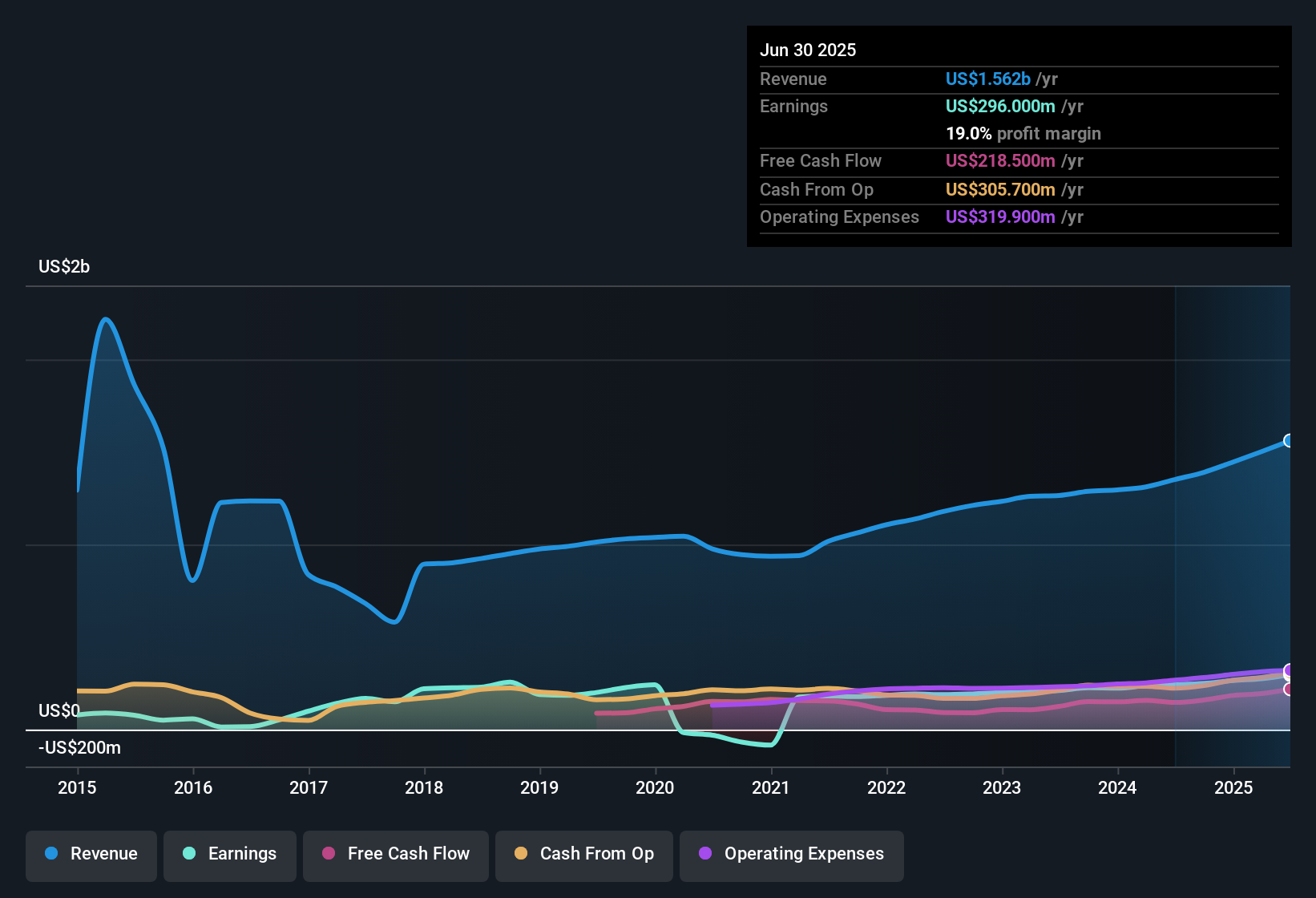

Thinking about what to do with Armstrong World Industries stock? You’re definitely not alone. With the market buzzing, figuring out whether to hold, buy more, or cash out can feel like high-stakes decision-making. But let’s talk specifics: over the past year, Armstrong has delivered a blistering 46.2% gain for shareholders. Zooming out even further, the stock has soared 253.0% in the last five years. Just this year, it’s already up 44.9%. If that kind of run doesn’t get your attention, it is hard to say what will.

Recent months have seen steady, confidence-building growth. The last 30 days brought a 4.2% climb and the past week alone is up 2.5%. The backdrop to these price moves includes positive shifts in investor sentiment and increased optimism about Armstrong’s market positioning, especially as demand for sustainable building solutions continues to rise across the construction industry. While analysts have noted a moderation in broader market risk perception, Armstrong’s specific focus on innovative, energy-efficient building products is keeping the company front and center in several bullish outlooks.

If you’re weighing valuation, here’s a quick check-in: Armstrong World Industries scores just 1 out of 6 on standard undervaluation tests, a figure that suggests caution for value-focused investors. But don’t tune out yet. In the next section, we’ll break down the key valuation methods, and stick around because there may just be a better way to grasp what this stock is really worth.

Armstrong World Industries scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Armstrong World Industries Discounted Cash Flow (DCF) Analysis

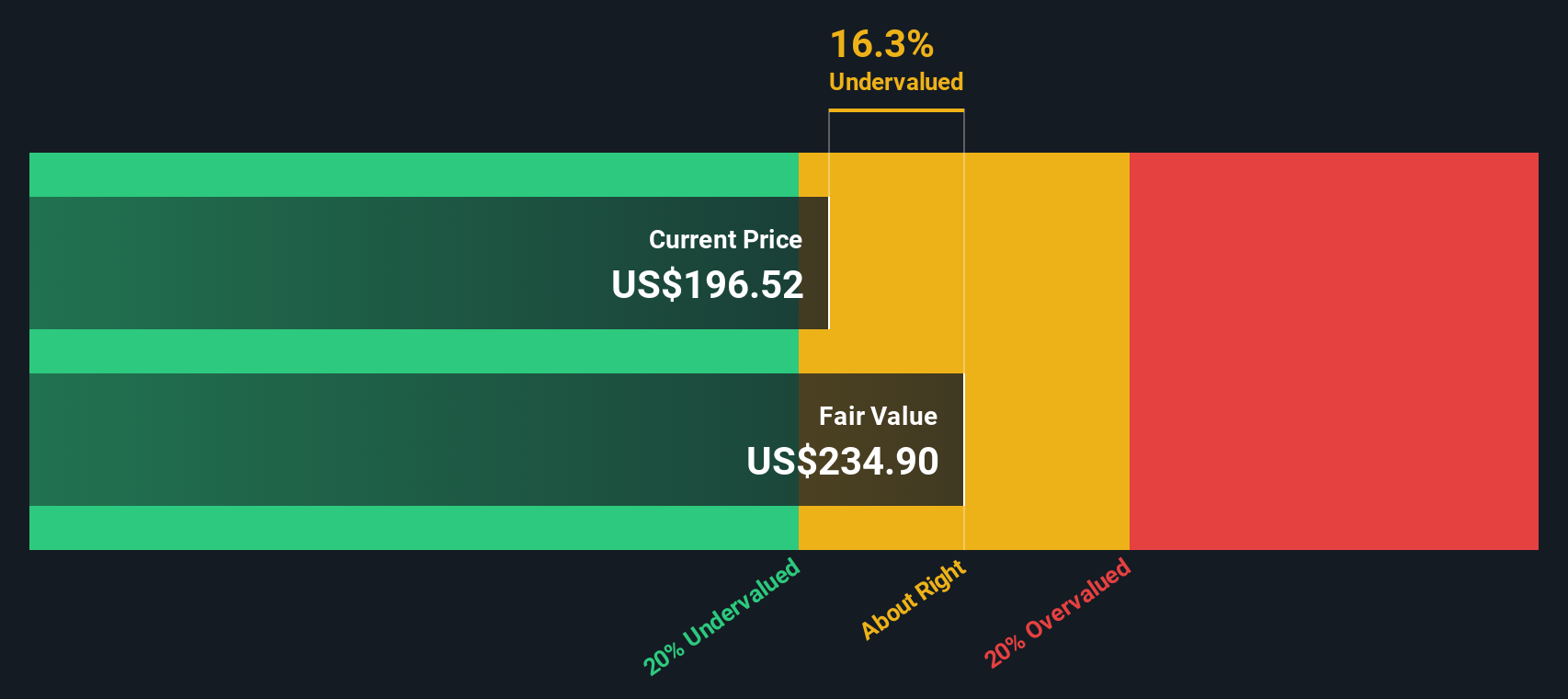

The Discounted Cash Flow (DCF) model estimates what a company is worth by forecasting its future cash flows and discounting them back to today's value. For Armstrong World Industries, this method uses the company's existing Free Cash Flow (FCF) as a starting point and then projects forward using growth rates based on analyst estimates for the next five years and extrapolated values after that.

Currently, Armstrong's latest twelve-month Free Cash Flow stands at $211.3 million. Analysts anticipate healthy growth, with annual FCF projections climbing steadily. For example, FCF is expected to reach $410.4 million by 2027. Looking further ahead, Simply Wall St extrapolates these figures and estimates FCF at around $571.9 million by 2035, highlighting the company’s capacity for consistent expansion in the years to come.

Factoring in all of these projections and discounting them to present value using the two-stage Free Cash Flow to Equity model, the DCF analysis suggests an intrinsic value of $193.02 per share. Given this estimate and the current share price, the model indicates Armstrong stock is 5.2% overvalued.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Armstrong World Industries's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

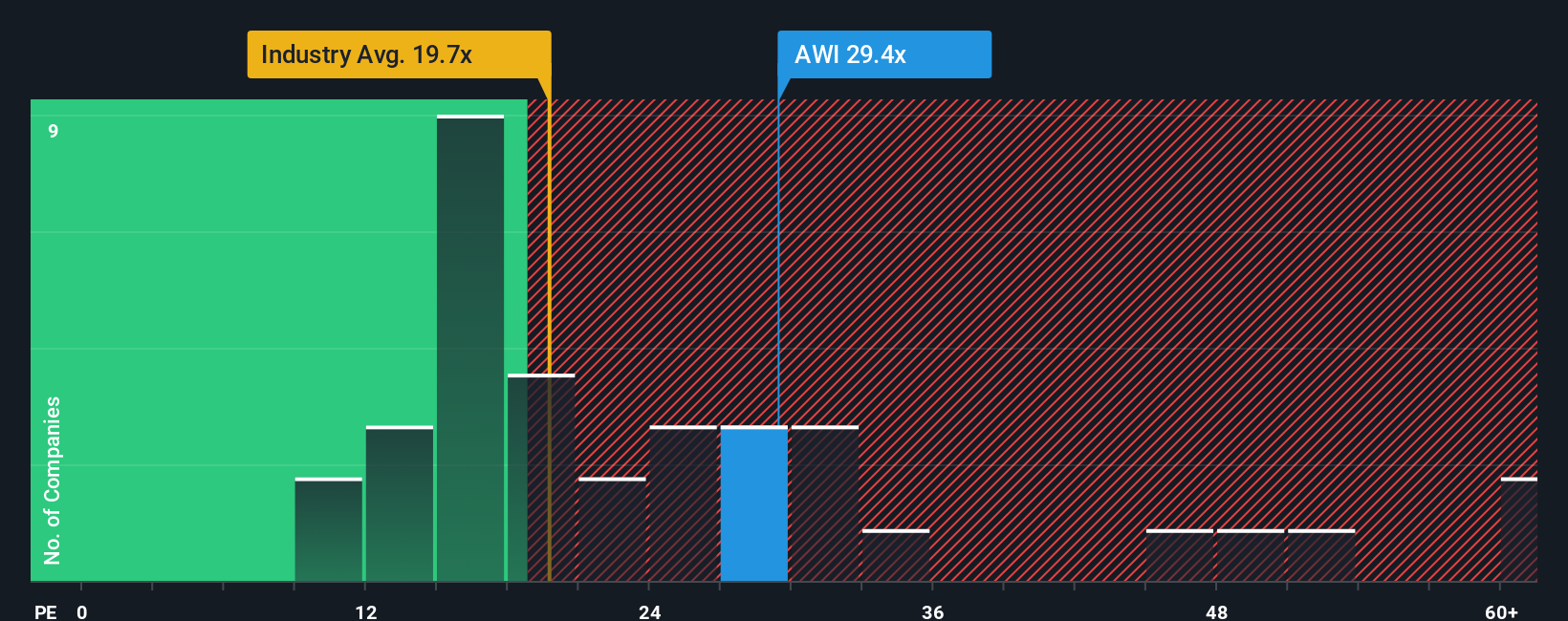

Approach 2: Armstrong World Industries Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely used metric for valuing established, profitable companies like Armstrong World Industries. Since it compares a company’s share price to its earnings, it gives investors a quick way to gauge how the market is valuing each dollar of profit. A higher PE ratio can reflect optimism about future growth, while a lower ratio can indicate lowered expectations or increased risk.

Growth prospects and business risks play a big part in determining what’s considered a “reasonable” PE ratio. When a company is anticipated to grow earnings quickly, markets typically assign it a higher PE as investors are willing to pay up for that future potential. Conversely, higher uncertainty or industry headwinds tend to keep the PE ratio in check.

Currently, Armstrong World Industries trades at a PE ratio of 29.7x. Compared to the building industry average of 19.8x and a peer group average of 37.6x, Armstrong’s valuation lands somewhere in between, above its industry but slightly below similar peers. Simply Wall St’s “Fair Ratio” calculation, which incorporates growth, profit margin, company size, and risk factors, suggests a fair value PE of 21.7x for Armstrong. This approach is more tailored than a basic industry or peer comparison because it captures Armstrong’s specific circumstances and outlook, not just broad sector trends. With the company’s current PE at 29.7x and a fair ratio of 21.7x, the stock appears to be overvalued on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Armstrong World Industries Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, story-driven forecast that you create to reflect your own perspective on a company, linking the real-world story and your expectations for Armstrong World Industries directly to financial forecasts such as future revenue, earnings, and margins, and ultimately to your assumed fair value.

Unlike one-size-fits-all metrics, Narratives let you connect what you believe about Armstrong’s trajectory to clear financial outcomes, helping you explain and act on whether the stock is undervalued or overvalued for your unique view. Available to millions of investors on Simply Wall St’s Community page, Narratives are easy to use and update automatically as new news or earnings come in, giving you a current and relevant foundation for buy or sell decisions by comparing your Fair Value to the market Price.

For example, some investors see Armstrong’s innovation and digital platform growth supporting aggressive revenue and margin gains, justifying a Fair Value above $199 per share. Others focus on industry risks and project slower growth, leading to a Fair Value closer to $191. Both perspectives are possible within the Narrative tool.

Do you think there's more to the story for Armstrong World Industries? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AWI

Armstrong World Industries

Engages in the design, manufacture, and sale of ceiling and wall solutions in the Americas.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives